рџ ґ Payroll In Excel How To Create Payroll In Excel Youtube

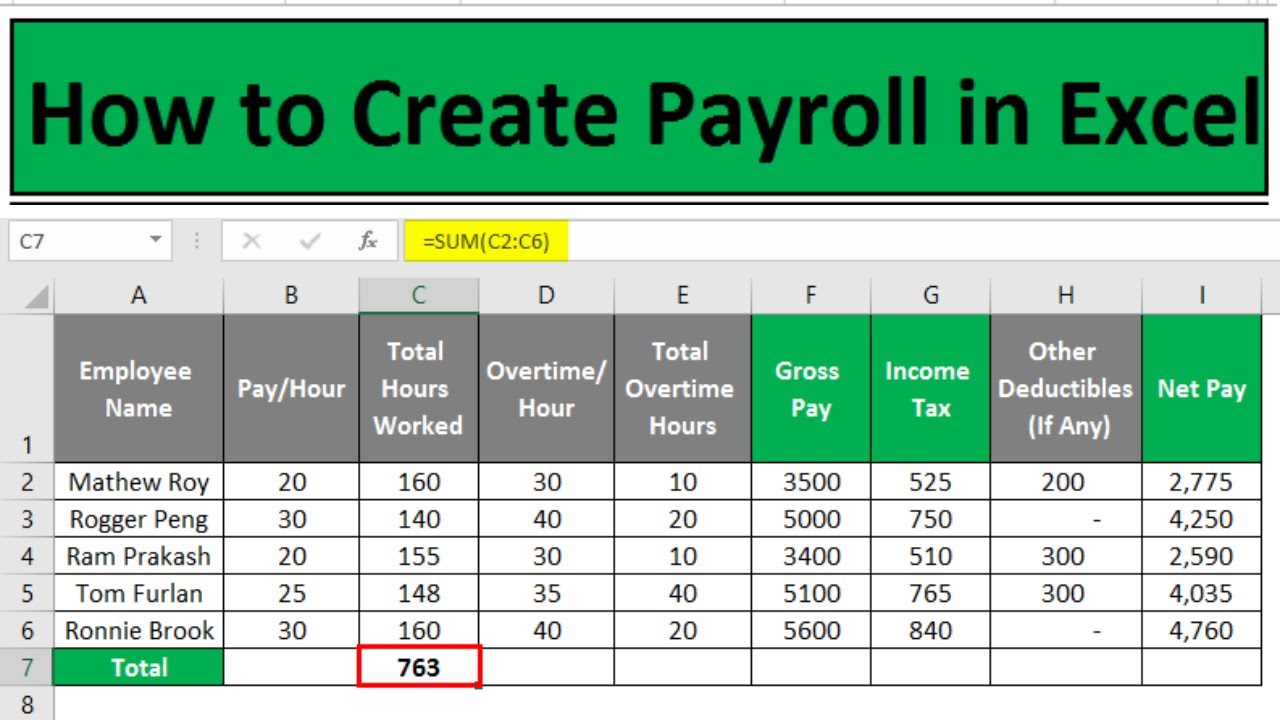

рџ ґ Payroll In Excel How To Create Payroll In Excel Youtube Set up payroll information for each employee. set up employer payroll tax information. enter hours worked and other income details. review automatic. Need to create a payroll calculator & payslip generator with excel? watch this video.⏱ video topics:0:00 demo of the payroll workbook0:30 payroll data (t.

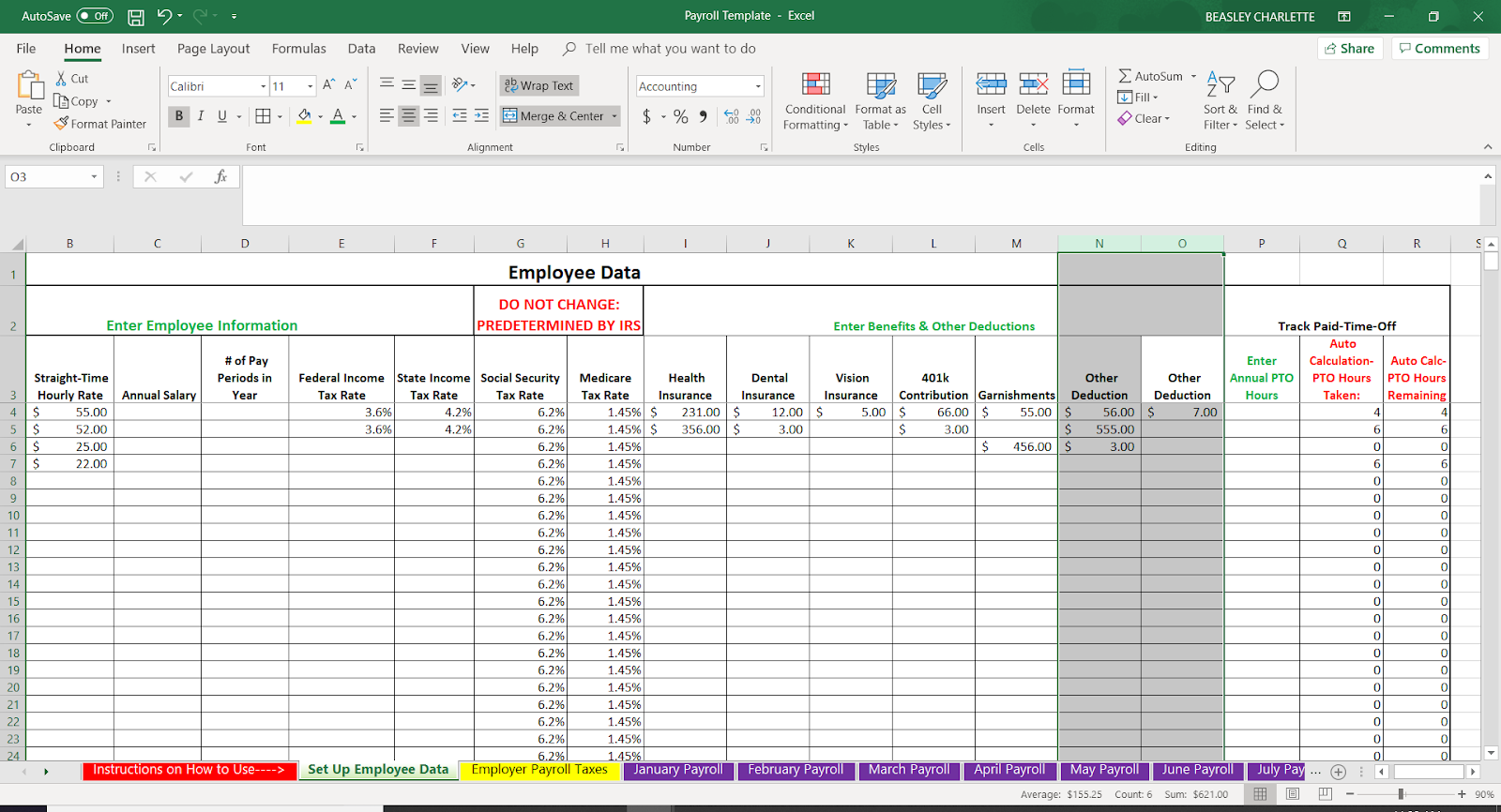

How To Make A Payroll System In Excel Youtube 🔥 get this 350 of my best done for you templates here rebrand.ly 350wkbks ytdesc📚 get a discounted developers library here rebrand.ly. Go to the appropriate monthly payroll tab—so if it’s january, go to the “january payroll” tab. enter the pay date in column a and the full name of each employee you are paying for the period in column b. the monthly payroll tabs have specific columns to enter your employees’ names and actual hours worked. To calculate payroll taxes in excel, you can use the following steps: 1. determine the applicable tax rates for federal, state, and local taxes. these rates can vary depending on the employee’s income and location. 2. multiply the employee’s gross pay by the tax rates to calculate the amount of taxes to be deducted. 3. Check out our step by step guide below and learn how to prepare your payroll in excel. 1. build a payroll template. to start a successful business, you’ll need a good productivity software suite including a word processor, presentation programme and a spreadsheet for calculations. to create your payroll, open a new spreadsheet in excel.

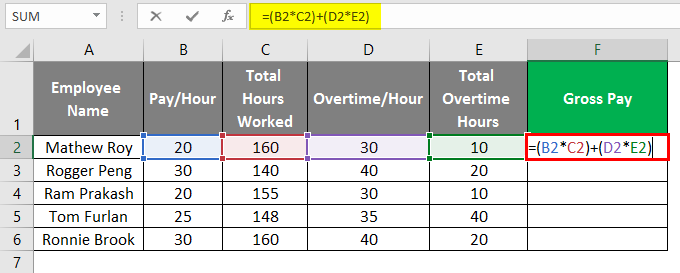

Payroll In Excel How To Create Payroll In Excel With Steps To calculate payroll taxes in excel, you can use the following steps: 1. determine the applicable tax rates for federal, state, and local taxes. these rates can vary depending on the employee’s income and location. 2. multiply the employee’s gross pay by the tax rates to calculate the amount of taxes to be deducted. 3. Check out our step by step guide below and learn how to prepare your payroll in excel. 1. build a payroll template. to start a successful business, you’ll need a good productivity software suite including a word processor, presentation programme and a spreadsheet for calculations. to create your payroll, open a new spreadsheet in excel. Step #1: open a new excel spreadsheet. the first step in making payroll in excel is to open a new excel sheet. for this: go to the “ search box ” at the bottom left end of the windows desktop screen. type “ excel ”. click the excel icon to open a new blank excel spreadsheet. Our payroll template will help you to calculate and maintain the records of pay and deductions for each of your employees. you can keep the confidential employee register where you can record employee information like name, address, date of joining, annual salary, federal allowances, pre tax withholdings, post tax deductions, etc. advertisement.

How To Create Payroll In Excel Step By Step Free Template Images And Step #1: open a new excel spreadsheet. the first step in making payroll in excel is to open a new excel sheet. for this: go to the “ search box ” at the bottom left end of the windows desktop screen. type “ excel ”. click the excel icon to open a new blank excel spreadsheet. Our payroll template will help you to calculate and maintain the records of pay and deductions for each of your employees. you can keep the confidential employee register where you can record employee information like name, address, date of joining, annual salary, federal allowances, pre tax withholdings, post tax deductions, etc. advertisement.

Comments are closed.