🏠the Ultimate Mortgage Pre Approval Document Checklist For Buying A House ✅

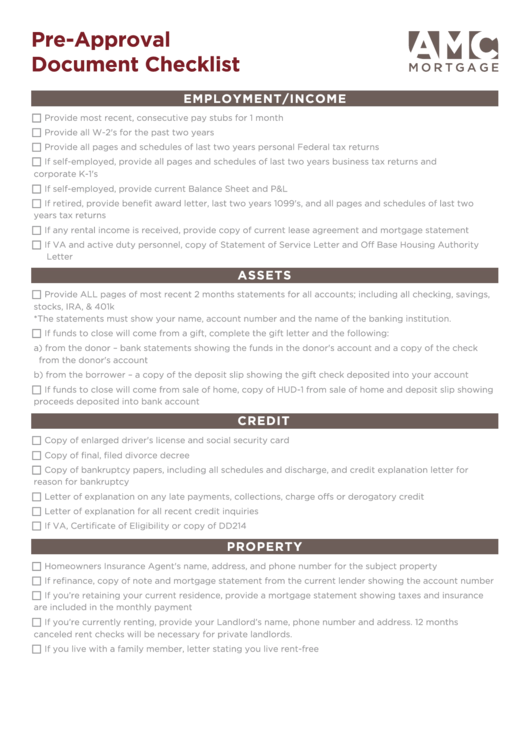

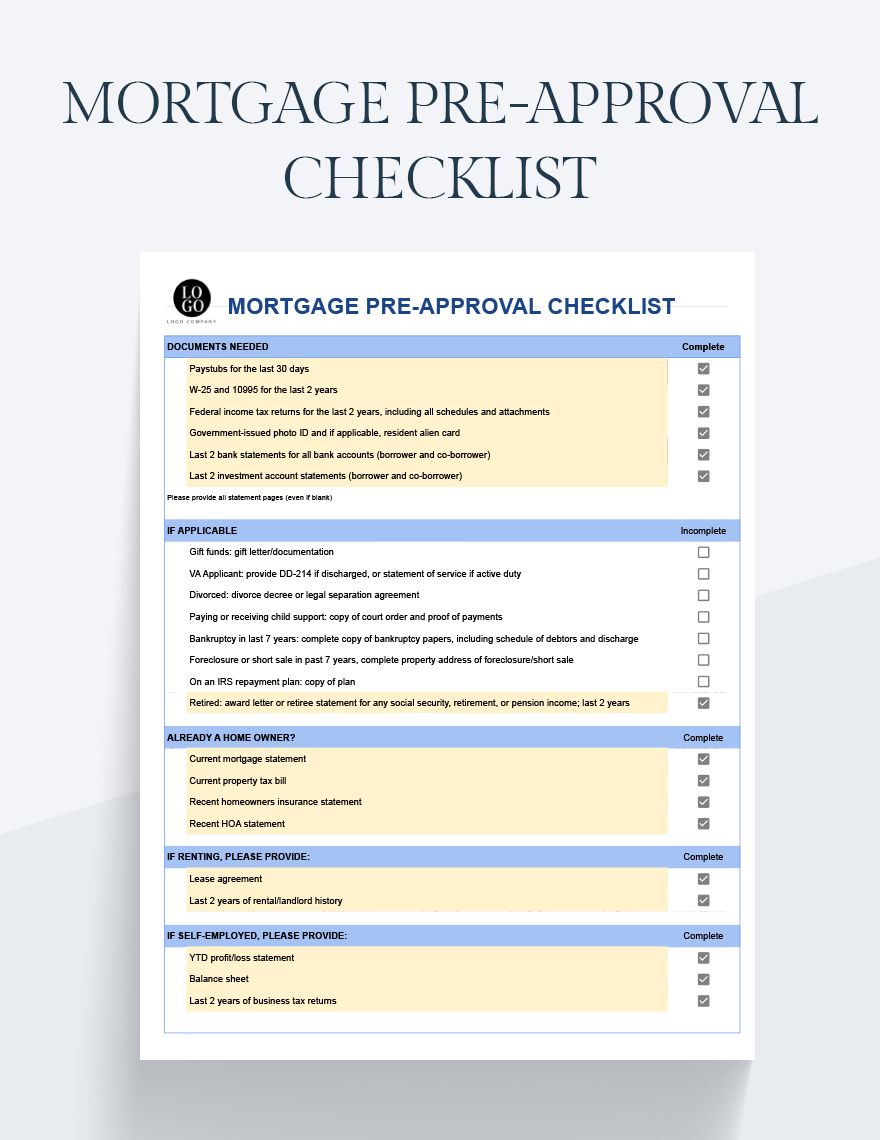

Pre Approval Template #mortgage #homeloans #documents#mortgage #firsttimehomebuyeradvice #homeloans #documents looking to get pre approved for a mortgage? this video will walk you. Mortgage pre approval checklist. explore our mortgage pre approval checklist, thoughtfully designed to guide you through the essential steps of preparing for a mortgage pre approval process. our template includes all the necessary elements to assist you in gathering the required documents and information. available in word, pdf, and google docs.

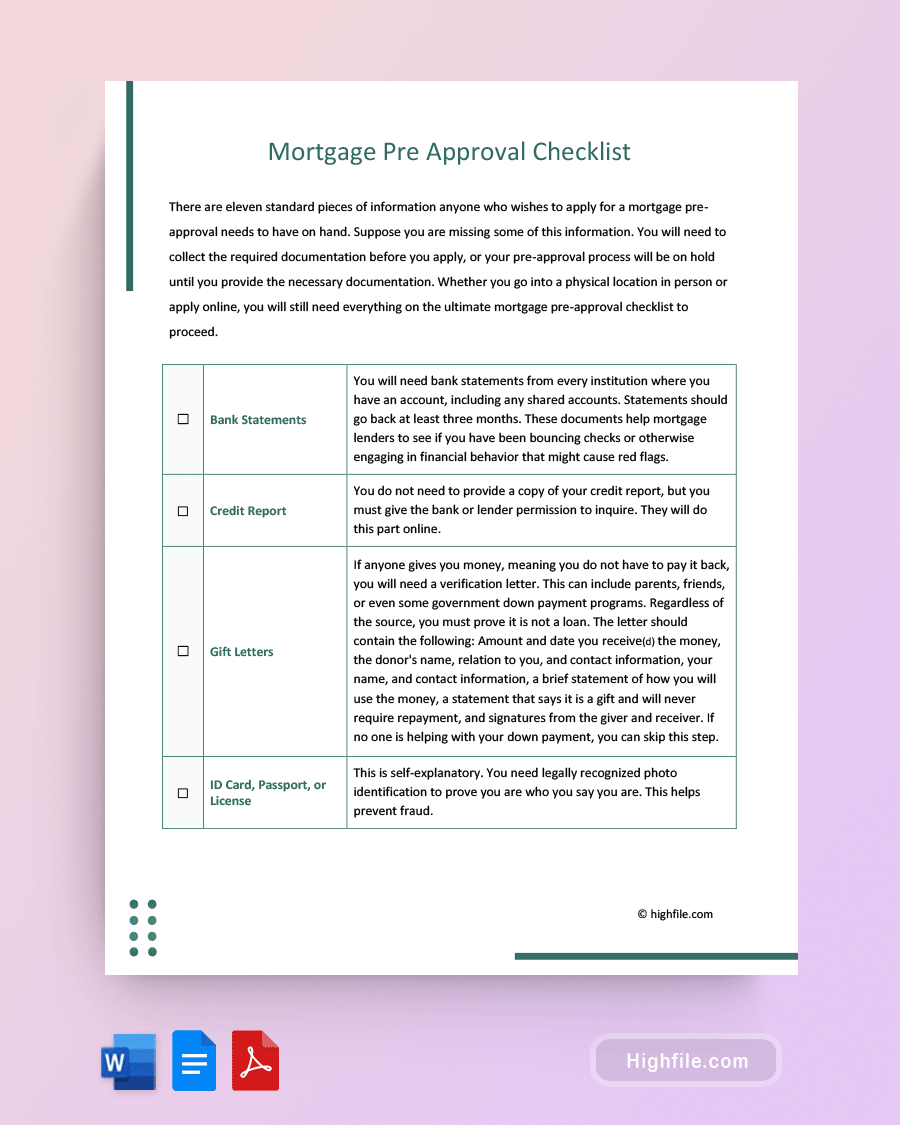

11 Mortgage Agreement Templates In Pdf Doc Securing a mortgage pre approval is an essential step in the home buying process. it provides clarity, credibility, and negotiating power, ensuring you’re well equipped to find and purchase your dream home. use this comprehensive guide and checklist to navigate the pre approval process with ease and confidence. The ultimate mortgage loan documents checklist for first time homebuyers. the mortgage loan process is pretty messy! it’s easy to forget an important document when you’re busy looking at houses and figuring out which one best suits your needs and budget. if you’re a list person, then you appreciate the value of keeping track of your items. 10. disclose money held in the stock market. 11. bring proof of other property currently owned. 12. be ready to disclose past financial issues like bankruptcy. provide a written explanation of. 1. check your credit score. do not pass “go,” and do not start looking at real estate until you have checked your credit score. this is the number that mortgage lenders will look at to.

Ultimate Mortgage Pre Approval Checklist Word Pdf Docs 10. disclose money held in the stock market. 11. bring proof of other property currently owned. 12. be ready to disclose past financial issues like bankruptcy. provide a written explanation of. 1. check your credit score. do not pass “go,” and do not start looking at real estate until you have checked your credit score. this is the number that mortgage lenders will look at to. If you're self employed or own a business, these are the documents you need for the mortgage pre approval process: identification (one of these, which you will need to show in person) driver's license. passport. other state or federal issued id. income. pay stubs for the last 30 days, if applicable. A mortgage pre approval is documentation that shows you’re a good candidate for receiving a home loan. to get pre approved, you’ll complete an application and the lender will review your financial information, which includes pulling your credit. once pre approved, you’ll receive a pre approval letter with an estimate of how much money you.

Checklist Approval If you're self employed or own a business, these are the documents you need for the mortgage pre approval process: identification (one of these, which you will need to show in person) driver's license. passport. other state or federal issued id. income. pay stubs for the last 30 days, if applicable. A mortgage pre approval is documentation that shows you’re a good candidate for receiving a home loan. to get pre approved, you’ll complete an application and the lender will review your financial information, which includes pulling your credit. once pre approved, you’ll receive a pre approval letter with an estimate of how much money you.

Comments are closed.