10 Best Bookkeeping Tips For Small Business And Beginners A I Financia

10 Best Bookkeeping Tips For Small Business And Beginners Sticking to the business budget. organizing accounting records. keeping the business finances polished. for llcs or corporations, having a different bank account is important because a separate account for personal finances helps with filing taxes. 2. keep track of cash payments. Small business bookkeeping tips #1. 1. keep business and personal banking separate. all new business owners must make it a priority to open a new bank account for their business, preferably an account with online access, to keep business funds separate from personal funds. processing transactions for your personal expenses within the.

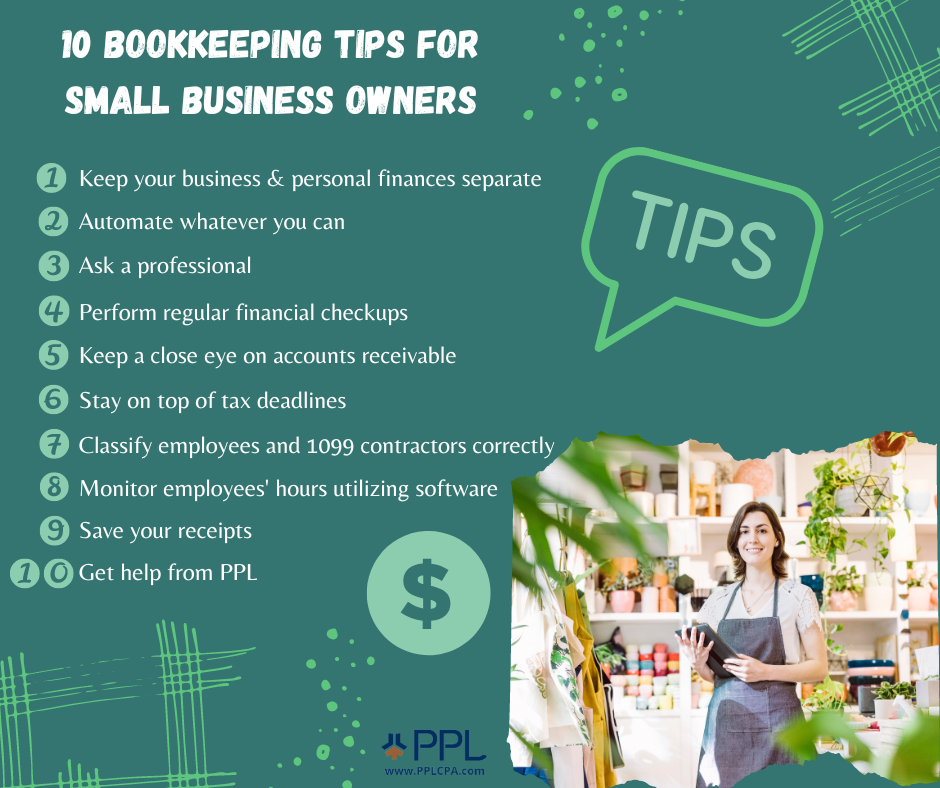

10 Bookkeeping Tips For Small Business Owners Ppl Cpa Table of contents. bookkeeping is the process of tracking income and expenses in your business. it lets you know how you’re doing with cash flow and how your business is doing overall. staying. Get in the know with our how to guide to bookkeeping basics for small business owners. then, block an hour on your calendar every week for bookkeeping. during that hour, you can work through a checklist of routine tasks. these tasks can include the following: check on invoices and record payments. review and pay expenses and invoices. Step 1: gather your financial documents. the first step is to gather your business’s “source financial documents.”. a “source financial document” is the first documentation of a business transaction. think: invoices and receipts. they need to contain information about the: date of the transaction. It offers unlimited users and bills on a transaction basis rather than a standard monthly fee. 2. choose an accounting method. the two primary methods of small business accounting are cash based and accrual. while the cash based method is the simplest to use, it’s not suitable for every small business.

7 Tips For Better Financial Records Ansi Information Systems Step 1: gather your financial documents. the first step is to gather your business’s “source financial documents.”. a “source financial document” is the first documentation of a business transaction. think: invoices and receipts. they need to contain information about the: date of the transaction. It offers unlimited users and bills on a transaction basis rather than a standard monthly fee. 2. choose an accounting method. the two primary methods of small business accounting are cash based and accrual. while the cash based method is the simplest to use, it’s not suitable for every small business. 1. open a separate business account. one of the most important bookkeeping basics for a business owner is to keep personal and business finances separate. combining your personal and business finances in the same checking account raises the risk of errors in small business bookkeeping. 7. set aside time to review the books. even if you’re not the one doing the bookkeeping and payroll, it’s important for you to block out time to review the accounting records and financial statements with your professional bookkeeper. it keeps you up to speed with how the business is performing and growing.

Comments are closed.