4 Things You Need To Know Before Opening A Roth Ira

4 Things You Need To Know Before Opening A Roth Ira Youtube At higher income levels, your maximum contribution declines the more you earn. and if your magi is $161,000 or more, you’re no longer eligible to contribute to a roth ira. if you’re a married couple filing jointly, you can contribute up to the maximum amount to each spouse’s ira if your combined magi is under $230,000 for 2024. For 2020, the maximum contribution to a roth ira is $6,000 per year. but if you’re 50 or older, that increases to $7,000 per year. there is a bit of a catch with that contribution. it’s only.

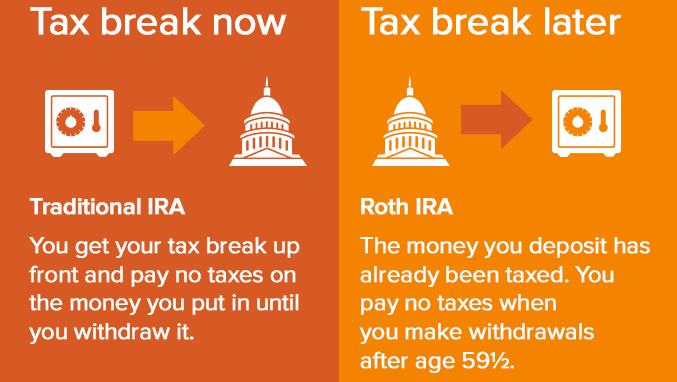

4 Things To Know Before Opening A Roth Ira Youtube Steps to open a roth ira. to open a roth ira, follow these steps: 1. determine your eligibility. the first step to opening a roth ira is finding out if you're eligible. the criteria for roth ira. 4. select a provider to open your roth ira. opening a roth ira as a 'do it yourself' investor. for people who want to pick their own investments, opening a roth ira at an online broker makes a lot. The bottom line. a roth ira is an individual retirement account (ira) that allows you to withdraw money (without paying a penalty) on a tax free basis after age 59½, and after you have owned the. The headline advantage of having your money in a roth ira is that you’re able to enjoy tax free compounding on your money. the biggest drawback of roth iras is that you will not earn that tax.

Four Things You Must Know Before Opening A Roth Ira Market The bottom line. a roth ira is an individual retirement account (ira) that allows you to withdraw money (without paying a penalty) on a tax free basis after age 59½, and after you have owned the. The headline advantage of having your money in a roth ira is that you’re able to enjoy tax free compounding on your money. the biggest drawback of roth iras is that you will not earn that tax. That means you can let the money keep growing until you need it, or even leave tax free income to your beneficiaries. the steps to open a roth ira are simple: make sure you're eligible. decide. These are the documents that you need. once you’ve determined your eligibility status, opening a roth ira is relatively simple. most banking or investing platforms require just a few key pieces.

Comments are closed.