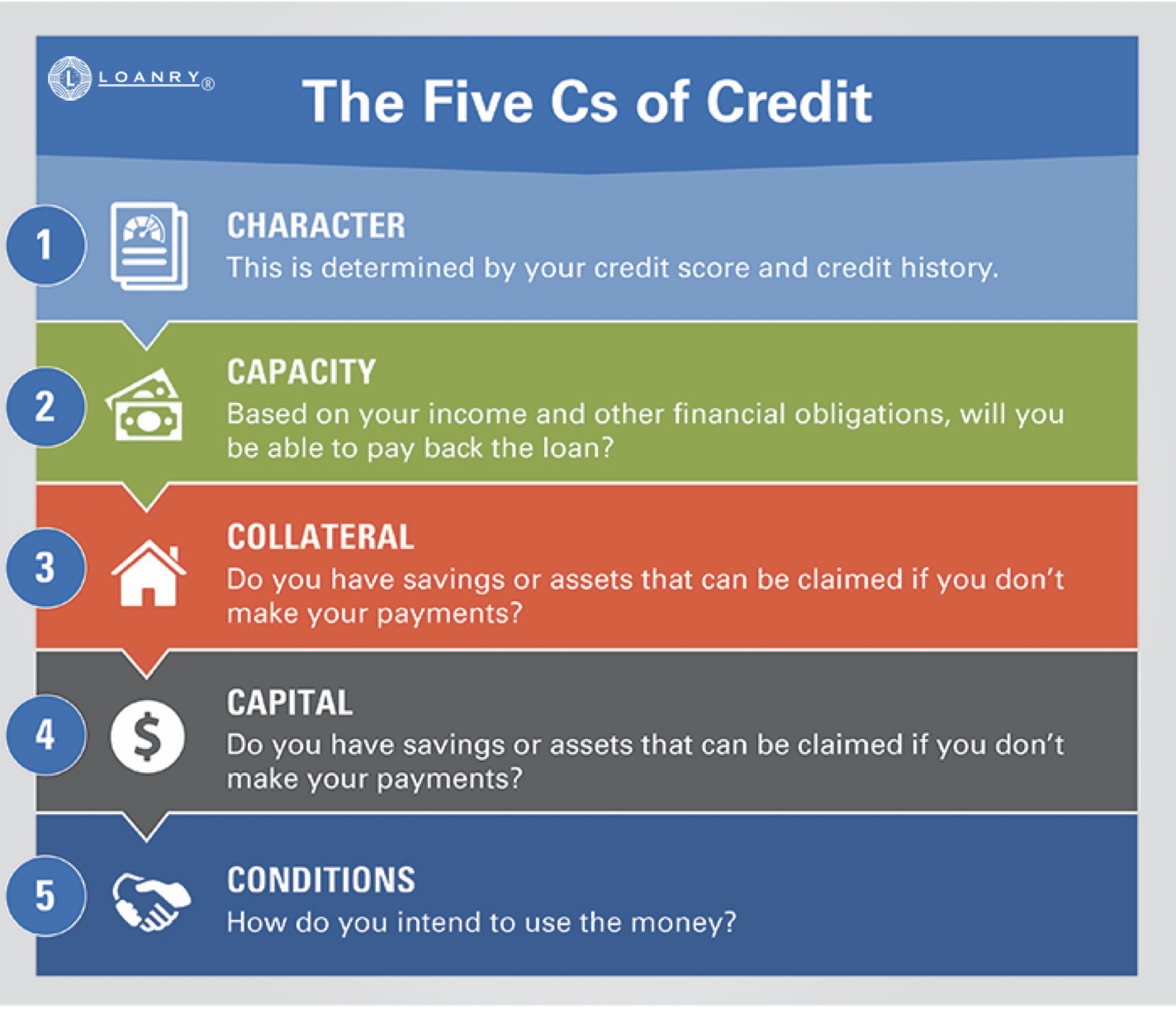

5 Cs Of Credit

юаа5юаб юааcтащsюаб юааof Creditюаб What Lenders Are Looking For Expert Advice Cdc Learn what the five cs of credit are and how they affect your ability to borrow money. find out how lenders evaluate your character, capacity, capital, collateral, and conditions before approving a loan. Learn what the five c's of credit are and how they affect your borrowing potential. find out how to improve your character, capacity, capital, conditions and collateral before applying for a loan.

:max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)

юаа5 Cs Of Creditюаб What They Are How Theyтащre Used And Which Is Most Learn how lenders evaluate your creditworthiness based on character, capacity, capital, collateral and conditions. find out how to use the 5 c’s of credit to boost your chances of qualifying for credit. Learn what the five cs of credit are and how they affect your ability to get a loan. find out how character, capacity, capital, collateral and conditions influence your creditworthiness and interest rates. Learn how lenders use the 5 cs of credit (character, capacity, capital, collateral, and conditions) to evaluate borrowers and structure loans. cfi provides courses, templates, and cheat sheets for commercial lending. The five c’s, or characteristics, of credit — character, capacity, capital, conditions and collateral — are a framework used by many lenders to evaluate potential small business.

Your A Guide To The Five C S Of Credit Loanry Learn how lenders use the 5 cs of credit (character, capacity, capital, collateral, and conditions) to evaluate borrowers and structure loans. cfi provides courses, templates, and cheat sheets for commercial lending. The five c’s, or characteristics, of credit — character, capacity, capital, conditions and collateral — are a framework used by many lenders to evaluate potential small business. Learn how lenders evaluate your creditworthiness based on five key factors: capacity, capital, conditions, character, and collateral. find out how to improve your credit score and get better loan terms. The 5 cs of credit analysis are character, capacity, capital, collateral, and conditions. they are used by lenders to evaluate a borrower’s creditworthiness and include factors such as the borrower’s reputation, income, assets, collateral, and the economic conditions impacting repayment.

Comments are closed.