6 Basics Of Stock Trading Psychology

6 Basics Of Stock Trading Psychology Here are six basics to consider when pondering stock trading psychology: 1. understanding market behavior. understanding market behavior is essential for any trader looking to succeed in the financial markets. market behavior is often driven by emotions and psychological factors, such as fear, greed, and optimism. Overshopped: the perception that a firm's attempt to raise capital by selling equity or debt through a private or public offering is an act of desperation. when a company's management overshops a.

6 Basics Of Stock Trading Psychology вђ Maintaining Discipline Trading psychology is the mental and emotional state you experience when trading. it refers to aspects of a trader’s behavior that influence the decision making process when trading securities. Trading psychology plays a pivotal role in the success of traders by influencing how decisions are made under conditions of uncertainty and risk. it encompasses understanding one’s cognitive biases, exercising self control, and managing emotions to make informed and rational trading decisions. successful traders not only rely on their. Emotional traits like greed and fear of missing out and greed lead to illogical decisions, leading to considerable losses in trading. 2. revenge trading. it is another mistake where traders try to recover their losses through impulsive trades. hence, it leads to huge losses and monetary downgrades. 3. overconfidence. Trading psychology: the emotions and mental state that dictate success or failure in trading securities. trading psychology refers to the aspects of an individual’s mental makeup that help.

Six Strategies Every Trader Should Know Stock Trading Strategies Emotional traits like greed and fear of missing out and greed lead to illogical decisions, leading to considerable losses in trading. 2. revenge trading. it is another mistake where traders try to recover their losses through impulsive trades. hence, it leads to huge losses and monetary downgrades. 3. overconfidence. Trading psychology: the emotions and mental state that dictate success or failure in trading securities. trading psychology refers to the aspects of an individual’s mental makeup that help. Trading psychology refers to the study and understanding of the psychological and emotional aspects that influence traders' decision making, behavior, and performance in the financial markets. it. The basics of trading psychology. managing emotions. fear, greed, excitement, overconfidence and nervousness are all typical emotions experienced by traders at some point or another. managing the.

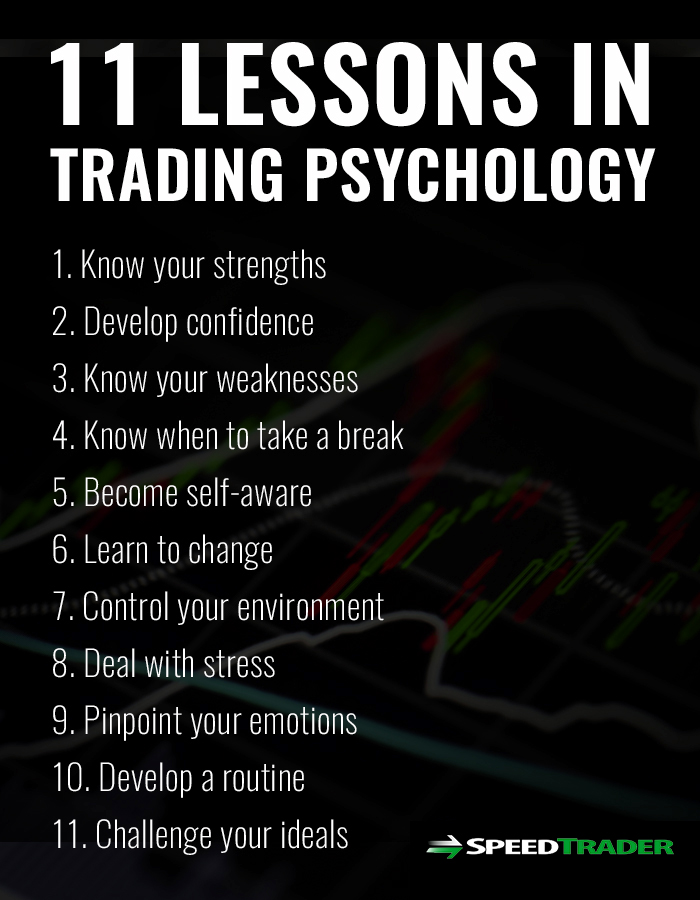

Trading Psychology 11 Lessons For Stock Market Traders Trading psychology refers to the study and understanding of the psychological and emotional aspects that influence traders' decision making, behavior, and performance in the financial markets. it. The basics of trading psychology. managing emotions. fear, greed, excitement, overconfidence and nervousness are all typical emotions experienced by traders at some point or another. managing the.

Trading Psychology Strategy And Planning Hantec Markets

Comments are closed.