A Detailed Post Explaining Why There Is A Difference In Your Equifax

Equifax Vs Transunion Why Is There A Difference Between The Scores When you log into your credit karma account, you can access your free credit reports and scores from both transunion and equifax. they’ll likely be slightly different, and it’s possible they could be very different. multiple factors could account for why your scores are different. credit scoring models can differ and produce different scores. 1. in canada, there are two credit bureaus that financial institutions use in the credit scoring process: equifax and transunion. but while the two companies serve a similar purpose, each one will give you a different credit score. in this article, i’ll explain why that is, and show you how you can get an updated credit score every month for.

Transunion Vs Equifax Credit Scores Why The Difference Between Scores The most common scores range from 300 points to 850 points. in general, the higher your score, the better your chances of getting approved for credit cards or loans with more favorable terms, including lower interest rates and fees. credit score range. vantagescore 3.0. fico. Transunion is a chicago based company founded in 1968. it has information on more than a billion customers in 30 plus countries, including 200 million in the u.s. [2] transunion uses the vantagescore 3.0 model in compiling its credit score, which ranges from 300 to 850. a good credit score under the transunion model ranges from 720 to 780. Credit scores can easily get confusing, especially if you are new to monitoring your credit. in reality, the concepts are pretty simple. equifax and transunion are just two different credit bureaus that compile and distribute credit reports and scores. while these scores may differ slightly, they use the same information and should be similar. There are many reasons why the numbers between equifax and transunion may differ so much. one of which is that they use different algorithms to calculate your credit score. even then with the different algorithms, the variance between the two scores should be between 7 10% or even less. therefore, there are other reasons why the numbers between.

The Ultimate Post Explaining Why There Is A Difference In Your о Credit scores can easily get confusing, especially if you are new to monitoring your credit. in reality, the concepts are pretty simple. equifax and transunion are just two different credit bureaus that compile and distribute credit reports and scores. while these scores may differ slightly, they use the same information and should be similar. There are many reasons why the numbers between equifax and transunion may differ so much. one of which is that they use different algorithms to calculate your credit score. even then with the different algorithms, the variance between the two scores should be between 7 10% or even less. therefore, there are other reasons why the numbers between. Transunion credit monitoring. the transunion credit agency offers a one size fits all approach to credit monitoring that will cost you $29.95 a month. this service offers multiple benefits to keep your credit score intact: unlimited credit score updates. email updates of important changes to your credit history. When it comes to equifax vs. transunion, both bureaus are accurate and just as important as the other. a slight difference in these scores is not usually a cause for concern. if you see a major difference when checking your credit scores, check your credit reports and decide if you need credit help. the credit agents are professionals that can.

Transunion Vs Equifax Differences Explained For Beginners 2021 Transunion credit monitoring. the transunion credit agency offers a one size fits all approach to credit monitoring that will cost you $29.95 a month. this service offers multiple benefits to keep your credit score intact: unlimited credit score updates. email updates of important changes to your credit history. When it comes to equifax vs. transunion, both bureaus are accurate and just as important as the other. a slight difference in these scores is not usually a cause for concern. if you see a major difference when checking your credit scores, check your credit reports and decide if you need credit help. the credit agents are professionals that can.

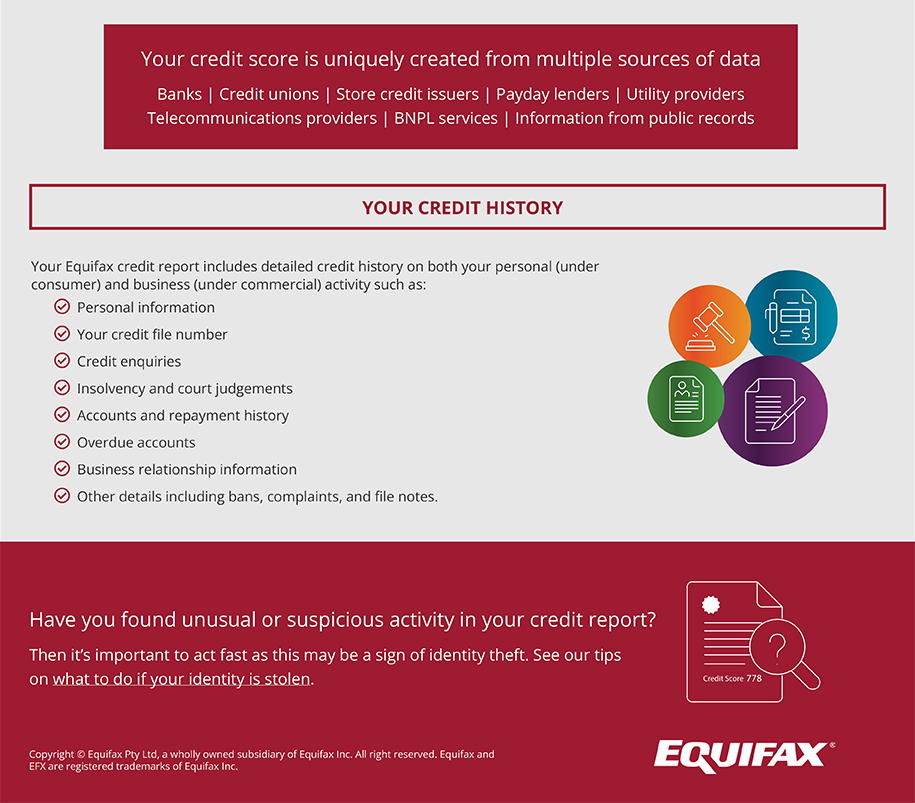

How To Read Your Equifax Credit Report Equifax Personal

Comments are closed.