Accounting Basics For Small Business Owners By A Cpa

Accounting Basics For Small Business Owners By A Cpa вђ Merni Net Learn the accounting basics for small business from a cpa. today, you will learn the role of accounting in small business. become a tax client: sched. The first part of the accounting process is to record all transactions that occur in your business. every time a transaction occurs, you must record it. now there are 5 major types of transactions that you must know. these 5 transaction types are: revenue, expenses, assets, liabilities, and equity.

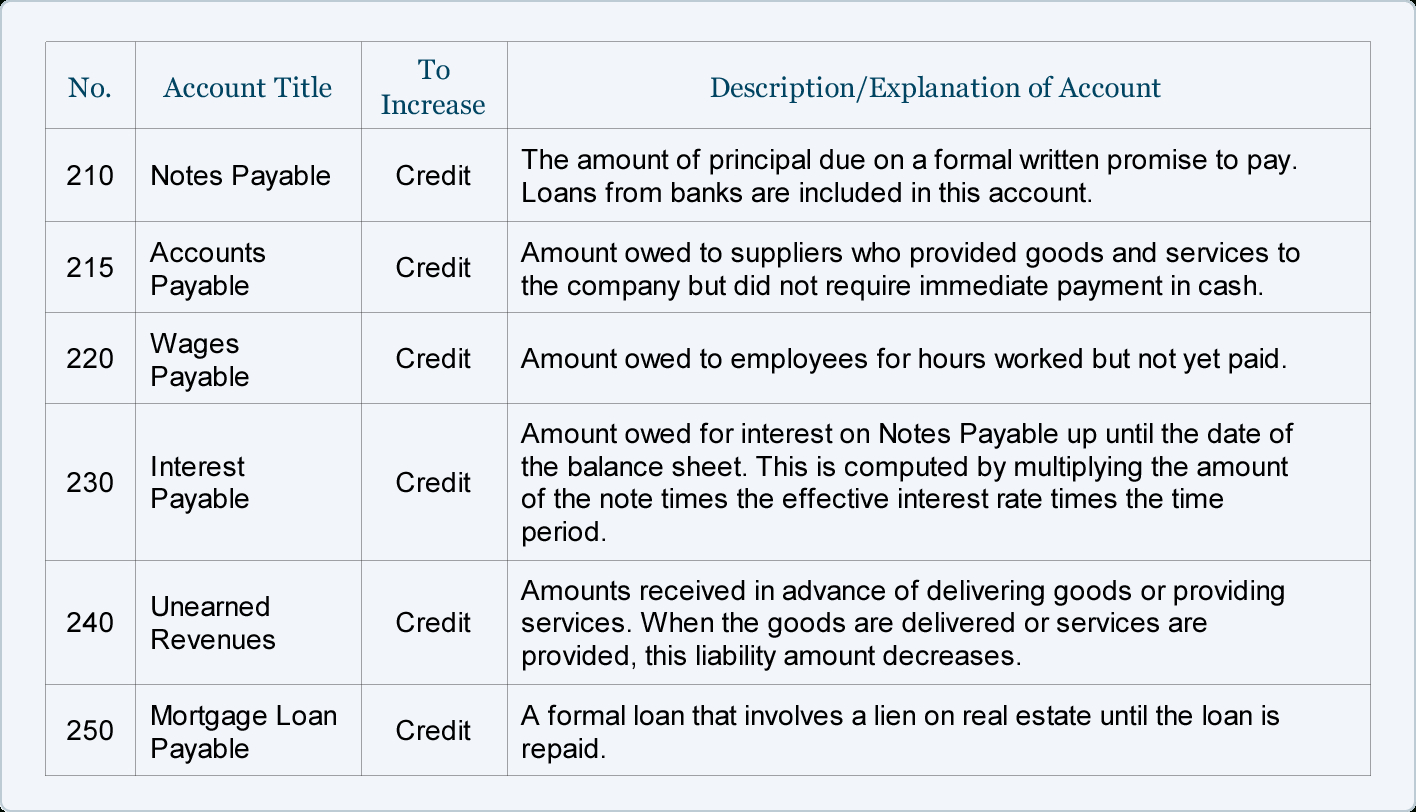

Chart Of Accounts Template Printable Business owners have to settle on one of two basic accounting methods before filing their first tax returns: cash basis and accrual basis accounting. the accounting method you choose has a huge impact on your business, so we highly recommend you talk to your small business accountant, cpa, or bookkeeper about which method works best for you. Accounting reports every business owner should use reports, reports, reports! they are the secret sauce to business management. the small things that happen in your business every day combine to create a big impact on your financial success. there’s no way to know that these things happen if you can’t see them. financial reports are where they. Accounting as a small business owner begins with laying a proper foundation. that includes four key activities: opening a small business bank account. choosing an accounting method (cash or. Receiving vendor invoices and recording expenses. maintaining and balancing subsidiaries, general ledgers, and historical accounts. completing payroll. the act of bookkeeping produces financial statements, which your cpa then uses to file your taxes and make strategic financial decisions that help your business grow.

Ask A Cpa 10 Accounting Basics For Small Business Owners The Accounting as a small business owner begins with laying a proper foundation. that includes four key activities: opening a small business bank account. choosing an accounting method (cash or. Receiving vendor invoices and recording expenses. maintaining and balancing subsidiaries, general ledgers, and historical accounts. completing payroll. the act of bookkeeping produces financial statements, which your cpa then uses to file your taxes and make strategic financial decisions that help your business grow. Most small business owners know the big four names in accounting: pricewaterhousecoopers; deloitte touche tohmatsu; ernst & young; kpmg; these firms are established and well staffed with qualified cpas. however, their large size leads some small business owners to prefer smaller accounting firms that will not lose them among their larger clients. Step 1: select your accounting method. one of the first accounting decisions you need to make in your small business is the method you’ll use to record financial transactions. there are two basic accounting methods: cash basis. under the cash accounting method, you record income and expenses when money changes hands.

Comments are closed.