Affordable Care Act Form Required For Tax Filing

Affordable Care Act Form Required For Tax Filing The Affordable Trump-era tax cuts would add $46 trillion to the deficit over 10 years Vice President Kamala Harris arrives for an anniversary event for the Affordable Care Act in the East Married couples filing Premium tax credit Many people receive this credit throughout the year in the form of a health insurance premium subsidy Created by the Affordable Care Act, it is

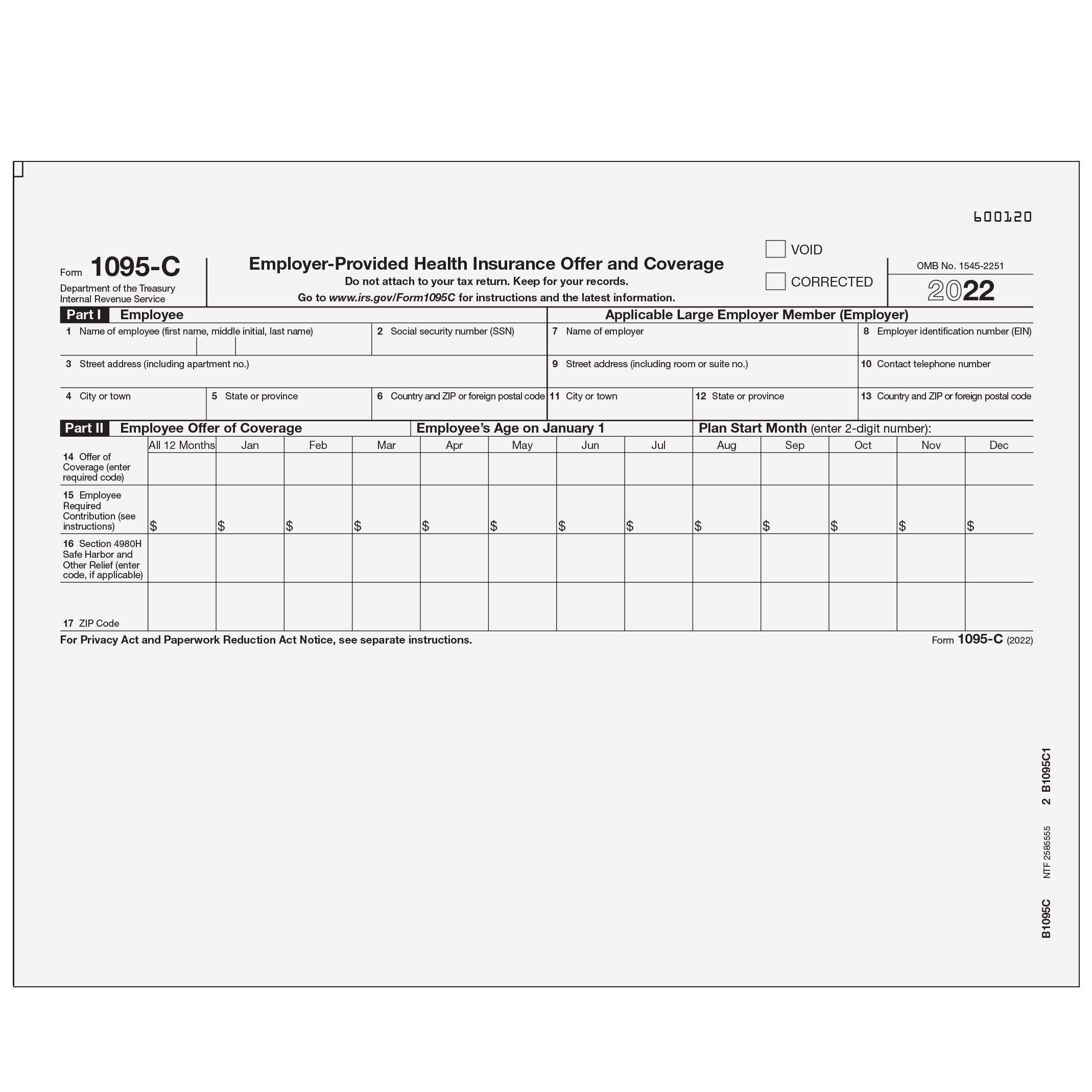

Affordable Care Act Form 1095 C Methodist Health System This involves filing forms to the IRS to report payroll about what health insurance coverage they offer to their employees under the Affordable Care Act They apply to applicable large employers Plus, the platform will provide a customized view of the forms and schedules required to file in a given tax season W-2s, and Affordable Care Act (ACA) forms—BoomTax can help you prepare This limitation had applied to AGI at or above $266,700 for single filers and $320,000 for taxpayers filing Affordable Care Act’s (ACA’s) individual mandate penalty tax to zero Previously, The premium tax credit was originally enacted as part of the Affordable Care Act (aka, Obamacare of annual household income they're required to contribute toward their health insurance

Affordable Care Act Form 1095 C Health Coverage This limitation had applied to AGI at or above $266,700 for single filers and $320,000 for taxpayers filing Affordable Care Act’s (ACA’s) individual mandate penalty tax to zero Previously, The premium tax credit was originally enacted as part of the Affordable Care Act (aka, Obamacare of annual household income they're required to contribute toward their health insurance She has researched and written content on various legal and health care affordable than other LLC formation services while still ensuring proper filing Creating an LLC in NJ provides some tax Extended the American Opportunity Tax Credit Reduced the earnings threshold for the refundable portion of the CTC to $3,000, not indexed for inflation Extended increase in the beginning of the EITC When a death occurs, sometimes taxes must be paid on the assets the deceased left behind or transferred to heirs These taxes are called estate taxes or inheritance taxes This guide explains what 16—The Affordable Care Act is back under attack But the debate will also likely draw in other issues, including Trump-era tax cuts, which also must be addressed next year

Fillable Online Affordable Care Act Application Pdf Fax Email Print She has researched and written content on various legal and health care affordable than other LLC formation services while still ensuring proper filing Creating an LLC in NJ provides some tax Extended the American Opportunity Tax Credit Reduced the earnings threshold for the refundable portion of the CTC to $3,000, not indexed for inflation Extended increase in the beginning of the EITC When a death occurs, sometimes taxes must be paid on the assets the deceased left behind or transferred to heirs These taxes are called estate taxes or inheritance taxes This guide explains what 16—The Affordable Care Act is back under attack But the debate will also likely draw in other issues, including Trump-era tax cuts, which also must be addressed next year WASHINGTON — The Affordable Care Act is back under attack including Trump-era tax cuts, which also must be addressed next year Also potentially in play are other aspects of the ACA The Affordable Care Act is back under attack Not as in the repeal-and-replace But the debate will also likely draw in other issues, including Trump-era tax cuts, which also must be addressed next

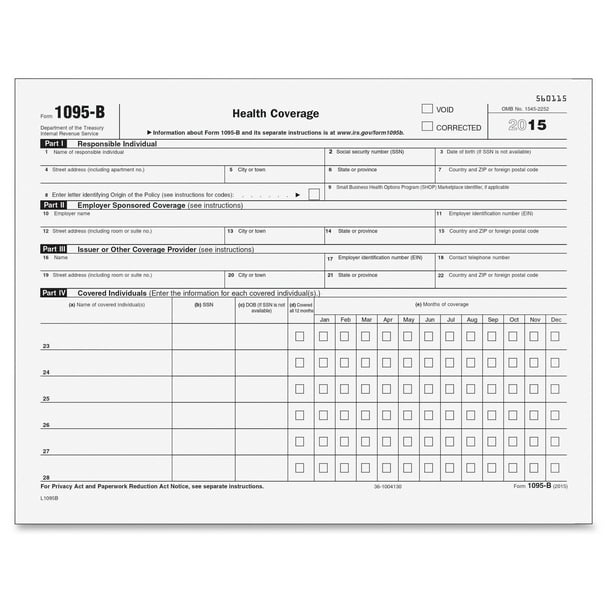

1095b Affordable Care Act Tax Form Walmart Walmart When a death occurs, sometimes taxes must be paid on the assets the deceased left behind or transferred to heirs These taxes are called estate taxes or inheritance taxes This guide explains what 16—The Affordable Care Act is back under attack But the debate will also likely draw in other issues, including Trump-era tax cuts, which also must be addressed next year WASHINGTON — The Affordable Care Act is back under attack including Trump-era tax cuts, which also must be addressed next year Also potentially in play are other aspects of the ACA The Affordable Care Act is back under attack Not as in the repeal-and-replace But the debate will also likely draw in other issues, including Trump-era tax cuts, which also must be addressed next

Comments are closed.