Allstate Homeowners Insurance Review The Motley Fool

Allstate Homeowners Insurance Review Top Ten Reviews 5.00 5. get a quote. allstate homeowners insurance offers some of the most generous discounts in the industry. with flexible policies and a large network of agents, many people find allstate. Allstate offers some of the most generous discounts in the industry, which includes a discount of up to 25% when you bundle home and auto policies, up to 20% when you switch to allstate without a.

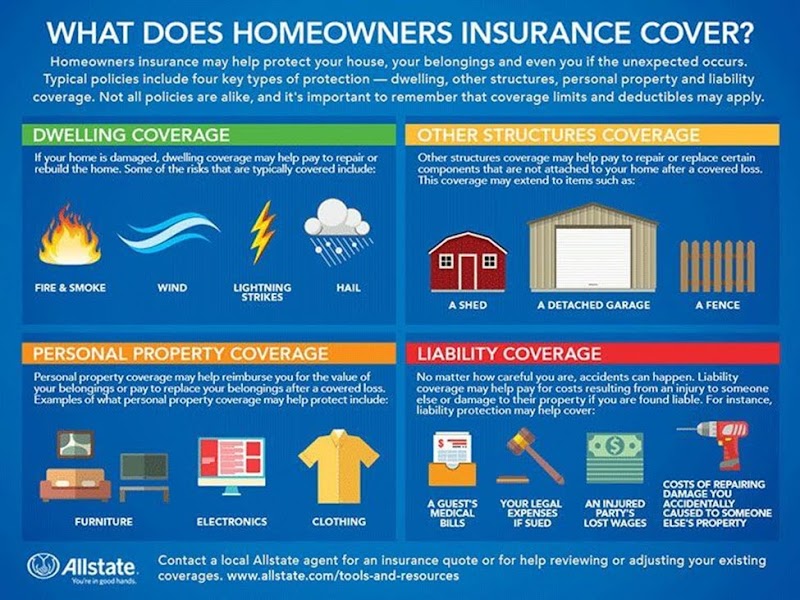

Which Homeowners Insurance Policy Do You Need Allstate Agent Darlene Here's a closer look at five upgrades that could save homeowners money on insurance over the long term: roof replacement: roof replacement decreases the likelihood of leaks and damages from high. The average cost of home insurance in the u.s. varies widely by state. for example, the average annual cost of homeowners insurance in new hampshire is $813. in nebraska, it's a whopping $4,398. Allstate ranks no. 3 in our best homeowners insurance companies rating, tied with auto owners. allstate has the fourth lowest sample premium, averaging $184.15 per month for $300,000 in dwelling. Our analysis found that allstate home insurance costs an average of $116 a month ($1,395 annually) for a policy with $350,000 in dwelling coverage, which is about $300 less than the national.

Federal Deposit Insurance Corporation Ah вђ Studio Blog Allstate ranks no. 3 in our best homeowners insurance companies rating, tied with auto owners. allstate has the fourth lowest sample premium, averaging $184.15 per month for $300,000 in dwelling. Our analysis found that allstate home insurance costs an average of $116 a month ($1,395 annually) for a policy with $350,000 in dwelling coverage, which is about $300 less than the national. Living in a condo means you can expect lower rates as the dwelling coverage requirements are small. many states charge an average of $20 $30 monthly for a condo policy. in a sample quote we. The national association of realtors says the average annual homeowners insurance premium is $2,377 annually, up 20% from two years ago and it could rise another 6% by the end of this year.

Allstate Homeowners Insurance Review Valuepenguin Living in a condo means you can expect lower rates as the dwelling coverage requirements are small. many states charge an average of $20 $30 monthly for a condo policy. in a sample quote we. The national association of realtors says the average annual homeowners insurance premium is $2,377 annually, up 20% from two years ago and it could rise another 6% by the end of this year.

Allstate Homeowners Insurance Review Money

Comments are closed.