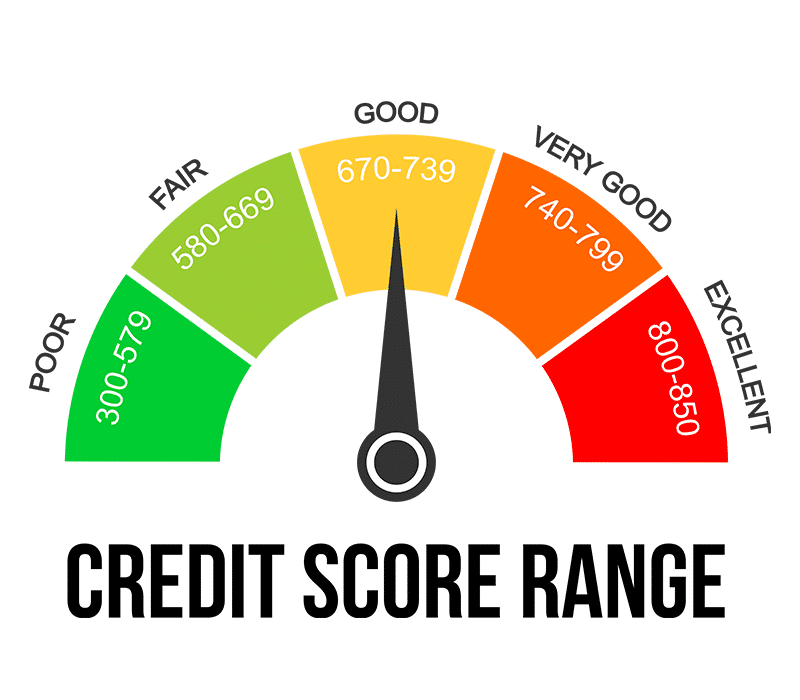

An Infographic Shows The Credit Score Range Credit Score Range G

An Infographic Shows The Credit Score Range Credit Score о The information in the above chart is for general educational purposes only and does not represent score ranges specific to any one credit bureau or credit scoring model. the loan terms offered to you are tied to how much risk the lender believes they are taking by extending credit to you. Solutions) are two of the most commonly used credit scores. two different ranges of credit scores most credit scores range from 300 to 850. a higher credit score means you are predicted to be less of a risk. usually a high credit score makes it easier to get a loan and may result in a better interest rate, but lenders have their own cutoffs to.

Credit Score Range Higher Score Benefits A vantagescore 3.0 score of 661 could put you in the good range for example, while a 661 fico score may be considered fair. and lenders create or use their own standards when making credit based decisions. in other words, what one lender might consider “very good” another could consider “good.”. 740 to 799: very good credit score. individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit. 670 to 739: good credit score. lenders generally view those with credit scores of 670 and up as acceptable or lower risk borrowers. But both use a credit score range of 300 to 850. these are the general guidelines: a score of 720 or higher is generally considered excellent credit. a score of 690 to 719 is considered good. Fico credit score ranges. fico score ranges are calculated using a combination of data like payment history, total amounts owed, new credit and length of credit history. here are the ranges according to fico: poor: less than 580. fair: 580 669. good: 670 739. very good: 740 799.

What Is A Credit Score Understanding Credit Score Ranges Lendstart But both use a credit score range of 300 to 850. these are the general guidelines: a score of 720 or higher is generally considered excellent credit. a score of 690 to 719 is considered good. Fico credit score ranges. fico score ranges are calculated using a combination of data like payment history, total amounts owed, new credit and length of credit history. here are the ranges according to fico: poor: less than 580. fair: 580 669. good: 670 739. very good: 740 799. Good scores (670 739) if your fico score falls between 670 and 739 you have a credit score that is at or near average. as of 2020, the average fico score in the united states was 703. most lenders will consider you to have a good credit score in this range. so, you’re still likely to qualify for many types of financing. June 20, 2024. credit scores usually range from 300 850. the goal is to get to 670 to be in the good range for your credit score. once you get to 740, your credit is very good. the ultimate credit.

Infographic All You Need To Know About Credit Scores Blog Good scores (670 739) if your fico score falls between 670 and 739 you have a credit score that is at or near average. as of 2020, the average fico score in the united states was 703. most lenders will consider you to have a good credit score in this range. so, you’re still likely to qualify for many types of financing. June 20, 2024. credit scores usually range from 300 850. the goal is to get to 670 to be in the good range for your credit score. once you get to 740, your credit is very good. the ultimate credit.

Credit Scores 101 The Key Powering Your Financial Independence

Comments are closed.