Application Letter To Bank For Applying Business Loan Loan Request Application

Application Letter To Bank For Applying Business Loan Loan Answer: a business loan request letter is a formal written document submitted by an individual or a business to a financial institution or lender, seeking financial assistance in the form of a loan. it outlines the purpose of the loan, the amount requested, and provides supporting information to convince the lender of the borrower’s creditworthiness. The first sentence of your letter should express your request for the loan and the amount you want to borrow. next, use a few short and concise sentences to provide a basic overview of your business. in this section, be sure to include: business’s legal name and any dba that your business uses.

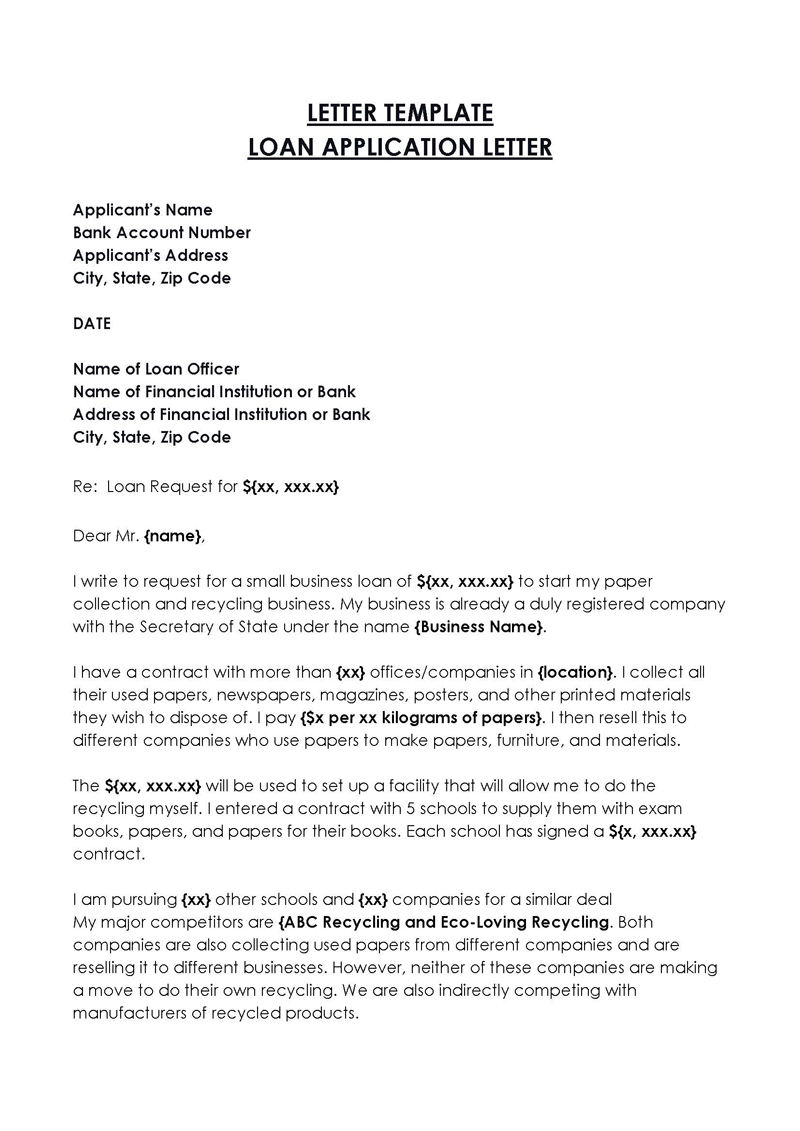

20 Best Loan Application Letter Samples How To Write Format When drafting a request letter to a bank for a business loan, it's crucial to maintain clarity and politeness while providing all necessary details about your business and loan requirements. clearly state your name, company name, designation, and the purpose of the loan. For example, your summary might look something like this: i’m writing to request a [loan amount] loan for my small business in the [industry name] industry, [business name]. with this loan, [business name] would [describe your intended business loan use]. as you can see, you don’t need much detail here. you’re just giving the reader a. Name of loan officer. name of financial institution or bank. address of financial institution or bank. city, state, zip code. re: loan application for $100,000. dear [loan officer’s name], i am writing to formally request a loan of $100,000. as a loyal customer for the past 20 years, i have always trusted this institution with my financial. How to write a request letter for a business loan.

4 Loan Application Letters Perfect For Starting Up A Business Name of loan officer. name of financial institution or bank. address of financial institution or bank. city, state, zip code. re: loan application for $100,000. dear [loan officer’s name], i am writing to formally request a loan of $100,000. as a loyal customer for the past 20 years, i have always trusted this institution with my financial. How to write a request letter for a business loan. While a loan request letter may be needed for bank and sba loans, it won’t be enough for approval unless it’s supported by a sound credit situation and solid financial planning. for your request to be persuasive to lenders, you should do 2 things before preparing your business request letter and loan application package:. 1. start with a header and a greeting. the top of your letter is reserved for basic identifying information and a subject line that includes your requested loan amount. most loan request headers include personal details such as: your first and last name. the name of your business. your business’s address.

20 Best Loan Application Letter Samples How To Write Format While a loan request letter may be needed for bank and sba loans, it won’t be enough for approval unless it’s supported by a sound credit situation and solid financial planning. for your request to be persuasive to lenders, you should do 2 things before preparing your business request letter and loan application package:. 1. start with a header and a greeting. the top of your letter is reserved for basic identifying information and a subject line that includes your requested loan amount. most loan request headers include personal details such as: your first and last name. the name of your business. your business’s address.

Comments are closed.