Avoid Legal Nightmares By Making Your Private Practice An Llc Vs Sole

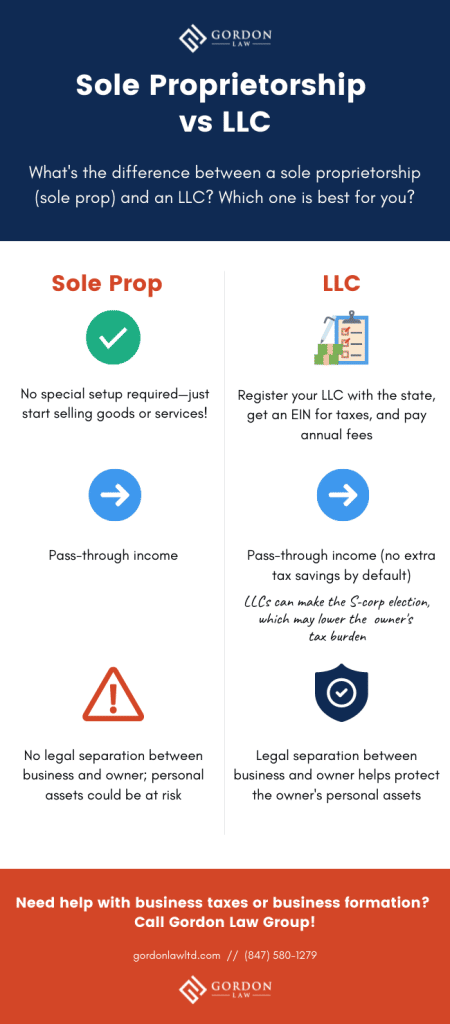

Avoid Legal Nightmares By Making Your Private Practice An Llc Vs Sole Jumping into the legal side of opening your private practice is extremely intimidating. you want to make the right decision and protect yourself as best you. Llc. sole proprietorships and limited liability companies (llc) are two of the most common business structures for individuals and small businesses. a sole proprietorship is the simplest and.

Llc Vs Sole Proprietorship The Complete Comparison A sole proprietorship can be riskier than an llc. a sole proprietorship is not a separate legal entity from the owner and does not provide the same legal protections as an llc. this means the. Compared to a sole proprietorship, registering an llc is time consuming. llc taxes are also more complex. the irs classifies llcs as "pass through entities" meaning that the llc does not pay federal income taxes on business income. the income "passes through" to individual members of the llc who pay taxes on income earned from the llc on their. This guide explains how an llc vs. sole proprietorship differs in terms of formation, operations, management, taxes and legal protection. updated mar 6, 2024 · 7 min read written by priyanka prakash. A limited liability company is a combination between a sole proprietorship and a corporation. this means that you get a bit of both worlds. an llc means that you and your private practice are two separate entities. although separate entities, profits, losses, and taxes are all the members’ (owners) responsibilities like they are in a sole.

How To Convert A Sole Proprietorship To An Llc Gordon Law Group This guide explains how an llc vs. sole proprietorship differs in terms of formation, operations, management, taxes and legal protection. updated mar 6, 2024 · 7 min read written by priyanka prakash. A limited liability company is a combination between a sole proprietorship and a corporation. this means that you get a bit of both worlds. an llc means that you and your private practice are two separate entities. although separate entities, profits, losses, and taxes are all the members’ (owners) responsibilities like they are in a sole. An llc can have a single owner or multiple owners, and it affords them legal protections that a sole proprietorship does not (hence “limited liability”). llcs with just one owner are sometimes. Llc vs. sole proprietorship: quick facts. an llc may be better for you if you value: limited personal liability: because an llc exists as a separate business entity, it's an excellent choice in any situation where you may face lawsuits, such as selling products, maintaining a physical location, or hiring employees. rather than risking your.

Sole Proprietorship Vs Llc A Comparison Step By Step Business An llc can have a single owner or multiple owners, and it affords them legal protections that a sole proprietorship does not (hence “limited liability”). llcs with just one owner are sometimes. Llc vs. sole proprietorship: quick facts. an llc may be better for you if you value: limited personal liability: because an llc exists as a separate business entity, it's an excellent choice in any situation where you may face lawsuits, such as selling products, maintaining a physical location, or hiring employees. rather than risking your.

Sole Proprietorship Vs Llc For Your Online Business

Comments are closed.