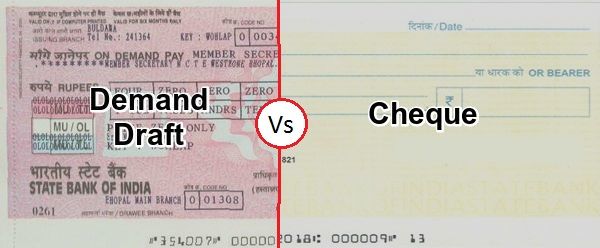

Bank Draft Vs Demand Draft Vs Cheque Dd Kya Hota Hai What Is Bank

Difference Between Cheque And Demand Draft With Comparison Chart डिमांड ड्राफ्ट या डीडी (dd) क्या होता है (what is a demand draft or dd?)डिमांड ड्राफ्ट को शार्ट में हम डीडी (dd) कहते है | इसके अलावा एक डिमांड ड्राफ्ट को रिमोटली क्रिएटेड चेक (rcc. Demand draft: a demand draft is a method used by an individual for making a transfer payment from one bank account to another. demand drafts differ from normal checks in that they do not require.

14 Latest Differences Between Cheque And Demand Draft в Banksforyou The banker’s cheque is pre printed with the word “not negotiable” however, this is not so in the case of demand draft. a demand draft of value rs. 20000 or more can be issued only with a c payee crossing, however, in the case of banker’s cheque, there is no such condition. bankers cheque can be cleared in any branch of the bank provided. A bank draft, also known as a banker's draft or cashier's check, is a payment instrument issued by a bank on behalf of a customer. it guarantees the payment as the funds are already debited from the customer's account. on the other hand, a cheque is a written order from an account holder to their bank, instructing them to pay a specific amount. Step 2: click on 'service' on the upper right of the menu. in the drop down menu, select 'request for' and then click on 'demand draft'. step 3: select the debit account and enter the amount, name of the beneficiary, and the city where the dd should be paid. step 4: select the dispatch mode by the bank or courier. then, click on 'proceed'. The cheque is just like a paper leaf, containing an order to the bank to pay the specified amount to the person whose name is stated on it. however, there is always a risk of dishonour of a cheque due to various reason, for which many entities prefer demand draft instead, as the payment is guaranteed.

Comments are closed.