Bank Of India Form 15g 2023 2024 Student Forum

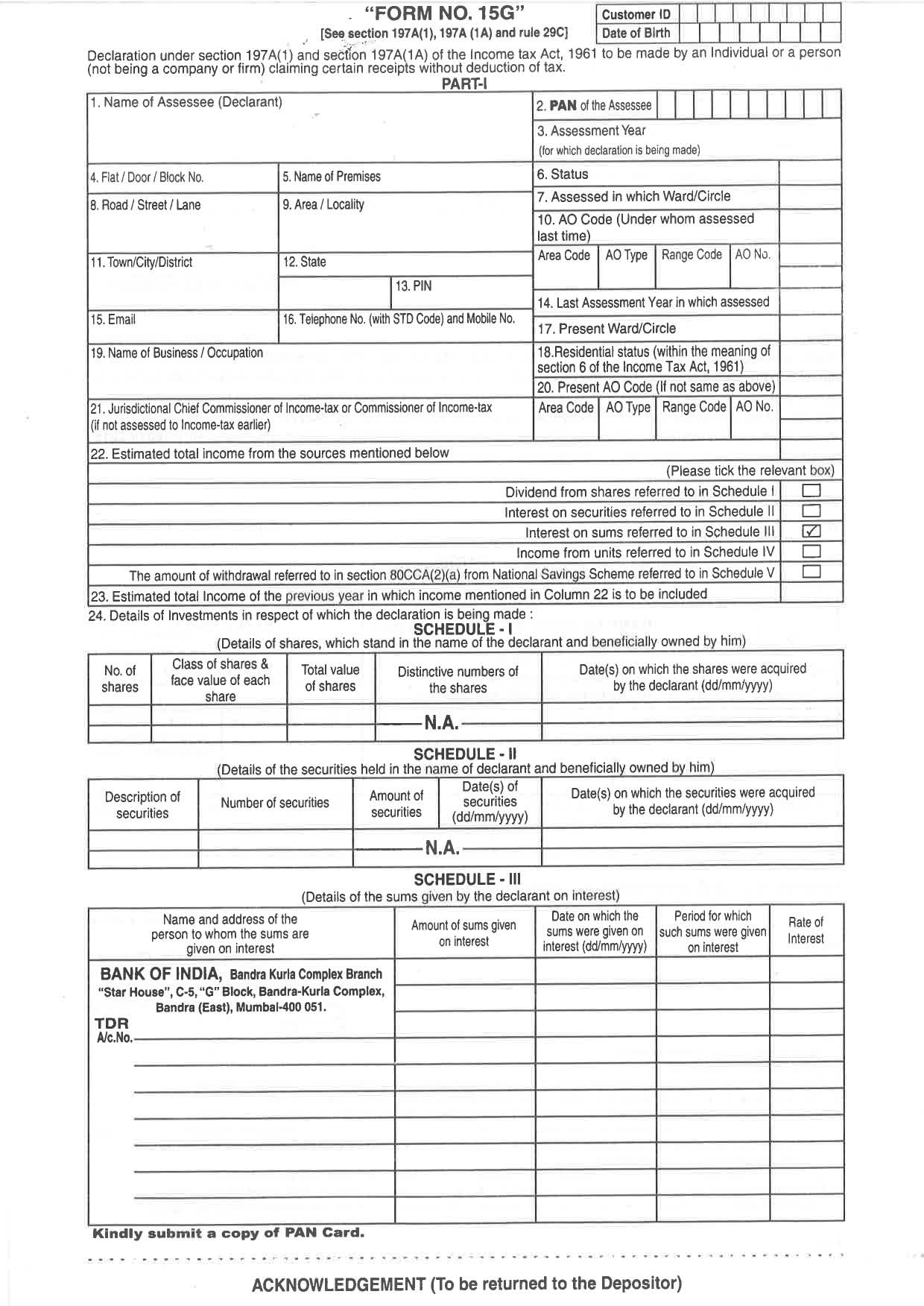

Bank Of India Form 15g 2024 2025 Student Forum Bank of india form 15g 2023 2024, get the latest information and updates about bank of india form 15g here at management.ind.in bank of india form 15g 2024 2025 student forum 2024 2025 student forum > management forum > main forum. Form 15g, form 15h to save tds on interest income.

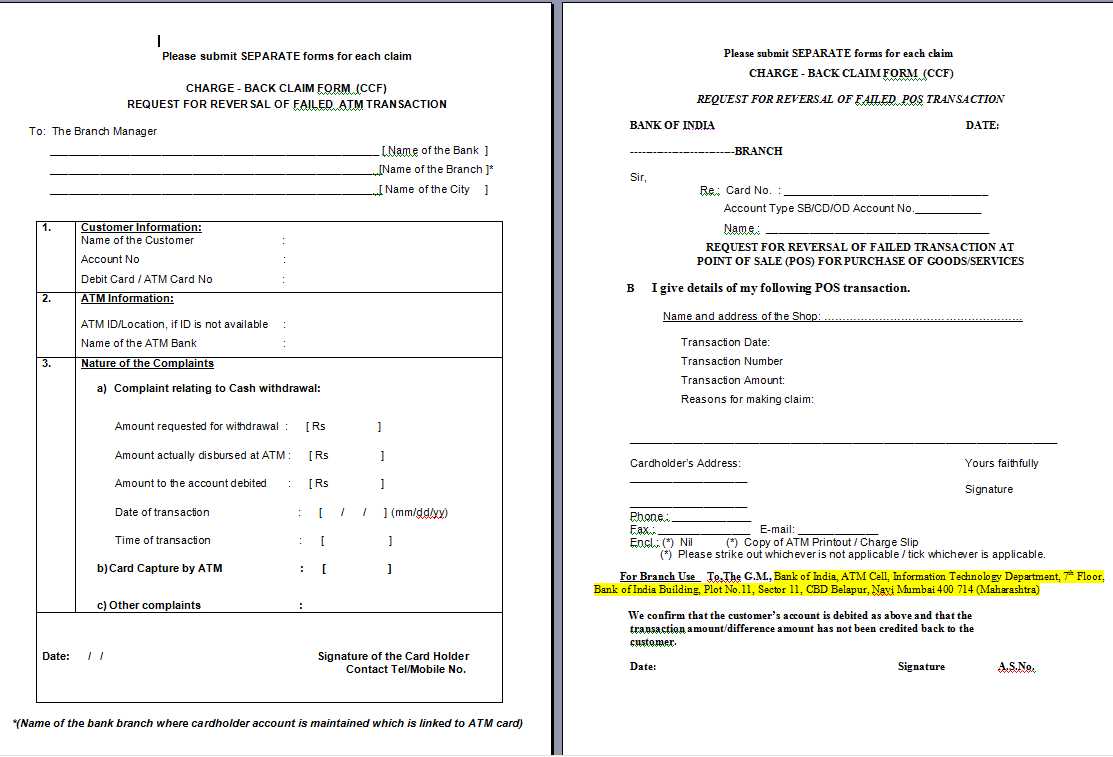

Bank Of India Claim Form 2024 2025 Student Forum 2 declaration can be furnished by an individual under section 197a(1) and a person (other than a company or a firm) under section 197a(1a). 3 the financial year to which the income pertains. 4 please mention the residential status as per the provisions of section 6 of the income tax act, 1961. please mention “yes” if assessed to tax under. Nris cannot submit form 15g h: what can they do to lower. How to download and fill form 15g for pf withdrawal?. Form 15g for pf withdrawal – a step by step process. let’s understand how to fill form 15g for online epf withdrawal: step 1: log in to epfo unified portal for members. step 2: visit the ‘online services’ section. step 3: go to ‘claim (form 31, 19, 10c &10d)’ from the drop down menu.

Bank Of India New Account Opening Form 2023 2024 Student Foru How to download and fill form 15g for pf withdrawal?. Form 15g for pf withdrawal – a step by step process. let’s understand how to fill form 15g for online epf withdrawal: step 1: log in to epfo unified portal for members. step 2: visit the ‘online services’ section. step 3: go to ‘claim (form 31, 19, 10c &10d)’ from the drop down menu. If tax on your total income is nil, you can submit form 15g or form 15h to request the tenant to not deduct tds (applicable from 1 april 2019). tds on insurance commission. tds is deducted on insurance commission, if it exceeds rs 15000 per financial year. however, insurance agents can submit form 15g form 15h for non deduction of tds if tax on. How to e file form 15g and form 15h on e filing portal.

How To Fill Form 15g 2024 Youtube If tax on your total income is nil, you can submit form 15g or form 15h to request the tenant to not deduct tds (applicable from 1 april 2019). tds on insurance commission. tds is deducted on insurance commission, if it exceeds rs 15000 per financial year. however, insurance agents can submit form 15g form 15h for non deduction of tds if tax on. How to e file form 15g and form 15h on e filing portal.

Comments are closed.