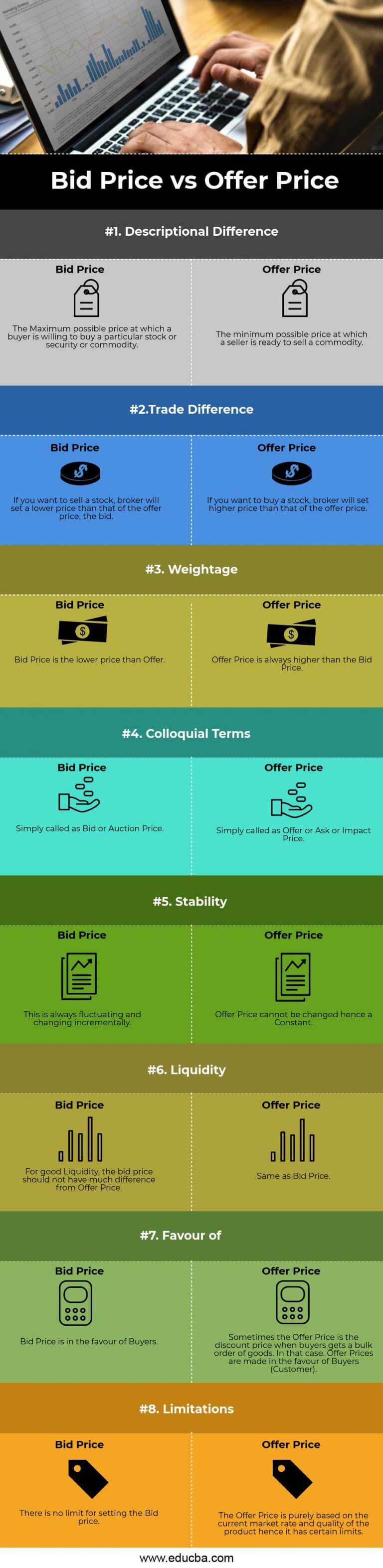

Bid Price Vs Offer Price Top 8 Differences To Learn With Infographics

Bid Price Vs Offer Price Top 8 Differences To Learn With Infographics The bid price is the maximum price at which a buyer is ready to buy a security. whereas offer price is the minimum price at which a seller is ready to sell a security. the bid price is the lower price, and the ask price is the higher price. if you want to buy a stock, a broker will set a higher price than the offer price. Similarly, by seeing the bid offer spread, investors can determine whether it is worth risk taking to buy sell such security derivative. recommended articles. this article is a guide to bid vs offer. here, we discuss the difference between bid and offer prices, infographics, and a comparison table. you may also look at the following articles: –.

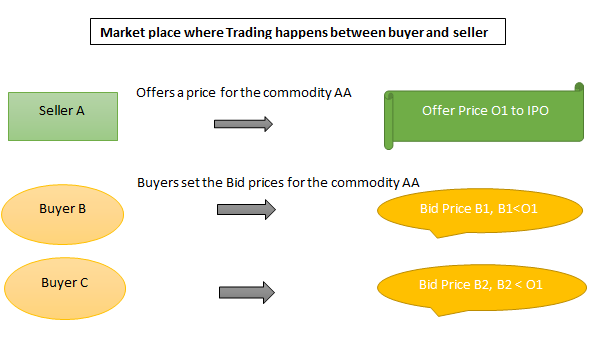

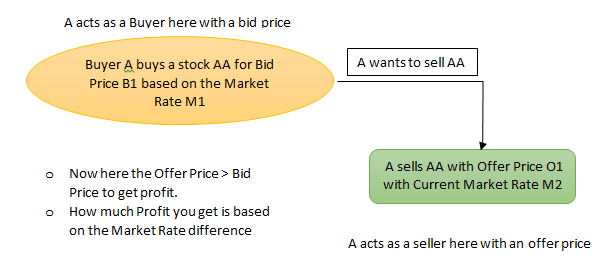

Bid Price Vs Offer Price Top 8 Differences To Learn With Infographics The difference between the bid and offer prices is known as the bid ask spread, which reflects the liquidity and market conditions of a security. traders and investors closely monitor bid and offer prices to determine the best time to buy or sell a security, as well as to assess the overall market sentiment. copy this url comparison. In stock trading, the bid price indicates the demand for a stock. a higher bid price can mean higher demand or interest in the stock. the offer price, on the other hand, reflects the supply, with a lower offer price potentially indicating a higher willingness or urgency to sell. 5. when placing a trade, if you want to execute a transaction. Tweet. key difference: the two prices contribute to investor transactions. the bid price is investor’s selling price while the offer price is the investor’s buying price. a bid price is set by the investor who sells the products in accordance to the price known to the investor. it can be said that the bid price is the motive oriented price. Bid price: a bid price is the price a buyer is willing to pay for a security. this is one part of the bid, with the other being the bid size , which details the amount of shares an investor.

Bid Price Vs Offer Price Top 8 Differences To Learn With Infographics Tweet. key difference: the two prices contribute to investor transactions. the bid price is investor’s selling price while the offer price is the investor’s buying price. a bid price is set by the investor who sells the products in accordance to the price known to the investor. it can be said that the bid price is the motive oriented price. Bid price: a bid price is the price a buyer is willing to pay for a security. this is one part of the bid, with the other being the bid size , which details the amount of shares an investor. Offer price refers to the price at which someone is willing to sell or offer a particular asset, product, or service. it is the amount of money that a seller or market maker is willing to accept in exchange for a financial instrument such as stocks, bonds, or real estate. the offer price is an essential element in many financial transactions as. A ‘bid’ is the maximum price that a buyer is willing to pay to purchase shares in a stock. the ‘offer’ price, sometimes called the ‘ask’ price, is the price at which the seller is offering to sell their shares. during trading hours, when the bid price ‘meets’ the offer price, a trade is executed.

Bid Price Vs Offer Price Top 8 Differences To Learn With Infographics Offer price refers to the price at which someone is willing to sell or offer a particular asset, product, or service. it is the amount of money that a seller or market maker is willing to accept in exchange for a financial instrument such as stocks, bonds, or real estate. the offer price is an essential element in many financial transactions as. A ‘bid’ is the maximum price that a buyer is willing to pay to purchase shares in a stock. the ‘offer’ price, sometimes called the ‘ask’ price, is the price at which the seller is offering to sell their shares. during trading hours, when the bid price ‘meets’ the offer price, a trade is executed.

Comments are closed.