Bill Discounting For Essential Goods Kredx Pdf Factoring Finance

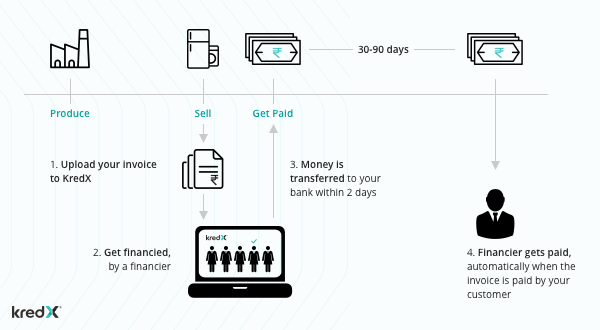

Bill Discounting For Essential Goods Kredx Pdf Factoring Finance The bill discounting process is transparent and simple. it includes the following steps: . the business generates an invoice (usually payable within 30 to 90 days) from the date of sale. business visits the kredx website and uploads the unpaid invoice digitally. investors in the kredx platform purchase the invoice at a discounted rate. Invoice factoring is a form of debtor financing service and helps avail external funding based on a business’s receivables. also known as debt factoring, it allows businesses to sell their client’s unsettled bills to a third party, called factor for funds. such third party, which is usually a financial institution, extends a percentage of.

Apply For Invoice Discounting Facility To Grow Your Business Kredx Kredx offers invoice discounting to provide essential goods businesses with working capital in 24 72 hours. unpaid invoices are used as collateral free funds to manage costs and meet demands. the digital process is paperless and transparent. businesses can unlock money tied in unpaid invoices, shorten cash cycles, and improve efficiency and growth. kredx works by vendors uploading unpaid. Release yourlocked cash. with kredx invoice discounting platform, you no longer have to wait for several days to get paid for your goods and services. use your company's unpaid invoice as collateral to get instant cash for your business expansion. register now. The same also applies to export bill discounting in india. before a business avails of such a facility, the owner and buyer must agree to the bill discounting contract. once the contract has been agreed upon, the financial intermediary will issue the payment to the business and collect the same from the buyer on a predetermined date. Bill discounting has several benefits that make it the go to financing option for businesses; some of which include . 1. quick cash in hand – bill discounting process is relatively fast when compared with other means of financing, and because of that, it is opted by businesses in a recurring manner. 2.

Comments are closed.