Budgeting Basics

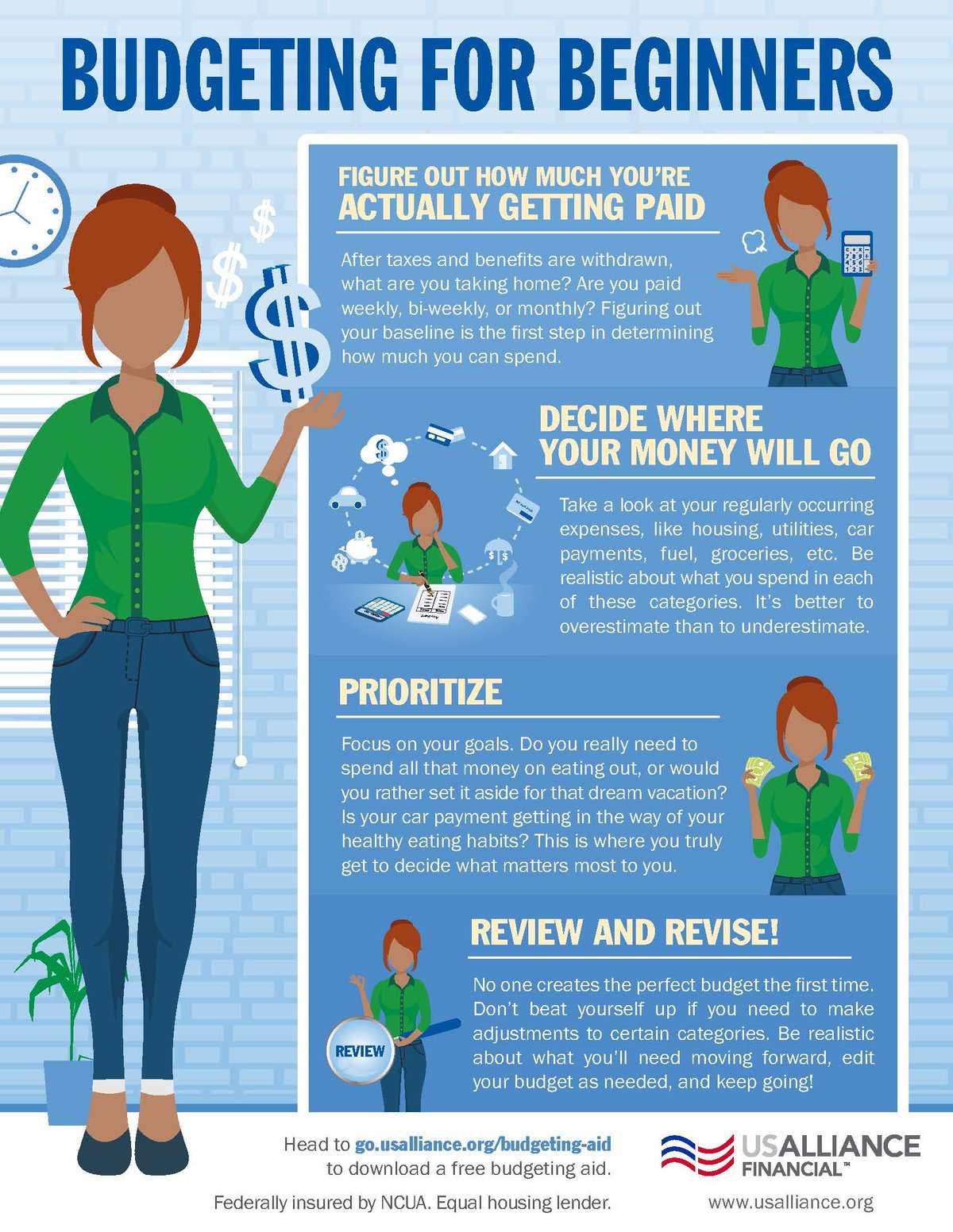

Budgeting Basics How To Create A Budget See full bio. step 1. figure out your after tax income step 2. choose a budgeting system step 3. track your progress step 4. automate your savings step 5. practice budget management. Once you have calculated the amount you spend each month on these necessities, you have your baseline spending budget. for henry and janine, their baseline monthly spending budget is $3,430.

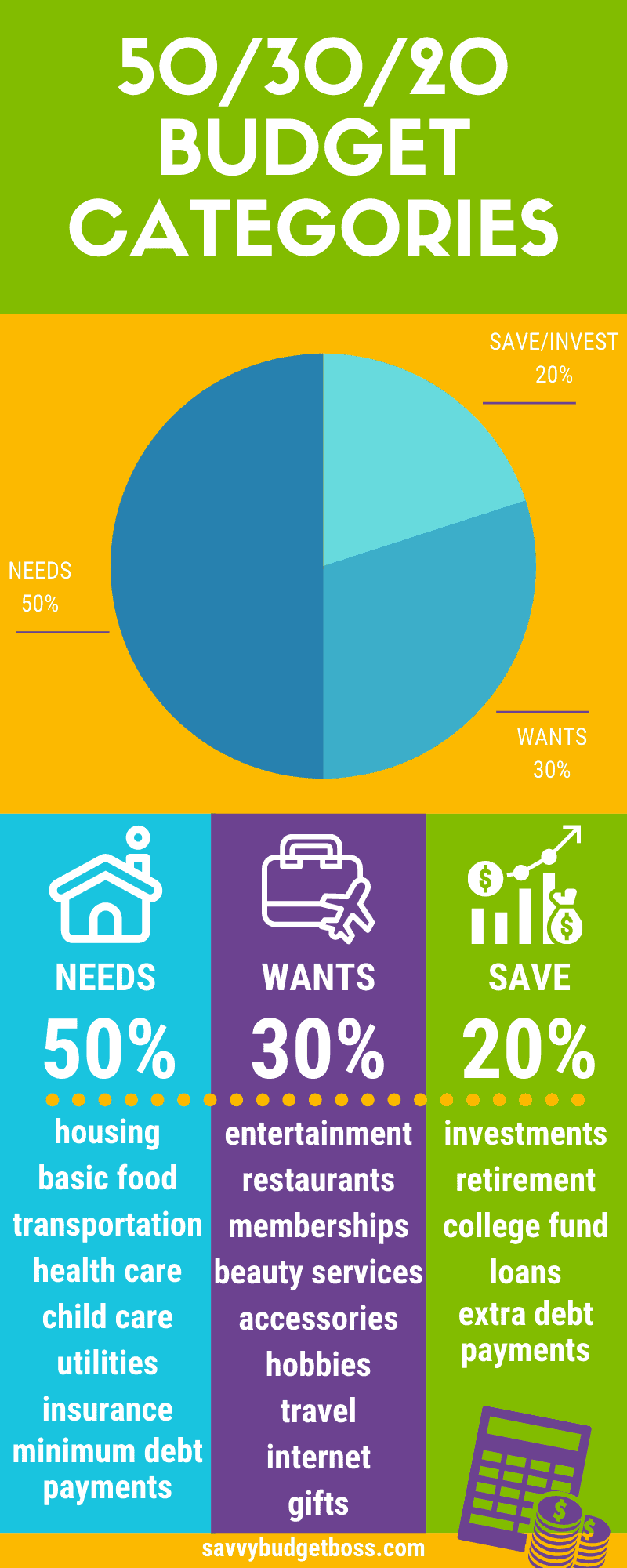

Budgeting Basics Infographic My Credit Check Blog Learn how to make a budget in five easy steps with this guide from ramsey solutions. find out how to list your income, expenses, subtract expenses from income, track your transactions and make a new budget before the month begins. Learn how to make a budget and stick to it with this guide. find out the benefits of budgeting, the types of budgets, and the tools to help you manage your money. Choose your budgeting strategy . budgeting can feel like an overwhelming task for some people. but keep in mind that the best budgeting method is the one that works for you. “there are many great ways to budget, but each plays to different skill sets and financial goals. The 50 30 20 budget requires you to allocate money to just three separate categories, like so: 50% of your income for necessities. 30% of your income for discretionary spending. 20% of your income for saving. although this is super simple, it will only work if 50% of your income will cover your essential bills.

Budgeting Tips For Beginnersвђў Savvy Budget Boss Choose your budgeting strategy . budgeting can feel like an overwhelming task for some people. but keep in mind that the best budgeting method is the one that works for you. “there are many great ways to budget, but each plays to different skill sets and financial goals. The 50 30 20 budget requires you to allocate money to just three separate categories, like so: 50% of your income for necessities. 30% of your income for discretionary spending. 20% of your income for saving. although this is super simple, it will only work if 50% of your income will cover your essential bills. Budgeting basics. if you’re new to budgeting, it’s important to understand what a budget is and how it helps you examine what you earn and how you are spending that income. a budget is a financial plan that takes income and expenses into account and provides estimates for how much you make and spend over a given period of time. addressing. Budgeting basics. a budget is a spending plan that helps you understand how much money you're making and where you're spending it. a budget is the cornerstone of a strong financial plan.

Best Budgeting Tips For Beginners That You Have To Know Budgeting basics. if you’re new to budgeting, it’s important to understand what a budget is and how it helps you examine what you earn and how you are spending that income. a budget is a financial plan that takes income and expenses into account and provides estimates for how much you make and spend over a given period of time. addressing. Budgeting basics. a budget is a spending plan that helps you understand how much money you're making and where you're spending it. a budget is the cornerstone of a strong financial plan.

Budgeting For Beginners

Comments are closed.