Bullish Engulfing Pattern Secret Of Bullish Engulfing Candlestick Pattern

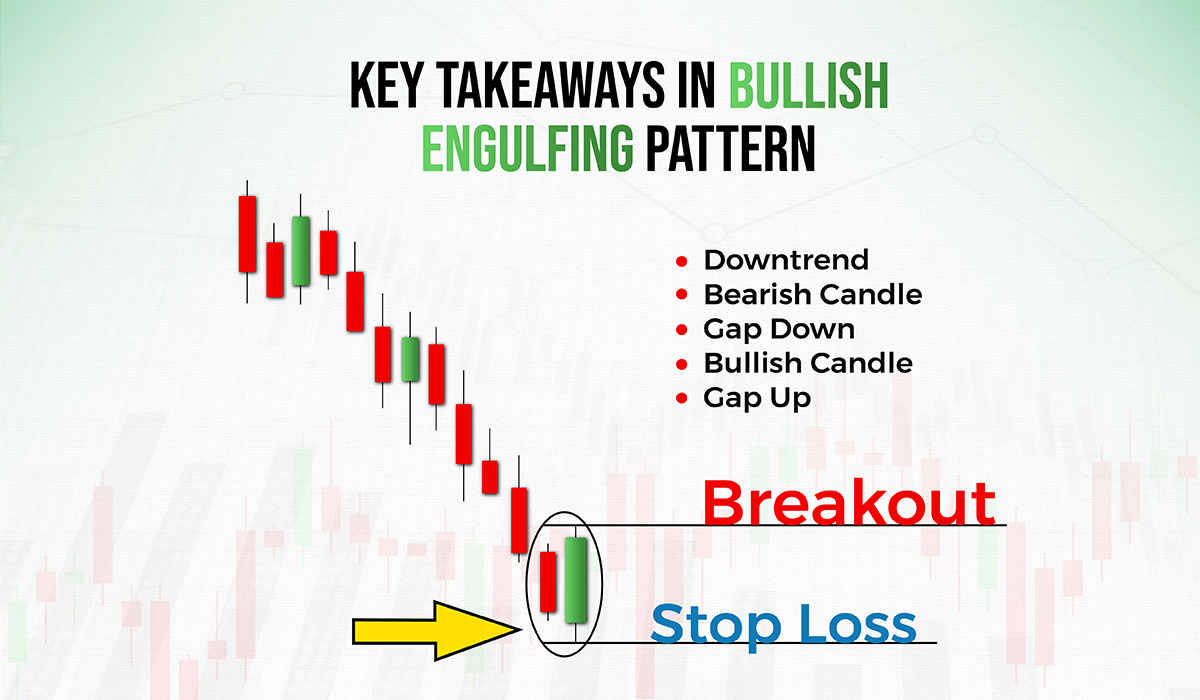

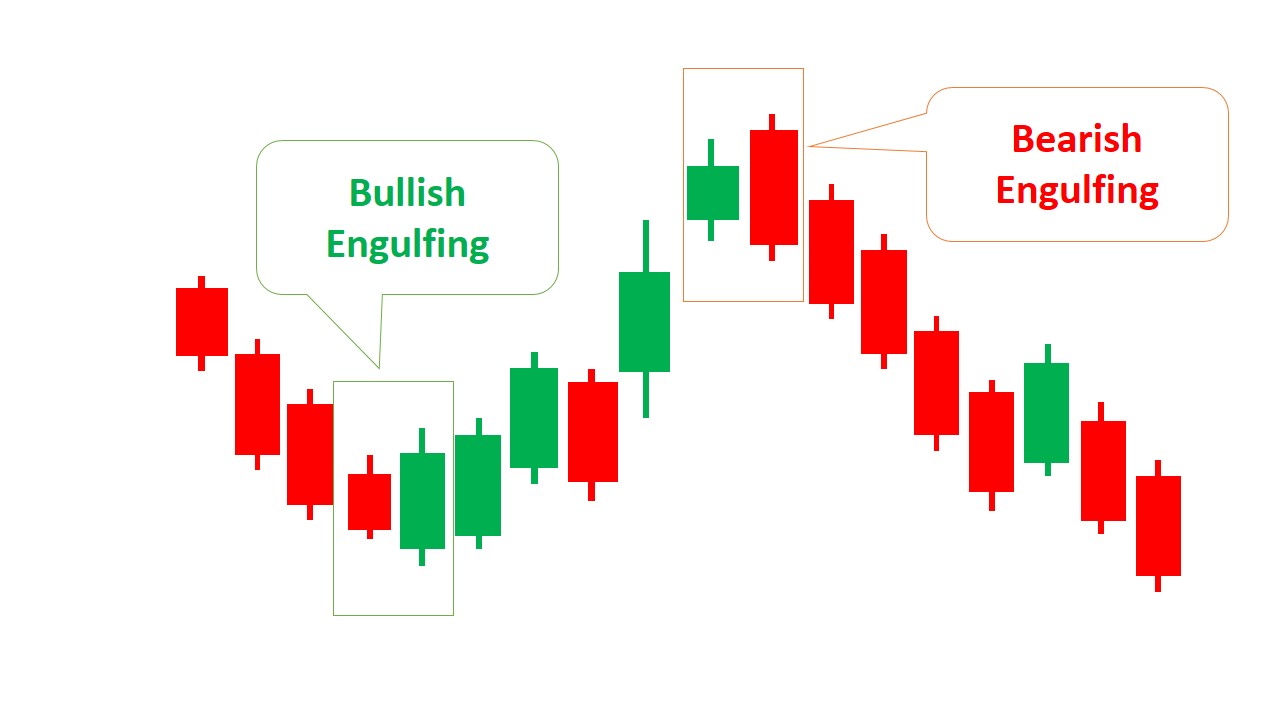

What Is Bullish Engulfing Pattern Definition And Examples Bullish engulfing pattern: a bullish engulfing pattern is a chart pattern that forms when a small black candlestick is followed by a large white candlestick that completely eclipses or "engulfs. Bullish engulfing patterns are two candlestick patterns found on stock charts. the bullish engulfing pattern is considered a reversal at the end of downtrends or near support levels. they consist of a big bullish candlestick that engulfs a smaller bearish one. watch for the price to break above the bullish candlestick and hold to confirm.

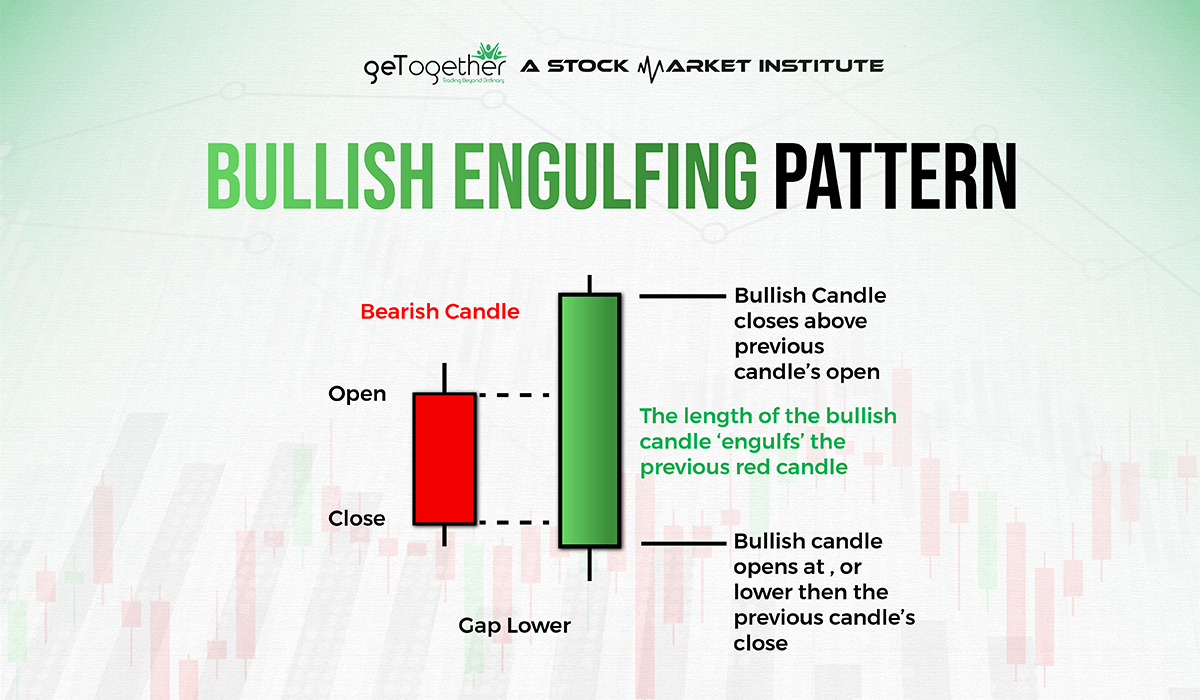

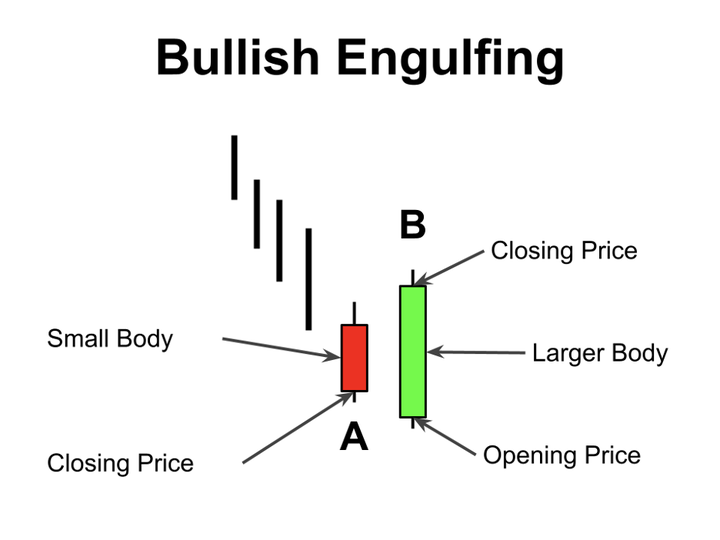

Engulfing Candlestick Patterns Types Examples How To Trade Updated on october 13, 2023. the bullish engulfing is a two bar bullish reversal japanese candlestick pattern that leads to a more significant bullish move in the crypto and stock markets and a shorter bearish bounce in forex, according to our extensive backtests. the bullish engulfing pattern loses money in most markets when traditionally traded. Bullish engulfing pattern is a candlestick pattern that converts a downtrend to an uptrend, but all bullish engulfing patterns do not convert a downtrend to. A bullish engulfing is a two candle reversal candlestick pattern that usually forms after a bearish trend, and signals that a bullish trend has been initiated. as to its appearance, the first bar of the bullish engulfing pattern is bearish and is followed by a bullish candle, which body completely engulfs the first bearish candle. The bullish engulfing pattern consists of two candlesticks: smaller bearish candle (day 1) larger bullish candle (day 2) the bearish candle real body of day 1 is usually contained within the real body of the bullish candle of day 2. on day 2, the market gaps down; however, the bears do not get very far before bulls take over and push prices.

What Is Bullish Engulfing Pattern Definition And Examples A bullish engulfing is a two candle reversal candlestick pattern that usually forms after a bearish trend, and signals that a bullish trend has been initiated. as to its appearance, the first bar of the bullish engulfing pattern is bearish and is followed by a bullish candle, which body completely engulfs the first bearish candle. The bullish engulfing pattern consists of two candlesticks: smaller bearish candle (day 1) larger bullish candle (day 2) the bearish candle real body of day 1 is usually contained within the real body of the bullish candle of day 2. on day 2, the market gaps down; however, the bears do not get very far before bulls take over and push prices. A bullish engulfing candlestick is a significant pattern in technical analysis that signals a potential reversal from a bearish to a bullish market trend. it is identified by a large white or green candlestick that follows a smaller black or red candlestick, with the body of the white candlestick fully engulfing the body of the previous day's. The bullish engulfing pattern is a 2 candlestick pattern that forms after a downward price swing and is characterized by the second candlestick completely consuming (engulfing) the first candlestick of the pattern. as the name indicates, it is a bullish reversal pattern that signals a potential beginning of an upward swing. the pattern consists.

Pine Script 学习笔记 4 1 蜡烛图形态 吞噬 知乎 A bullish engulfing candlestick is a significant pattern in technical analysis that signals a potential reversal from a bearish to a bullish market trend. it is identified by a large white or green candlestick that follows a smaller black or red candlestick, with the body of the white candlestick fully engulfing the body of the previous day's. The bullish engulfing pattern is a 2 candlestick pattern that forms after a downward price swing and is characterized by the second candlestick completely consuming (engulfing) the first candlestick of the pattern. as the name indicates, it is a bullish reversal pattern that signals a potential beginning of an upward swing. the pattern consists.

Comments are closed.