Calculate Overtime Pay Calculator

Ready To Use Overtime Calculator Template With Payslip Msofficegeek Calculate your overtime pay and total pay per year with this online tool. enter your hourly rate, work week, overtime multiplier, pay period and currency to see the results. To find this number: calculate the product of the overtime monthly hours and the pay multiplier: 10 × 1.5 = 15. divide the result by your regular monthly hours: 15 160 = 0.0938. to find your pay, multiply the result by your monthly salary. the result corresponds to 9.38% of that amount.

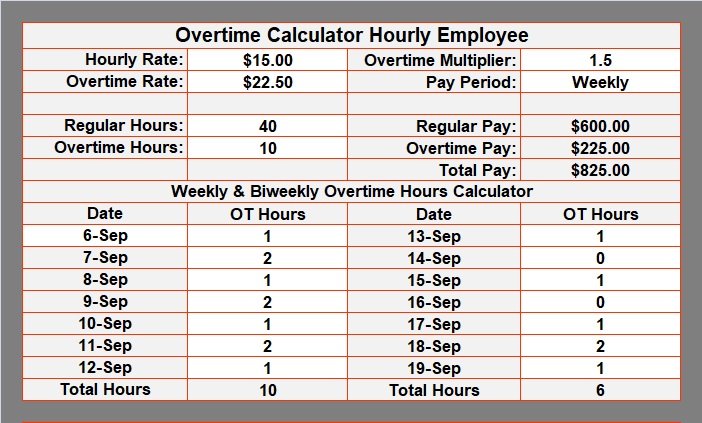

How To Calculate Overtime Pay In Excel The standard overtime rate is 1.5 times an employee's regular hourly wage ("time and a half"). this means that if you earn $15 per hour, your time and a half overtime rate will be $22.50 per hour ($15 × 1.5). if you earn double time, your overtime rate will be $30 per hour ($15 × 2). The regular rate of pay: $800 45 hours = $17.78 per hour. if the overtime rate is one and a half times the regular rate of pay, the calculation for overtime pay would be: overtime wages: 5 hours x $17.78 x 1.5 = $133.35. the employee's total wages for the week, including overtime pay, would be $933.35 ($800 $133.35). The overtime hourly pay can be calculated by multiplying the overtime multiplier by the regular hourly pay. determine the overtime pay. you can determine the overtime pay by multiplying the overtime hourly pay by the number of hours of overtime. calculate total pay with overtime. now, you can add up the regular pay and overtime pay. this will. Their normal pay rate is $30 per hour and they will receive overtime pay of time and a half. we can now plug these numbers into the overtime formula: overtime pay = $30 × 1.5 × 10. overtime pay = $450. the overtime pay rate is found by multiplying the hourly rate by the overtime multiplier. in this example, it is $30 × 1.5 = $45.

How To Calculate Overtime Pay Quickbooks The overtime hourly pay can be calculated by multiplying the overtime multiplier by the regular hourly pay. determine the overtime pay. you can determine the overtime pay by multiplying the overtime hourly pay by the number of hours of overtime. calculate total pay with overtime. now, you can add up the regular pay and overtime pay. this will. Their normal pay rate is $30 per hour and they will receive overtime pay of time and a half. we can now plug these numbers into the overtime formula: overtime pay = $30 × 1.5 × 10. overtime pay = $450. the overtime pay rate is found by multiplying the hourly rate by the overtime multiplier. in this example, it is $30 × 1.5 = $45. To calculate your overtime rate of pay, you convert the overtime description into a decimal number and multiply your regular rate of pay by the decimal multiplier. example overtime rate calculation. if your regular hourly rate is $12.00, and you're paid time and a half for overtime, your overtime rate would be $18.00 ($12.00 x 1.50). Step 2. the next step is to actually add the time entries on the overtime pay table. for example, enter 9:45 or 8:30. in case you have chosen the decimal time format, you need to enter decimal time like 9.75 or 8.5. step 3. the last step is to click on the calculate button to get your results.

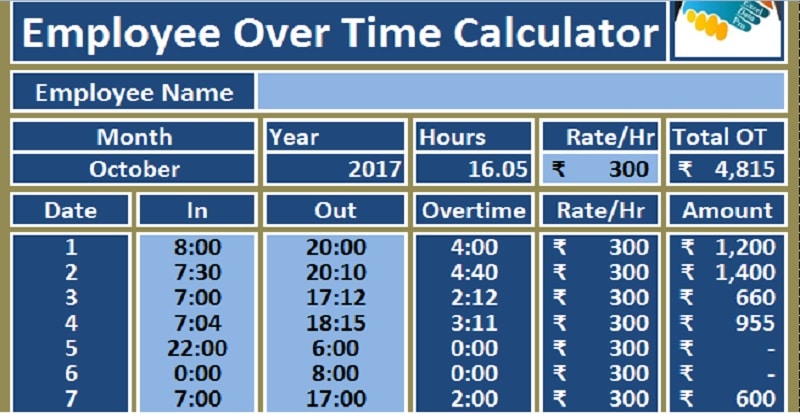

Download Employee Overtime Calculator Excel Template Exceldatapro To calculate your overtime rate of pay, you convert the overtime description into a decimal number and multiply your regular rate of pay by the decimal multiplier. example overtime rate calculation. if your regular hourly rate is $12.00, and you're paid time and a half for overtime, your overtime rate would be $18.00 ($12.00 x 1.50). Step 2. the next step is to actually add the time entries on the overtime pay table. for example, enter 9:45 or 8:30. in case you have chosen the decimal time format, you need to enter decimal time like 9.75 or 8.5. step 3. the last step is to click on the calculate button to get your results.

Comments are closed.