Calculation Of Tender Or Quotation Overheads Cost Accounting Cost

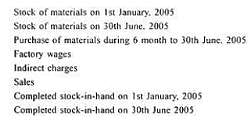

Calculation Of Tender Or Quotation Overheads Cost Accounting Cost 2. factory overheads: since tender price is determined before production is held and hence overheads are completely estimated. the percentage of factory overhead with direct wages will be the same which was in the previous cost sheet. 3. office overheads: for tender price, office overhead is certain percentage of factory cost or factory on cost. The "calculation of tender or quotation overheads, cost accounting b com questions" guide is a valuable resource for all aspiring students preparing for the b com exam. it focuses on providing a wide range of practice questions to help students gauge their understanding of the exam topics.

Calculation Of Tender Or Quotation Overheads Cost Accounting Cost Monthly overhead = $8,000 $6,000 $4,000 $1,000 $1,000. as a standalone metric, the $20k in overhead is not too useful, which is the reason our next step is to divide it by the monthly sales assumption to calculate the overhead rate (i.e. overhead divided by monthly sales) of 20%. overhead rate = $20k ÷ $100k = 0.20, or 20%. 4. estimation of profit for a tender or quotation: the tender price is determined after adding the amount of profit to total cost. generally, instead of giving the amount of profit, the percentage of profit is given in the questions. on the basis of such percentage, the amount of profit is determined. the following two conditions may be possible:. Overhead rate (%) = (total estimated overhead costs) (total estimated direct costs) x 100. if your company estimates $1 million in total overhead costs and $5 million in total direct costs for a year, the overhead rate would be 20%. this means for a project with $100,000 in direct costs, the allocated overhead cost would be $20,000 (100,000 x. To calculate the overhead rate, divide the indirect costs by the direct costs and multiply by 100. if your overhead rate is 20%, the business spends 20% of its revenue on producing a good or providing services. a lower overhead rate indicates efficiency and more profits.

Calculation Of Tender Or Quotation Overheads Cost Accounting Cost Overhead rate (%) = (total estimated overhead costs) (total estimated direct costs) x 100. if your company estimates $1 million in total overhead costs and $5 million in total direct costs for a year, the overhead rate would be 20%. this means for a project with $100,000 in direct costs, the allocated overhead cost would be $20,000 (100,000 x. To calculate the overhead rate, divide the indirect costs by the direct costs and multiply by 100. if your overhead rate is 20%, the business spends 20% of its revenue on producing a good or providing services. a lower overhead rate indicates efficiency and more profits. Key takeaways. overhead costs are indirect costs associated with running a business. overhead does not include cost of goods sold (costs directly associated with producing your goods or service). the three types of overhead costs are fixed, variable, and semi variable costs. some examples of overhead include administrative costs, rent, and. Luckily, overhead rate is quite simple to calculate. this formula handles it: overhead cost sales = overhead rate. for the formula to work, you need to use numbers from a single period, like one month. if you make $13,000 in sales in a typical month and you spend $1,600 on overhead, you get the following calculation: 1,600 13,000 = 0.123.

Comments are closed.