Credit Score Range What Is The Credit Score Range In Canada

The Ultimate Guide To Credit Scores In Canada Borrowellв ў Credit scores in canada are three digit numbers that range from 300 900, and are rated from poor to excellent. credit score ranges in canada vary based on the entity providing the score, but. Canada operates with a credit score range between 300 and 900. the lower your score, the less likely you are to be approved for a credit card or loan. if you do manage to qualify for a credit card.

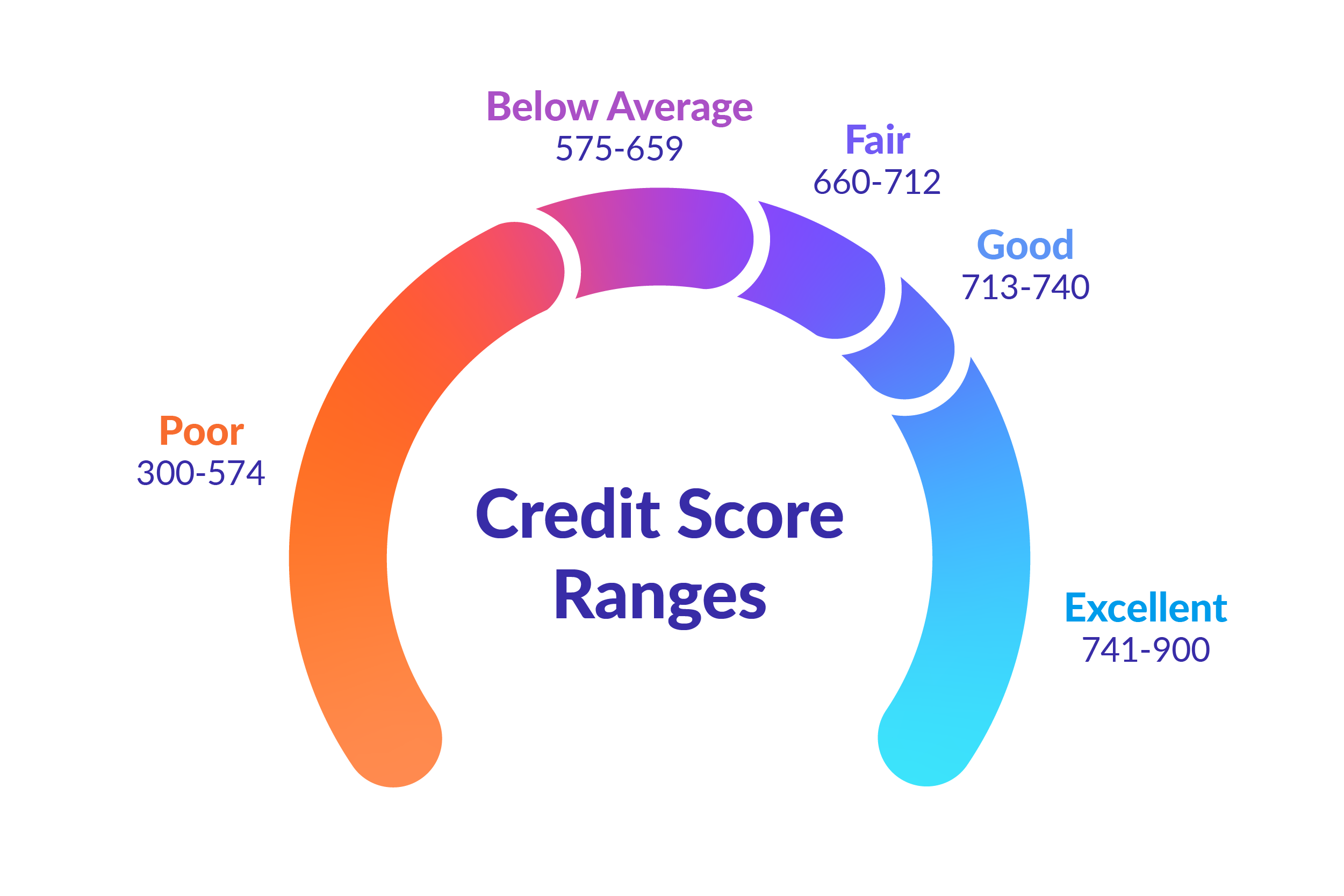

What Is A Good Credit Score In Canada Balancing That Budget Credit score ranges according to equifax. generally, a credit score of 660 and over is considered good in canada. anything in the 300 to 559 range is usually seen as a poor credit score. take this with a grain of salt, though. credit bureaus use different credit scoring models, which means there's a high chance your equifax credit score is not. Your credit score is a three digit number between 300 and 900 that represents your credit risk. credit risk is the likelihood you’ll pay your bills on time, or pay back a loan on the terms agreed upon. in canada, credit scores range from 300 (very poor) to 900 (excellent) with the average canadian credit score sitting at 650. A credit score is a three digit number that is assigned to you based on your credit report. in canada, credit scores range from 300 to 900. credit scores are used by lenders to determine how you. In canada, your credit scores can range from 300 to 900. if you have a credit score below 560, it means you have poor credit in the eyes of some lenders and creditors. while a bad credit score may affect your ability to access affordable credit products, it doesn’t mean you’re stuck with it.

Credit Score Ranges In Canada Explained Crc A credit score is a three digit number that is assigned to you based on your credit report. in canada, credit scores range from 300 to 900. credit scores are used by lenders to determine how you. In canada, your credit scores can range from 300 to 900. if you have a credit score below 560, it means you have poor credit in the eyes of some lenders and creditors. while a bad credit score may affect your ability to access affordable credit products, it doesn’t mean you’re stuck with it. In canada, your credit score is a number that ranges from 300 900. the higher the number, the better. this number reflects your creditworthiness to potential lenders, who use your credit score to estimate the likelihood that you will make your payments on time. the two credit reporting agencies in canada are equifax and transunion. A credit score between 300 and 659 is generally considered below average. in this score range, it is difficult to get certain types of credit accounts. this is particularly true if the amounts are large. for example, it is more difficult to obtain a car loan or a traditional mortgage loan without mortgage loan insurance.

What Is A Credit Score How Is It Calculated In Canada My Money Coach In canada, your credit score is a number that ranges from 300 900. the higher the number, the better. this number reflects your creditworthiness to potential lenders, who use your credit score to estimate the likelihood that you will make your payments on time. the two credit reporting agencies in canada are equifax and transunion. A credit score between 300 and 659 is generally considered below average. in this score range, it is difficult to get certain types of credit accounts. this is particularly true if the amounts are large. for example, it is more difficult to obtain a car loan or a traditional mortgage loan without mortgage loan insurance.

Comments are closed.