Credit Scores 101 The Key Powering Your Financial Independence

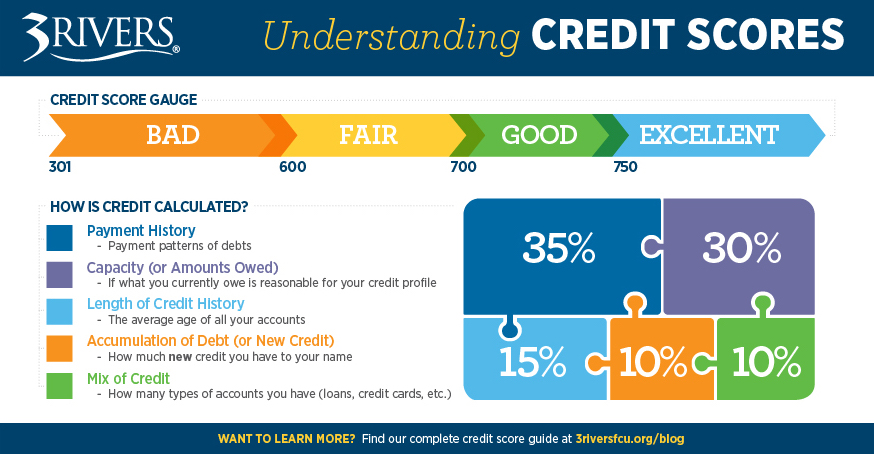

Credit Scores 101 The Key Powering Your Financial Independence The borrower’s payment history generally makes up 40% of the score, while credit utilisation is 20%. the length of the credit history contributes 21%, and the total amount of recently reported balances 11%. finally, new credit accounts are responsible for 5% while the available credit makes up 3%. Live below your means. 3. reduce high interest debt. 4. improve your credit score. 5. invest in your future. financial independence makes it possible for you to live how you want without needing to rely on income from a job. achieving financial independence is a lofty goal, and it can take several years or even decades to do, so the sooner you.

Credit Scores 101 The Penny Hoarder Academy It’s important to come back to your imagination and vision of your financial future, so that you have the motivation to keep going over the years it’s going to take. 2. stay focused. once you. Very good (740 to 799): a very good credit score is above average, and it illustrates a low level of risk. good (670 to 739): a good credit score is at or near the u.s. average, which is why most. Financial independence refers to a state where an individual has enough personal wealth or passive income to cover all living expenses without relying on active employment. it is the ability to maintain your desired lifestyle without having to work. this can be achieved through a variety of means, including building wealth through investments. All three levels of financial independence should meet the following basic criteria: 1) no need to work for a living. investment income or non work income covers all living expenses into perpetuity. or. 2) net worth is equal to or greater than the number of years left in your life x living expenses.

Credit Scores 101 What Is Your Credit Score Community Mortgage I Financial independence refers to a state where an individual has enough personal wealth or passive income to cover all living expenses without relying on active employment. it is the ability to maintain your desired lifestyle without having to work. this can be achieved through a variety of means, including building wealth through investments. All three levels of financial independence should meet the following basic criteria: 1) no need to work for a living. investment income or non work income covers all living expenses into perpetuity. or. 2) net worth is equal to or greater than the number of years left in your life x living expenses. Moving to a cheaper city that has a lower cost of living to save money. the more you can cut from your budget, the more you can save toward your goal of financial independence. and it may take a lot more than the standard 15% of your income most financial experts suggest for a typical retirement. instead, you may need to save 40%, 50% or even. Check your score and report. according to a february 2018 creditcards poll, 50 percent of americans had not checked their credit score in the past six months. young adults were the biggest culprits, with 27 percent of respondents aged 18 37 claiming they had never checked their credit reports or scores, including 36 percent of those 30 and.

Understanding Credit Scores Moving to a cheaper city that has a lower cost of living to save money. the more you can cut from your budget, the more you can save toward your goal of financial independence. and it may take a lot more than the standard 15% of your income most financial experts suggest for a typical retirement. instead, you may need to save 40%, 50% or even. Check your score and report. according to a february 2018 creditcards poll, 50 percent of americans had not checked their credit score in the past six months. young adults were the biggest culprits, with 27 percent of respondents aged 18 37 claiming they had never checked their credit reports or scores, including 36 percent of those 30 and.

How Credit Scores Can Impact Your Financial Life

Comments are closed.