Credit Scores And Reports 101 Credit Card And Loan Basics 2 3

Credit Reports And Credit Scores 101 Payactiv In this video, you'll learn everything you need to know about your credit score and report, including what it is and how to improve it. also, because we may. Fair: 601 to 660. good: 661 to 780. excellent: 781 to 850. if your lender is pulling your score from experian, they will see your fico credit score. you would need to score between 670 and 739 to.

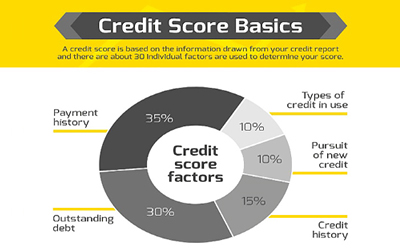

Credit Report And Credit Score Basics Score ranges: for the vantagescore and the base fico ® score, the range is 300 to 850. however, fico's bankcard and auto scoring models use a range of 250 to 900. weighting factors: when calculating your credit score, vantagescore and fico generally look at the same information. however, they weigh certain factors differently. How can you start. building a high credit score? 1. pay back student loans on time after you graduate. 2. pay any credit cards back on time and keep your monthly balance low. 3. don’t miss payments and don’t default on any loans, that will quickly lower your score!. The national average fico credit score was 717 as of october 2023. vantagescore 3.0 and 4.0 also use the same 300 to 850 range as fico, but scores are categorized a bit differently: excellent is. It's safe and smart to check it often. heavy credit card use, a missed payment or a flurry of credit applications could account for a credit score drop. pay everything on time. use less than 30%.

Understanding Your Credit Score The national average fico credit score was 717 as of october 2023. vantagescore 3.0 and 4.0 also use the same 300 to 850 range as fico, but scores are categorized a bit differently: excellent is. It's safe and smart to check it often. heavy credit card use, a missed payment or a flurry of credit applications could account for a credit score drop. pay everything on time. use less than 30%. Poor – well below the average score of u.s. consumers. 580 669. fair – below the average score of u.s. consumers. 670 739. good – slightly above the average score of u.s. consumers. 740 799. very good – above the average score of u.s. consumers. 800 . exceptional – well above the average score of u.s. consumers. A credit score of 700 may not allow you to fill your wallet with high rewards credit cards named after precious metals and gems, but you’re well on your way if you keep building good credit.

Credit Scores 101 The Key Powering Your Financial Independence Poor – well below the average score of u.s. consumers. 580 669. fair – below the average score of u.s. consumers. 670 739. good – slightly above the average score of u.s. consumers. 740 799. very good – above the average score of u.s. consumers. 800 . exceptional – well above the average score of u.s. consumers. A credit score of 700 may not allow you to fill your wallet with high rewards credit cards named after precious metals and gems, but you’re well on your way if you keep building good credit.

Credit Score Basics Explained Credit 101 Youtube

Comments are closed.