Credit Scores Including Fico Scores And Vantagescores Offered By

Vantagescoreв Vs Ficoв How Credit Score Models Differ Self Credit Credit score range. fico scores range from 300 to 850. at first, vantagescore credit scores featured a different numerical scale (501 to 990). however, vantagescore 3.0 and 4.0 adopted the same. The base fico ® scores range from 300 to 850, while fico's industry specific scores range from 250 to 900. the first two versions of the vantagescore ranged from 501 to 990, but the latest vantagescore 3.0 and 4.0 use the same 300 to 850 range as base fico ® scores. what qualifies as a good score can vary from one creditor to another.

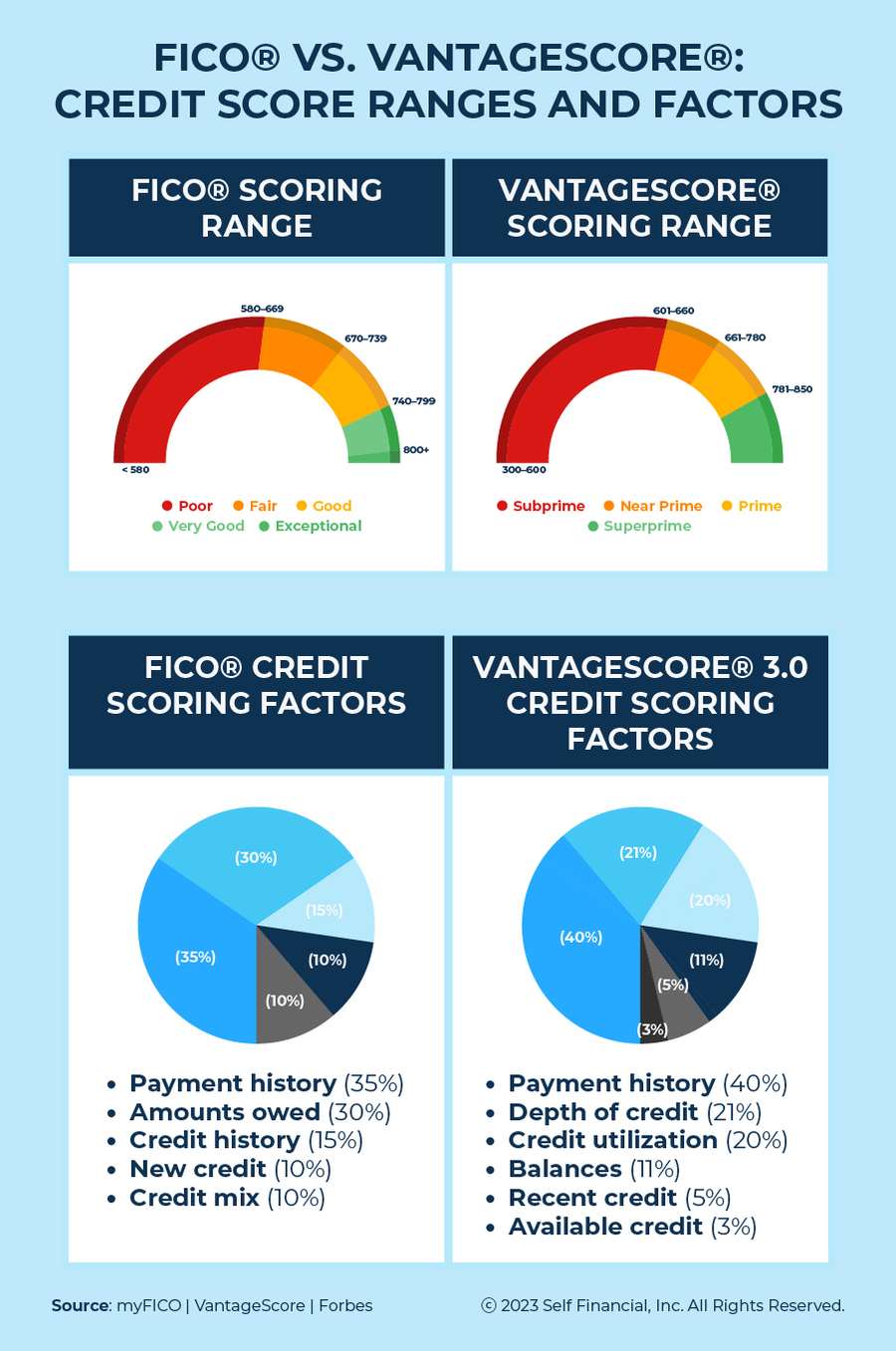

What Is A Vantagescore Avail All the latest generic scoring models range from 300 to 850, with a higher credit score being better. however, fico’s industry specific models and vantagescore 1.0 and 2.0 have different score. Otherwise, fico won’t generate your scores. on the other hand, the vantagescore® model may be able to score consumers who are new to credit or use credit infrequently. vantagescore can use data of just one month’s history and one account reported within the previous 24 months. Vantagescore 4.0. vantagescore 4.0 is the latest version of the company's scoring model. it was introduced in 2017 but is not yet as widely used as the vantagescore 3.0 model. the 4.0 model. Scores range from 300 to 850. the higher the number, the better your score. fico scores are calculated based on how a consumer handles debt and weighted according to the following categories: • payment history: 35%. • amounts owed: 30%. • length of credit history: 15%. • credit mix: 10%. • new credit: 10%.

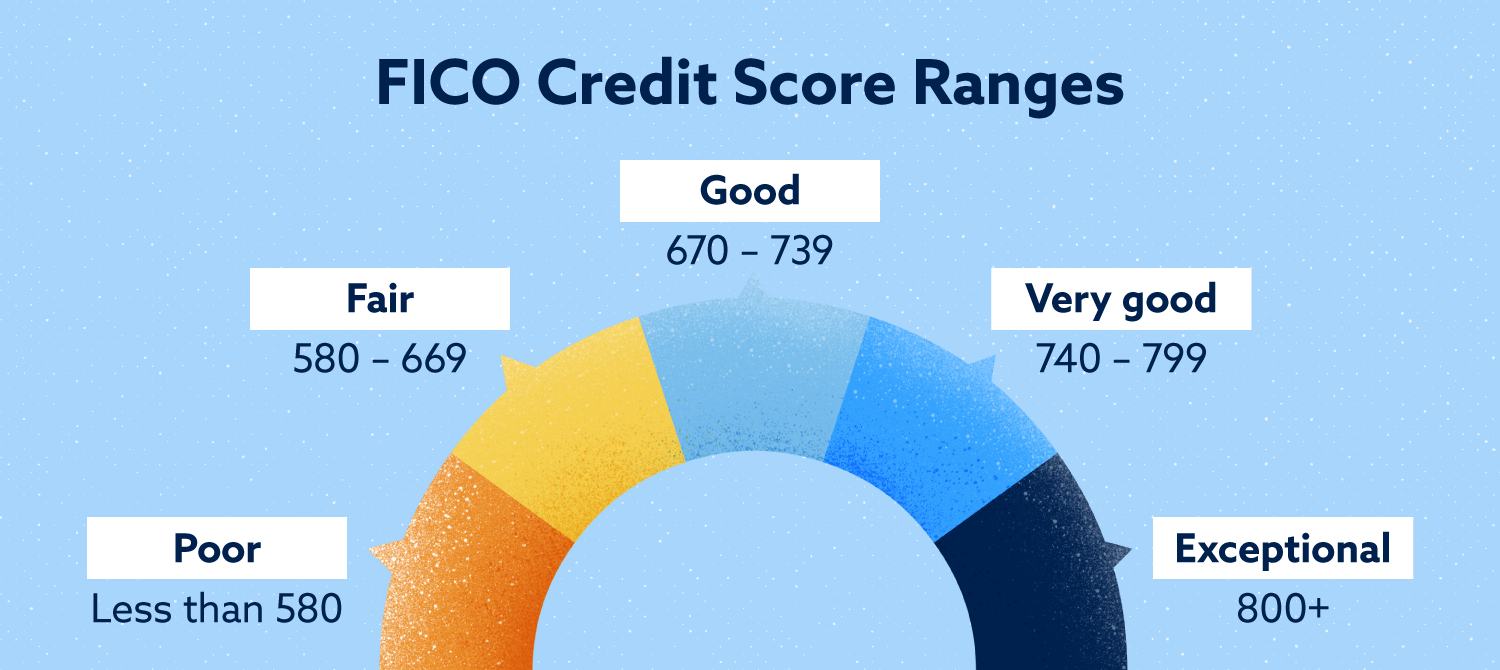

Credit Score Ranges What They Mean And Why They Matter Vantagescore 4.0. vantagescore 4.0 is the latest version of the company's scoring model. it was introduced in 2017 but is not yet as widely used as the vantagescore 3.0 model. the 4.0 model. Scores range from 300 to 850. the higher the number, the better your score. fico scores are calculated based on how a consumer handles debt and weighted according to the following categories: • payment history: 35%. • amounts owed: 30%. • length of credit history: 15%. • credit mix: 10%. • new credit: 10%. The most common types of credit scores used are fico scores and vantage scores. what is a fico score? the term “fico score” is often used interchangeably with the term “credit score.” fico is a publicly traded company based in california. the analytics company was founded in 1956 by an engineer, bill fair, and a mathematician, earl isaac. Generally, scores from 300 579 are “poor,” 580 669 are “fair,” 670 739 are “good,” 740 799 are “very good,” and 800 850 are “exceptional.”. while both fico and vantagescore have similar ranges, their scoring can differ for the same credit data, as noted above.

Fico Score Pie Chart The most common types of credit scores used are fico scores and vantage scores. what is a fico score? the term “fico score” is often used interchangeably with the term “credit score.” fico is a publicly traded company based in california. the analytics company was founded in 1956 by an engineer, bill fair, and a mathematician, earl isaac. Generally, scores from 300 579 are “poor,” 580 669 are “fair,” 670 739 are “good,” 740 799 are “very good,” and 800 850 are “exceptional.”. while both fico and vantagescore have similar ranges, their scoring can differ for the same credit data, as noted above.

Credit Scores How Fico And Vantagescore Are Different Savvymoney

Comments are closed.