Cryptocurrency Quant Trading Strategy

Cryptocurrency Quant Trading Strategy Immediate edge. immediate edge is a versatile ai bot trading that supports multiple cryptocurrencies and trading pairs. it uses cutting edge technology to analyze market trends and execute trades with high accuracy. immediate edge offers customizable trading strategies, allowing users to tailor the bot's performance to their specific needs. The early 2000s became the golden era of quant trading, with billions of dollars flowing from traditional discretionary funds to quant alternatives. this is the universe into which crypto was born.

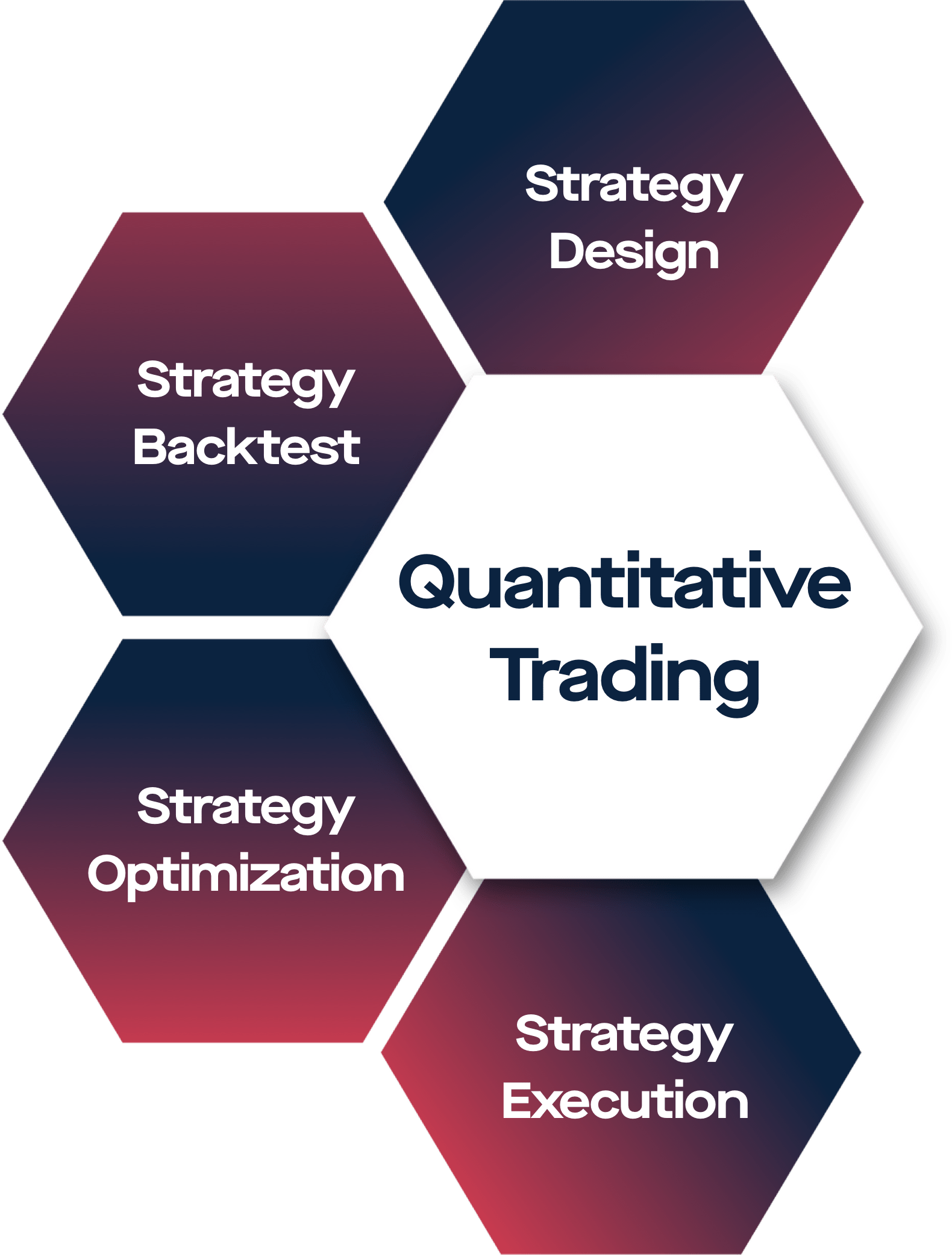

Cryptocurrency Quant Trading Strategy This ensures that quantitative trading strategies remain robust and relevant, providing a competitive edge in the fast evolving cryptocurrency market. implementing risk management in trading effective risk management in crypto trading minimizes potential financial damage and enhances portfolio performance. Quantitative trading is a method that uses mathematical computations and statistical models to identify trading opportunities. this analytical trading strategy focuses on quantitative analysis to generate trading insights. it's about crunching numbers from vast data sets, interpreting patterns, and creating algorithms that enable strategic. Quantitative trading, or quant trading, is a method of analyzing changes in securities’ prices by using advanced mathematical models and programming. it uses data, such as price and volume, in its analysis. historically used only by professional investors at a firm, it is becoming increasingly popular with retail investors. This approach is noted for its simplicity, effectiveness, and adaptability to new datasets, marking a significant contribution to quantitative investment strategies and cryptocurrency trading.

Algorithmic Trading Software For Crypto Assets Quantitative trading, or quant trading, is a method of analyzing changes in securities’ prices by using advanced mathematical models and programming. it uses data, such as price and volume, in its analysis. historically used only by professional investors at a firm, it is becoming increasingly popular with retail investors. This approach is noted for its simplicity, effectiveness, and adaptability to new datasets, marking a significant contribution to quantitative investment strategies and cryptocurrency trading. There are a number of benefits to utilizing quantitative analysis methods in cryptocurrency trading: 1. data driven decision making: quantitative evaluation relies on information quite than feelings or subjective opinions. it permits traders to make informed decisions primarily based on statistical proof and historical tendencies. I am the ceo of trading strategy. i have been a software developer for 25 years. for the last decade, i have been cto of various cryptocurrency and fintech companies. i am also one of the first ethereum dapp developers and solidity smart contract auditors. trading strategy is a remote first company with five people.

Comments are closed.