Difference Between Angel Investors And Venture Capitalists Side

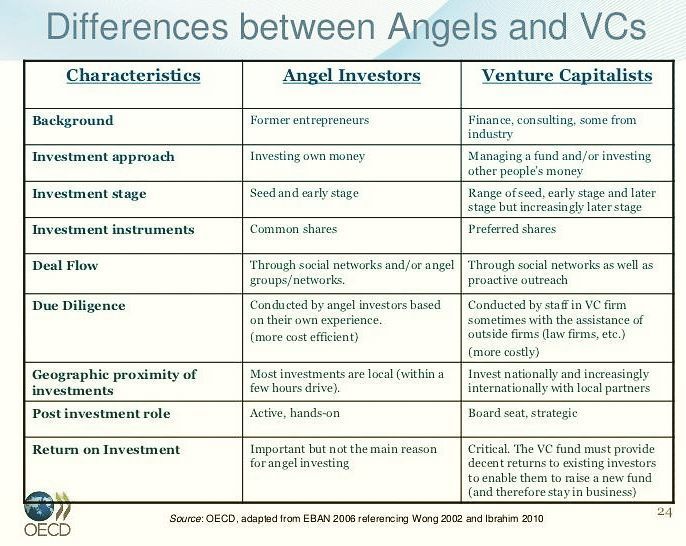

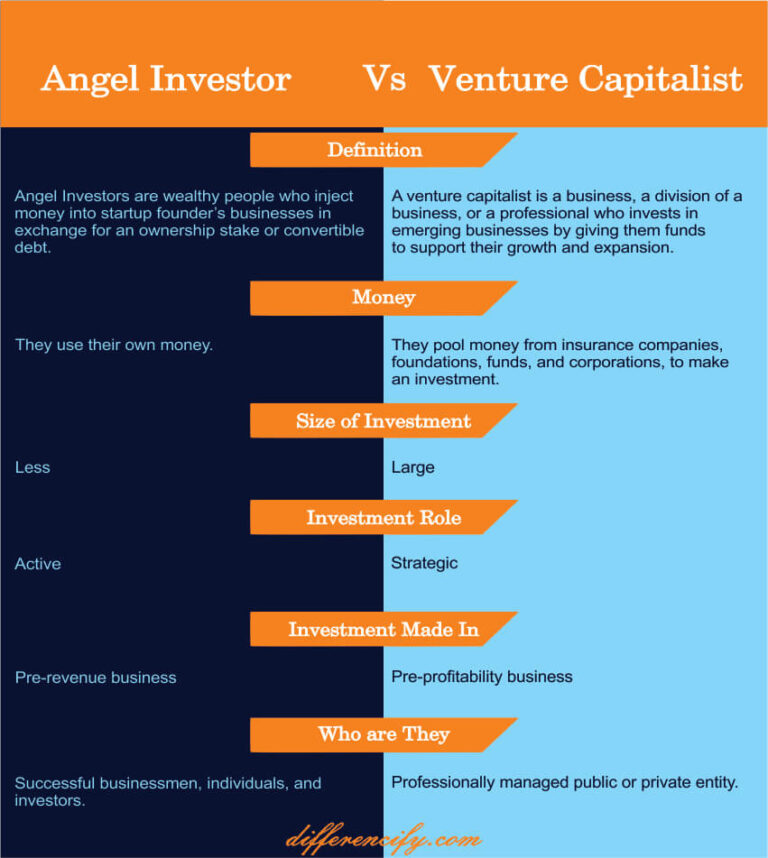

Ibc On Twitter Difference Between Angel Investor Venture Capital Venture capitalists ask for more company equity than angel investors. angel investors fund younger, less established businesses than venture capitalists. venture capitalists look for a bigger return on investment than angel investors. angel investors spend more time working with and mentoring business owners than venture capitalists do. Angel investors invest in a business in their initial stage, i.e. pre revenue stage. as against, venture capitalists invest in a business which is passed through their initial stage, i.e. pre profitability stage. angel investors are well off individuals, who invest their own surplus money in new and high growth potential businesses.

Difference Between Angel Investor And Venture Capitalist With Table Key points. angel investors and venture capitalists are known to fund new or early stage business endeavors. angels are more likely to be passive investors—friends or family—whereas venture capitalists typically work for professional firms. venture capital firms are more likely to take an active role in managing a company, as well as a. Venture capitalists and angel investors differ in several key ways, including their backgrounds, expertise, and investment approach. one of the main differences between venture capitalists and angel investors is their backgrounds and expertise. venture capitalists are typically professional investors who have a wealth of experience and. Angel investors: angel investors have a more flexible and faster decision making process, often based on personal discretion and can quickly decide to invest. 5. control and influence. venture capital: vcs exert significant control, often taking board seats and influencing the company's strategic direction. Angel investors are wealthy individuals (or groups of wealthy individuals) who invest their own money into companies. venture capitalists (vcs) are employees of venture capital firms that invest other people’s money (which they hold in a fund) into companies. now let’s take a closer at the two, before diving into the specific differences.

2023 म ए ज ल इन व स टर य व चर क प टल स ट स क स च न अपन व य प र Angel investors: angel investors have a more flexible and faster decision making process, often based on personal discretion and can quickly decide to invest. 5. control and influence. venture capital: vcs exert significant control, often taking board seats and influencing the company's strategic direction. Angel investors are wealthy individuals (or groups of wealthy individuals) who invest their own money into companies. venture capitalists (vcs) are employees of venture capital firms that invest other people’s money (which they hold in a fund) into companies. now let’s take a closer at the two, before diving into the specific differences. As two of the most common alternative funding sources, angel investors and venture capitalists have several similarities. both cater to innovative startup businesses, and both tend to prefer companies related to technology and science. however, there are some crucial differences between venture capitalists and angel investors. 1. Knowing the difference between angel investors and venture capitalists can help you make informed decisions about your business’s future. here are the key differences between these two types of investors: source of funds. angel investors: typically affluent individuals who often have a great deal of business and startup experience themselves.

Comments are closed.