Divergence Trading Strategy

Divergence Trading Guide 101 The Basics Technical Analysis Divergence trading strategy: 5 rules to enhance your. Learn what a divergence is and how to use it to find reliable trading signals. discover how to combine divergences with other tools and concepts to time your entries and exits in trends and reversals.

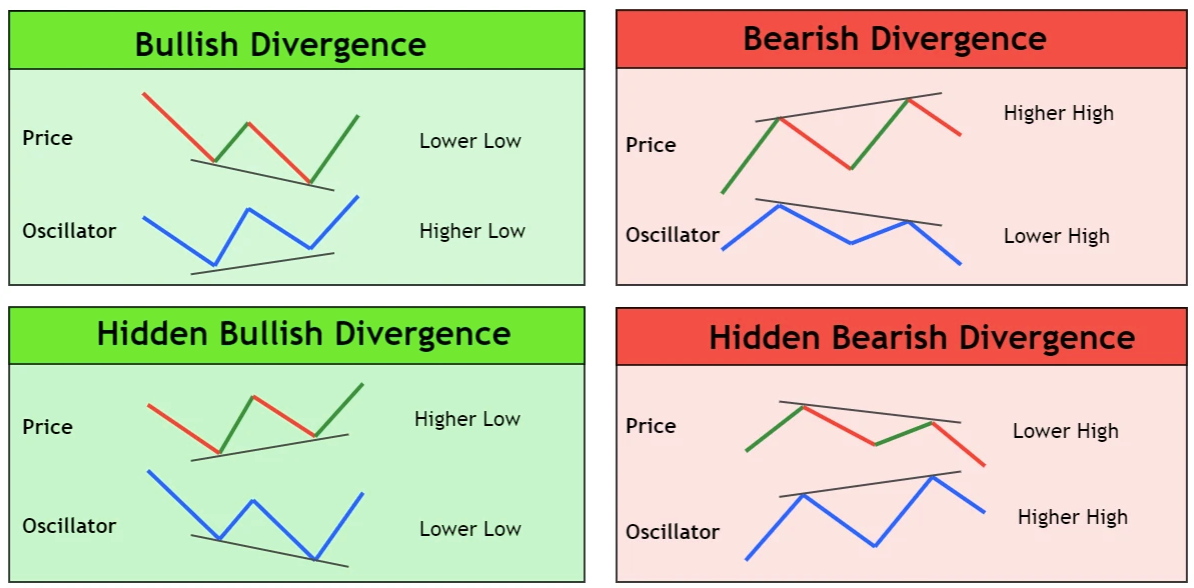

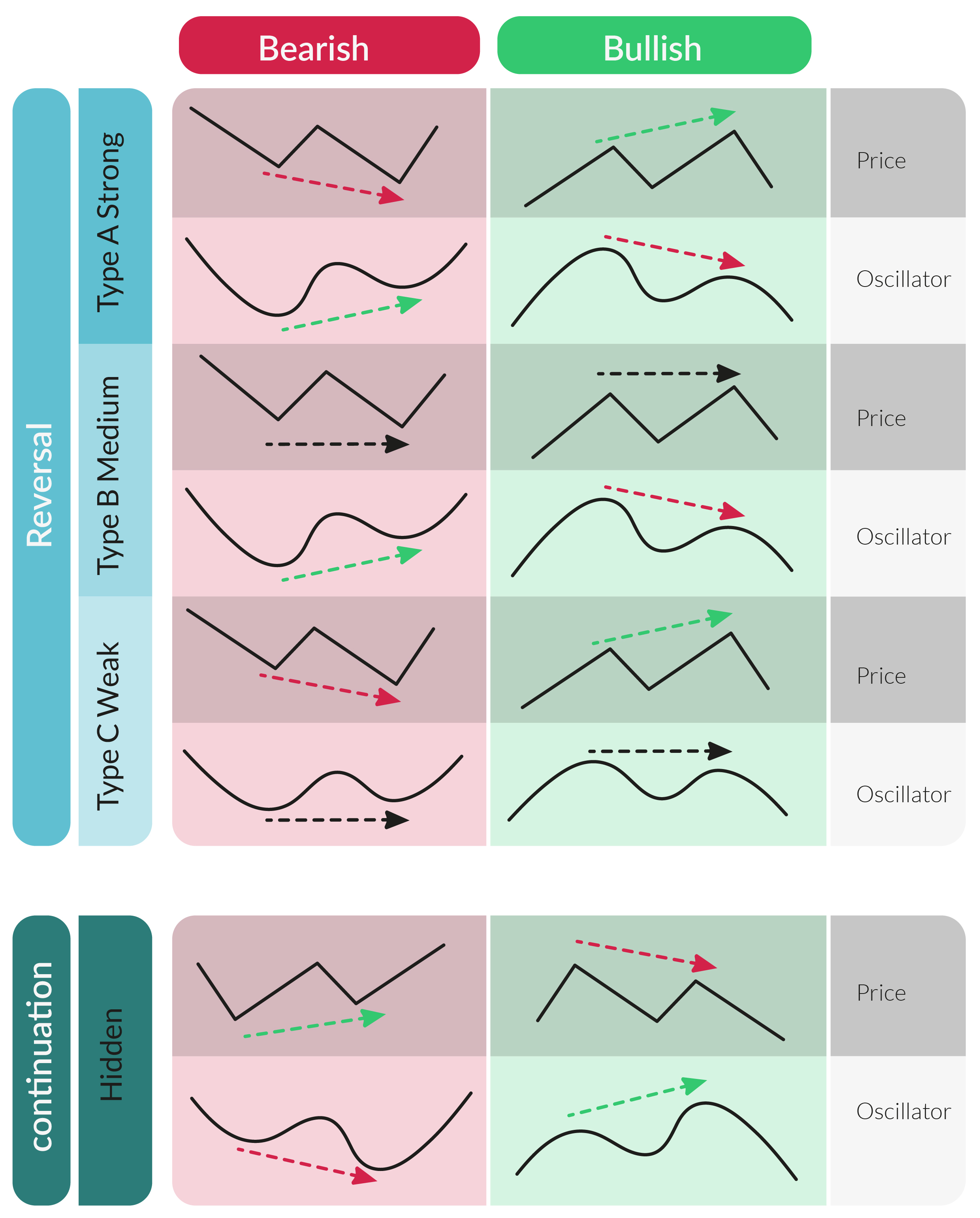

The New Divergence Indicator And Strategy 3rd Dimension Learn how to use divergence, a common signal in trading, to identify potential reversals or shifts in momentum. see examples, rules, and a backtest of a divergence strategy on the s&p 500 using various indicators. Trading divergence and understanding momentum. Because the hidden divergence is a trend continuation signal, out of the two types of divergence, the hidden divergence carries a higher rate of success. last but not least, trading divergence works across all time frames; however, the higher the time frame is, the more reliable the divergence signal tends to be. Versatility: divergence can be applied to various asset classes, timeframes, and trading strategies. whether you're a day trader or a long term investor, divergence analysis can be adapted to your trading style. avoiding false signals: divergence can help filter out false signals and noise in the market.

How To Trade A Divergence A Step By Step Divergence Trading Guide Because the hidden divergence is a trend continuation signal, out of the two types of divergence, the hidden divergence carries a higher rate of success. last but not least, trading divergence works across all time frames; however, the higher the time frame is, the more reliable the divergence signal tends to be. Versatility: divergence can be applied to various asset classes, timeframes, and trading strategies. whether you're a day trader or a long term investor, divergence analysis can be adapted to your trading style. avoiding false signals: divergence can help filter out false signals and noise in the market. The “hidden” principle behind divergence trading that no other textbook will tell you; a fool proof technique that will help you master identifying all types of divergences in trading; which indicator is the best for divergence trading (it’s not what you think) a complete and simple divergence trading strategy (including entries and exits). Divergence cheat sheet (free download) trading divergences is a common strategy focusing on finding a miscorrelation between the asset’s price and a technical indicator. with this strategy, divergence traders are looking for price reversals or trend continuation signals to capture long price movements. and, if used properly, it can turn out.

Comments are closed.