Dividend Yield Stock Capital Investment The Most Recommended

Dividend Yield Is A Key Way To Evaluate A Company And The Regular With a dividend yield of 10.28% as of april 15, bti is one of the best dividend stocks on our list. the number of hedge funds owning stakes in british american tobacco p.l.c. (nyse:bti) grew to 22. The company must have increased its dividend for at least 10 years in a row. decent annual dividend growth. the annual dividend amount has increased by at least 7% on average over the last five.

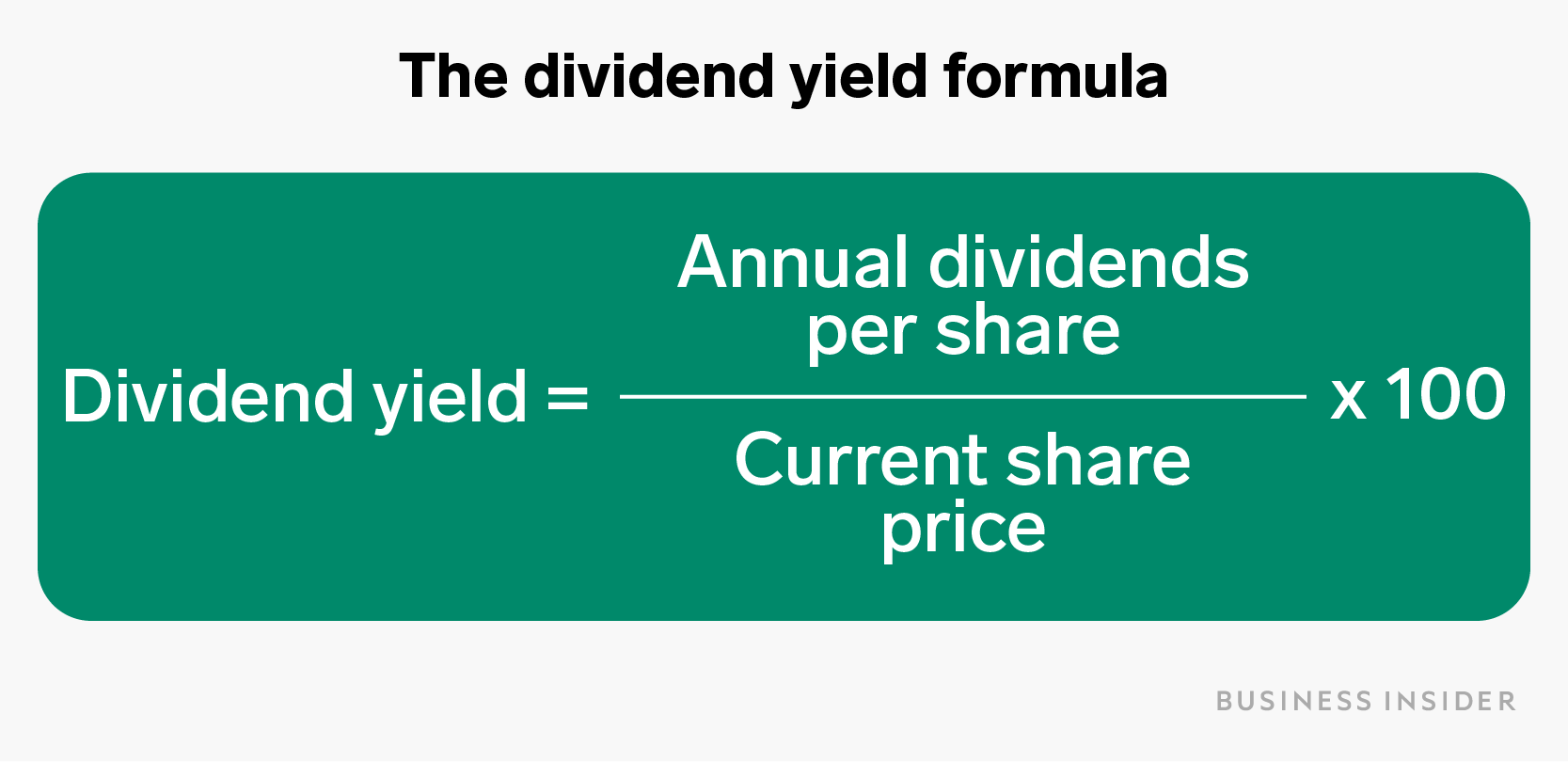

Dividend Yield Formula How To Calculate Dividend Yield Each offers exceptional dividend income and a real opportunity for meaningful price appreciation over time. dividend stock. trailing dividend yield*. xerox holdings corp. (ticker: xrx) 7.3%. Best high yield finance stock: best mortgage reit stock: pennymac mortgage investment trust; best credit card stock: visa; best monthly dividend stock: main street capital; best consumer. High dividend stocks vs. dividend growth stocks. most funds on our list of the best dividend etfs and mutual funds take one of two approaches to investing. In early 2024, the dividend yield on the s&p 500 averaged about 1.5%, while the 10 year note was around 4.1%. many investors would consider a stock as having a high dividend yield if it were.

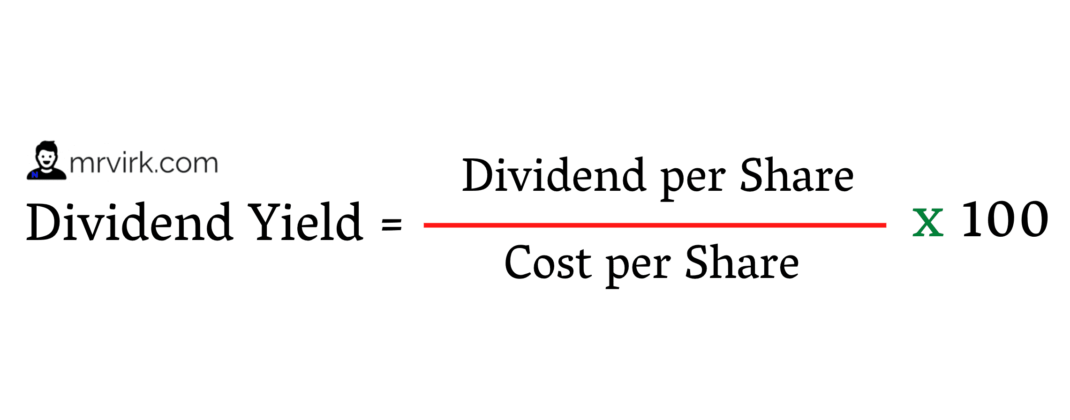

What Is A Dividend Investing Basics Mr Virk Media High dividend stocks vs. dividend growth stocks. most funds on our list of the best dividend etfs and mutual funds take one of two approaches to investing. In early 2024, the dividend yield on the s&p 500 averaged about 1.5%, while the 10 year note was around 4.1%. many investors would consider a stock as having a high dividend yield if it were. Two year estimated dividend growth rate: 39.6%. progressive's (pgr, $138.70) history dates back to 1937 when joseph lewis and jack green started the progressive mutual insurance company in. Using nerdwallet’s investment calculator, we can see that a $5,000 investment that grows at 6% annually for 20 years could grow to over $16,000. bump that up to 8% growth to include dividends.

Comments are closed.