Do I Trust Transunion Or Equifax Leia Aqui Which Credit Score Matters

Do I Trust Transunion Or Equifax Leia Aqui Which Credit Score Matters Transunion credit monitoring. the transunion credit agency offers a one size fits all approach to credit monitoring that will cost you $29.95 a month. this service offers multiple benefits to keep your credit score intact: unlimited credit score updates. email updates of important changes to your credit history. So, it’s possible that equifax and transunion could have different credit information on your reports, which could lead to your transunion score differing from your equifax score. you may be seeing scores from different dates. a credit score is a snapshot of your credit profile at a specific point in time. since credit scores can change over.

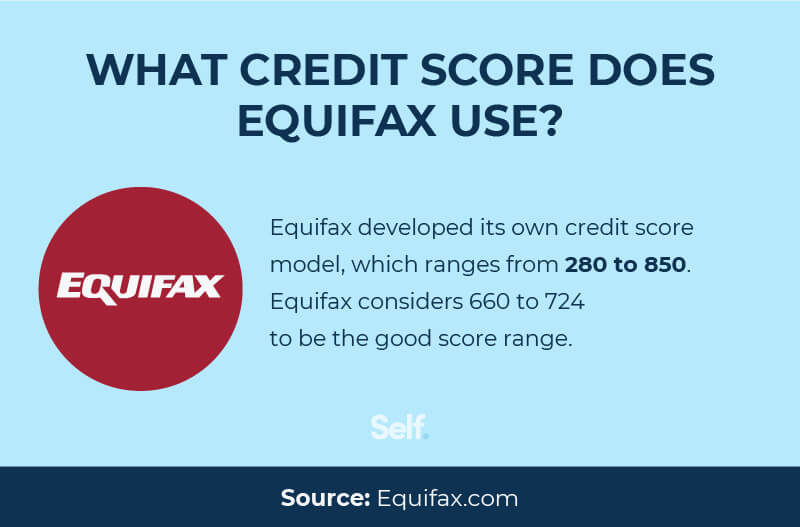

Transunion Vs Equifax Major Differences Explained Self Credit Builder 1. different algorithms and metrics. the algorithm used by equifax and transunion is proprietary to each company and most likely different in how they compute your score. equifax uses the equifax risk score, while transunion uses the creditvision scoring model. both range from 300 to 900, which is the credit score range in canada. Credit score reporting options for canadians. as canadians, we have quite a few options when it comes to finding out our credit score. of those options, you can either go directly through the credit bureaus themselves (meaning through equifax or transunion) or through a financial technology company like borrowell or credit karma. There are many reasons why the numbers between equifax and transunion may differ so much. one of which is that they use different algorithms to calculate your credit score. even then with the different algorithms, the variance between the two scores should be between 7 10% or even less. therefore, there are other reasons why the numbers between. 1. in canada, there are two credit bureaus that financial institutions use in the credit scoring process: equifax and transunion. but while the two companies serve a similar purpose, each one will give you a different credit score. in this article, i’ll explain why that is, and show you how you can get an updated credit score every month for.

Whatтащs The Difference Between юааtransunionюаб And юааequifaxюаб юааleiaюаб юааaquiюаб Which There are many reasons why the numbers between equifax and transunion may differ so much. one of which is that they use different algorithms to calculate your credit score. even then with the different algorithms, the variance between the two scores should be between 7 10% or even less. therefore, there are other reasons why the numbers between. 1. in canada, there are two credit bureaus that financial institutions use in the credit scoring process: equifax and transunion. but while the two companies serve a similar purpose, each one will give you a different credit score. in this article, i’ll explain why that is, and show you how you can get an updated credit score every month for. Credit scores can easily get confusing, especially if you are new to monitoring your credit. in reality, the concepts are pretty simple. equifax and transunion are just two different credit bureaus that compile and distribute credit reports and scores. while these scores may differ slightly, they use the same information and should be similar. Transunion offers transunion credit monitoring for $24.95 per month, as mentioned above. this is similar to equifax, and you will get detailed information on your credit report and score. again, you have alternative options where you can check your credit score for free, like credit karma.

What Credit Score Do Banks Look At Leia Aqui Do Banks Use Tra Credit scores can easily get confusing, especially if you are new to monitoring your credit. in reality, the concepts are pretty simple. equifax and transunion are just two different credit bureaus that compile and distribute credit reports and scores. while these scores may differ slightly, they use the same information and should be similar. Transunion offers transunion credit monitoring for $24.95 per month, as mentioned above. this is similar to equifax, and you will get detailed information on your credit report and score. again, you have alternative options where you can check your credit score for free, like credit karma.

Which Credit Score Matters More Transunion Or Equifax Leia Aq

Comments are closed.