Do You Have To Have A Schedule 2 On 1040

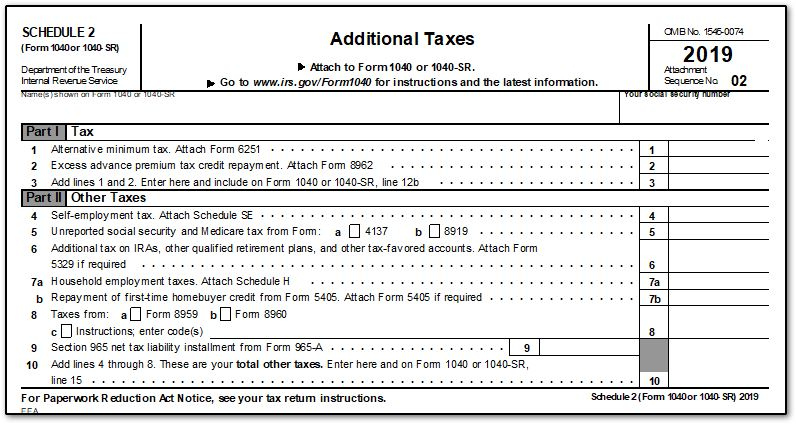

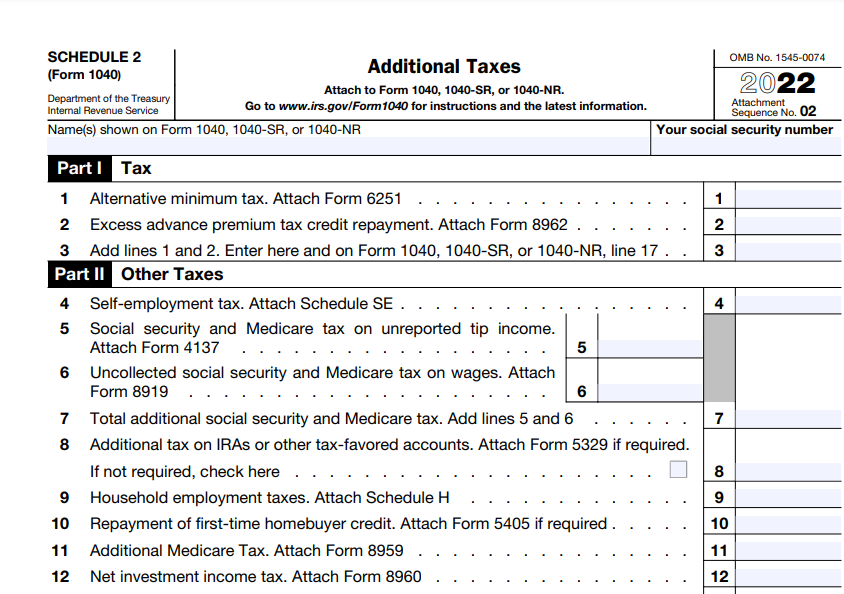

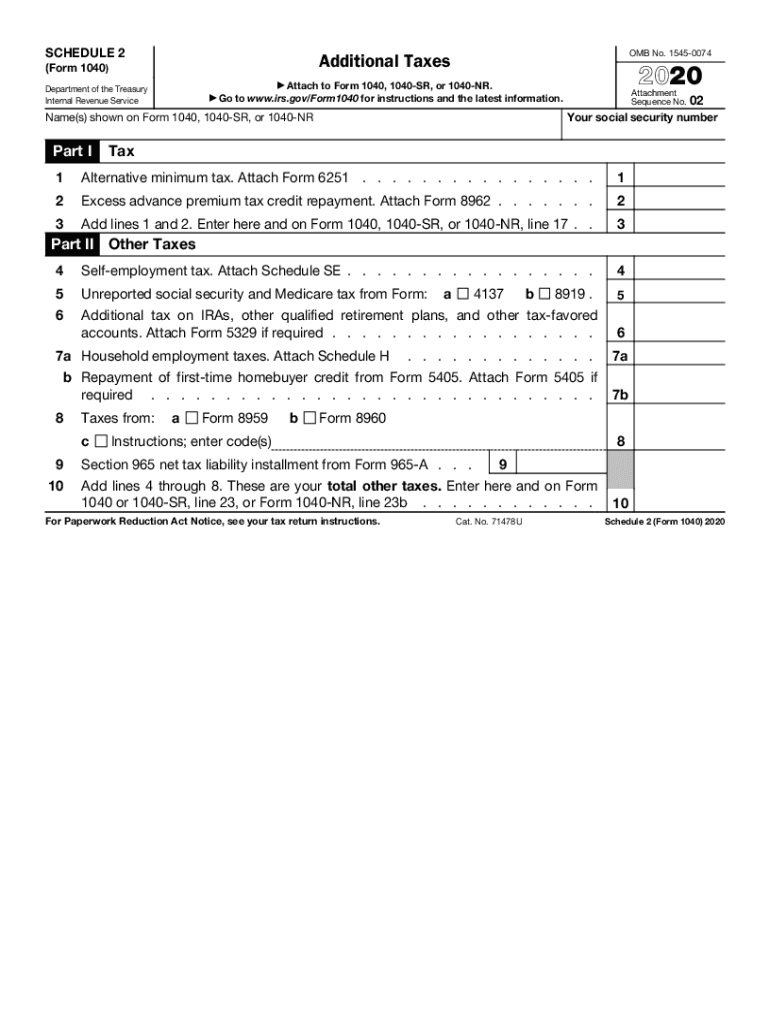

Tax Form 1040 Schedule 2 1040 Form Printable The part ii portion of schedule 2 includes information that was previously collected on schedule 4 in tax year 2018. prior to that, this information was collected on lines 57 through 62 of form 1040. this part has seven lines: if you're self employed, this line is where you'll enter the amount you owe in self employment taxes. Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out. schedule 1. this form is titled additional income and adjustments to income and has two parts. schedule 1 is included with your tax return, even if it is blank. for taxpayers with simple income, such as a.

Schedule 2 Tax Form 2024 Berta Celinka Key takeaways. irs form 1040 schedule 2 is used to report certain non traditional taxes not covered by the standard form 1040. you may need to file schedule 2 if: you earn a high income and owe alternative minimum tax (amt), net investment income tax (niit), or the additional medicare tax. you need to repay health insurance tax credits. 1. you need to fill out schedule 2 if you need to report that amount for certain residential lots and timeshares. 2. also complete the required sections accurately with the necessary information regarding your investments or properties. 3. once you have filled out schedule 2, attach it to your form 1040 before submitting your tax return. 4. Schedule 2 (form 1040) 2023 additional taxes department of the treasury internal revenue service attach to form 1040, 1040 sr, or 1040 nr. go to. Step 2: identify applicable sections: schedule 2 is divided into two parts. part i – taxes: this covers taxes like self employment tax, household employment tax, alternative minimum tax (amt), and others. part ii – other taxes: this section includes taxes on iras and retirement plans, net investment income tax, unreported social security.

Mississippi Income Tax Forms Evette Spivey Schedule 2 (form 1040) 2023 additional taxes department of the treasury internal revenue service attach to form 1040, 1040 sr, or 1040 nr. go to. Step 2: identify applicable sections: schedule 2 is divided into two parts. part i – taxes: this covers taxes like self employment tax, household employment tax, alternative minimum tax (amt), and others. part ii – other taxes: this section includes taxes on iras and retirement plans, net investment income tax, unreported social security. Can claim any credit that you didn't claim on form 1040 or 1040 sr, such as the foreign tax credit, education credits, general business credit. have other payments, such as an amount paid with a request for an extension to file or excess social security tax withheld. then use. schedule 3 pdf. Determine how much of the amount on form 1040 or 1040 sr, line 1z, was also reported on schedule se, part i, line 2. subtract that amount from the amount on form 1040 or 1040 sr, line 1z. enter the result on line 1 of the worksheet in step 5 (instead of entering the actual amount from form 1040 or 1040 sr, line 1z).

2020 Form Irs 1040 Schedule 2 Fill Online Printable Fillable Blank Can claim any credit that you didn't claim on form 1040 or 1040 sr, such as the foreign tax credit, education credits, general business credit. have other payments, such as an amount paid with a request for an extension to file or excess social security tax withheld. then use. schedule 3 pdf. Determine how much of the amount on form 1040 or 1040 sr, line 1z, was also reported on schedule se, part i, line 2. subtract that amount from the amount on form 1040 or 1040 sr, line 1z. enter the result on line 1 of the worksheet in step 5 (instead of entering the actual amount from form 1040 or 1040 sr, line 1z).

I Donтащt юааhaveюаб юааscheduleюаб юаа2юаб юаа1040юаб юааdoюаб I Need It R Fafsa

Comments are closed.