Download Form 15g Pdf For Pf Withdrawal Sample Filled

Form 15g Fill Online Printable Fillable Blank Pdffiller Download in pdf format. form 15g filled sample for pf withdrawal in 2022. form 15g consists two parts, we need to fill only part 1 of form 15g there is no need to fill part 2 of form 15g, just leave that page blank. here is an example of a sample filled form 15g part 1 and part 2, which will guide you on how to fill form 15g correctly for pf. If you are wondering how to fill out form 15g for pf withdrawal, follow the steps given below: firstly, log in to the epfo uan portal. then, select ‘online services’ and click on ‘claim’. for verification, enter your bank account number and click on ‘verify’. press on ‘upload form 15g’ below the ‘i want to apply for’ option.

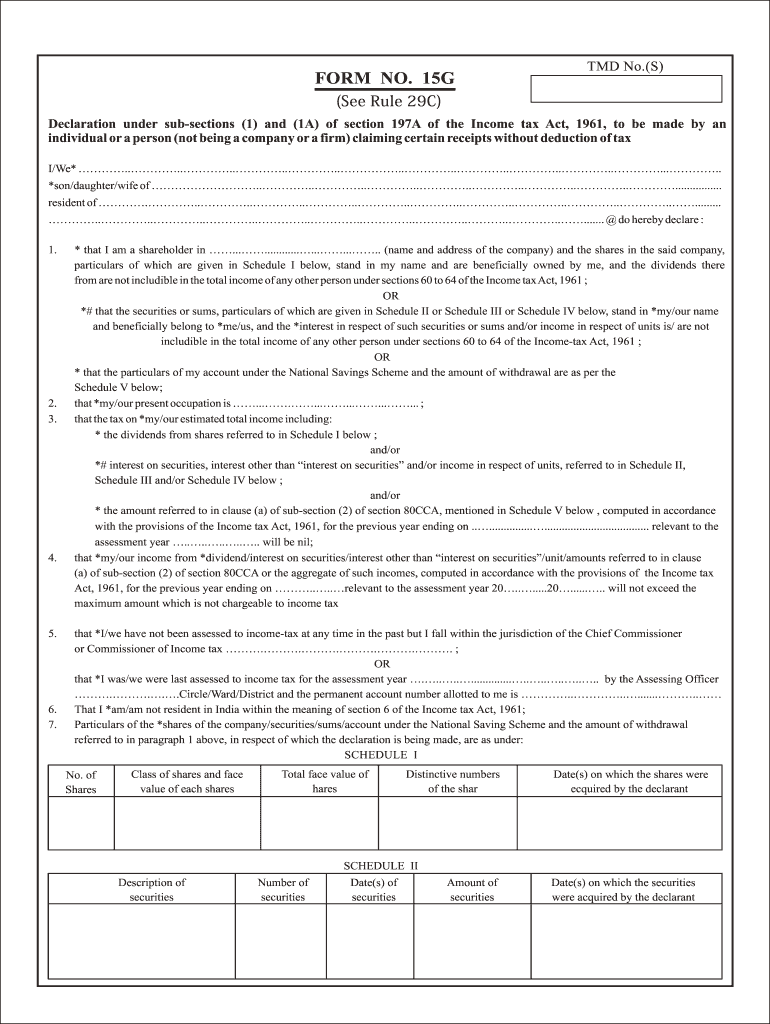

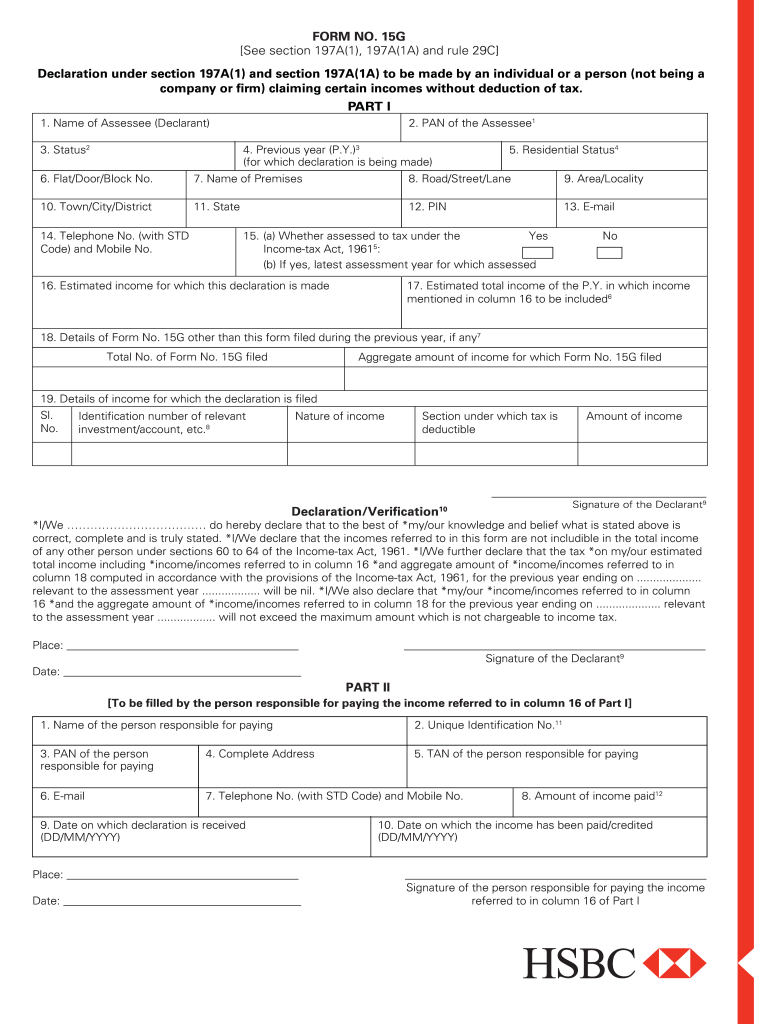

Sample Filled Form 15g 15h For Pf Withdrawal In 2021 Form Details to be filled in form 15g pdf for fy 2023 24. 1. name of assessee (declarant) – name as stated on pan card. 2. pan of assessee – enter pan card number here, a valid pan number is mandatory to fill form 15g. 3. status – individual huf (hindi united family) 4. previous year – enter the current financial year 2024 25 in case you are. What is form 15g for pf withdrawal. epf members need to submit form 15g whenever the pf claim amount is more than 50,000 rs but their total service is below 5 years, in remaining cases there is no need to submit form 15g. to submit form 15g online, the pan of the epf members must be linked with their pf account. Total no. of form no. 15g filed aggregate amount of income for which form no.15g filed 1 18. details of form no. 15g other than this form filed during the previous year, if any7 19. details of income for which the declaration is filed amount of income section under which tax is deductible nature of income identification number of relevant. Sample filled form 15g for pf withdrawal. the sample filled form 15g is given below: how to upload form 15g for pf withdrawl? the steps to upload form 15g in the portal are given below: after filling out form 15g, convert it to pdf format. make sure your form 15g is less than 1 mb. now login to the uan website with the help of your credentials.

Epf Form 15g Download Sample Filled Form 15g For Pf Total no. of form no. 15g filed aggregate amount of income for which form no.15g filed 1 18. details of form no. 15g other than this form filed during the previous year, if any7 19. details of income for which the declaration is filed amount of income section under which tax is deductible nature of income identification number of relevant. Sample filled form 15g for pf withdrawal. the sample filled form 15g is given below: how to upload form 15g for pf withdrawl? the steps to upload form 15g in the portal are given below: after filling out form 15g, convert it to pdf format. make sure your form 15g is less than 1 mb. now login to the uan website with the help of your credentials. Form no. 15g. [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income ‐ tax act, 1961 to be made by an individual or person (not being a company or firm) claiming certain receipts without deduction of tax. Step 1: log in to the epfo uan portal, click on the ‘online services’ option and select ‘claim’. step 2: now, you need to enter the last 4 digits of your registered bank account for verification. step 3: search for the “upload form 15g” option to obtain the form downloaded on your desktop or mobile.

Sample Filled Form 15g For Pf Withdrawal Fill Online Vrogue Co Form no. 15g. [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income ‐ tax act, 1961 to be made by an individual or person (not being a company or firm) claiming certain receipts without deduction of tax. Step 1: log in to the epfo uan portal, click on the ‘online services’ option and select ‘claim’. step 2: now, you need to enter the last 4 digits of your registered bank account for verification. step 3: search for the “upload form 15g” option to obtain the form downloaded on your desktop or mobile.

Form 15g For Pf Withdrawal Fill Online Printable Fillable Blank

Comments are closed.