Economic Recession What Is It What Happens Seeking Alpha

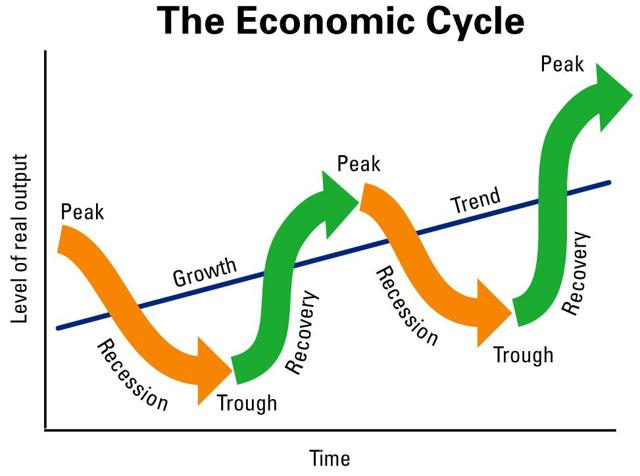

Economic Recession What Is It What Happens Seeking Alpha A recession is an integral part of the economic cycle, which is also known as the business cycle. it is comprised of these stages: recession: growth slows, the rate of employment falls, but prices. Summary. falling interest rates and a weaker dollar indicate a potential economic slowdown or recession. the steepening yield curve and declining breakeven rates also suggest weakening economic.

How Should You Invest During A Recession Seeking Alpha In reality, the economy had steady growth in 2023. the bureau of economic analysis (bea), in its summary of the 2023 economy, states: "real gdp increased 2.5 percent in 2023 (from the 2002 annual. The us economy is the envy of the world. 14 million new jobs, wages finally rising faster than inflation, record low unemployment rates, while japan is already in recession and germany, the eu, gb. The 2024 slowdown will probably not be recession, though that’s certainly a possibility. i had previously predicted a recession, of mild magnitude, beginning in late 2023 or early 2024. this. Summary. the latest conference board leading economic index (lei) decreased in july to its lowest level since april 2020. the index fell 0.6% from the previous month to 100.4, marking its fifth.

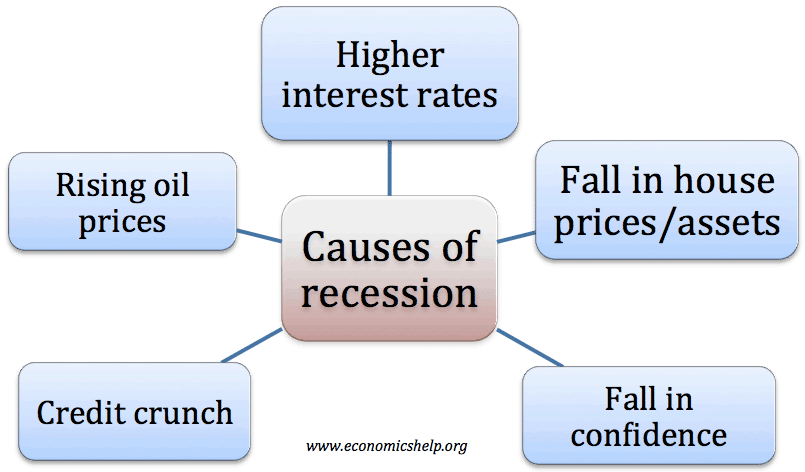

What Will Cause The Next Recession Seeking Alpha The 2024 slowdown will probably not be recession, though that’s certainly a possibility. i had previously predicted a recession, of mild magnitude, beginning in late 2023 or early 2024. this. Summary. the latest conference board leading economic index (lei) decreased in july to its lowest level since april 2020. the index fell 0.6% from the previous month to 100.4, marking its fifth. 1) reits are recession resistant: most reits earn cash flow from long term leases and use little debt, so they are not heavily impacted by recessions. take the example of nnn reit (nnn): it has 10. I think that the market is crashing because of three key reasons: firstly, there are growing fears of a recession. the consumer is weakening, real time inflation is down to 1.5%, and the fed is.

The Recession Is Here Seeking Alpha 1) reits are recession resistant: most reits earn cash flow from long term leases and use little debt, so they are not heavily impacted by recessions. take the example of nnn reit (nnn): it has 10. I think that the market is crashing because of three key reasons: firstly, there are growing fears of a recession. the consumer is weakening, real time inflation is down to 1.5%, and the fed is.

Comments are closed.