Employee Vs Independent Contractorвђ Which Is Better For Your Business

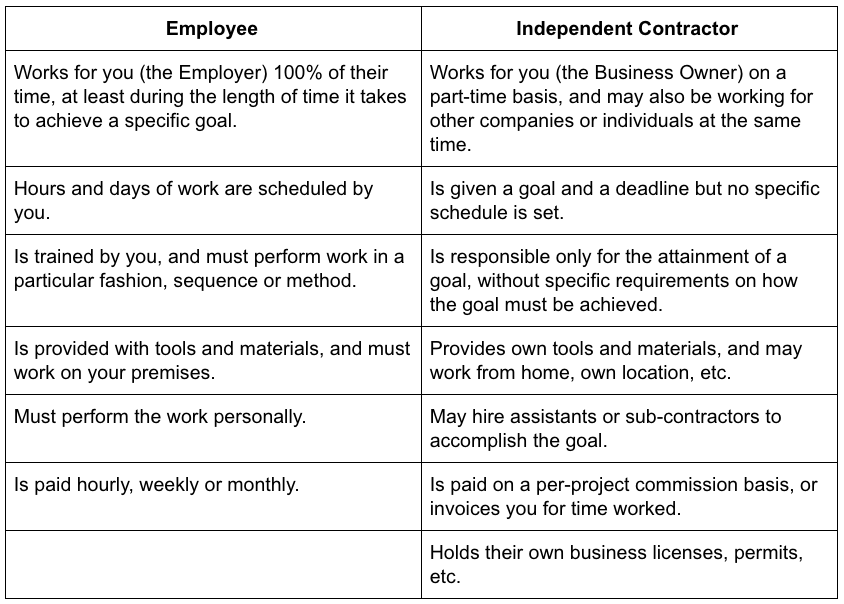

Employee Vs Independent Contractorвђ Which Is Better For Your ођ First, look at the chart below. this will help you understand the criteria used by the irs to determine employee vs. independent contractor status: now that you understand the difference between the two classifications, let's look at the major considerations in owning a business and which classification might be best for you. Independent contractor vs. employee, what does it matter?.

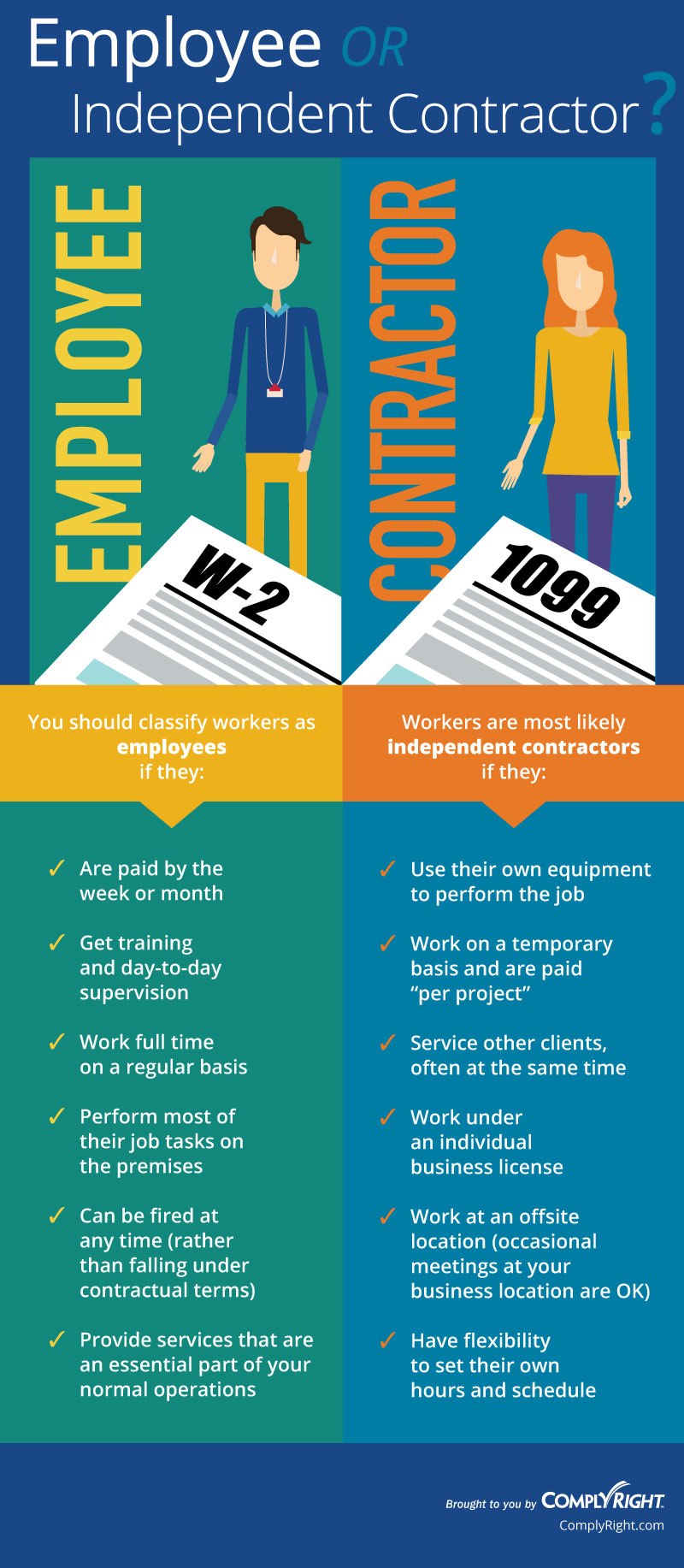

Independent Contractor Vs Employee Chart Whereas independent contractors fulfill specific tasks or projects, employees have regular duties. they also receive a salary or hourly wage, rather than a fixed fee or hourly rate. employees enjoy benefits such as minimum wage, overtime pay, and paid vacation, which independent contractors do not receive. Classifying contractors vs. employees. an employee is a permanent member of your company who must be treated in accordance with federal and state labor and wage laws. an independent contractor operates under a separate business name from your company and performs job functions for you temporarily. the irs has strict worker guidelines about when. An independent contractor operates as their own business and works independently – often for multiple clients. they are responsible for paying both halves of payroll taxes, both the employee’s and the employer’s (which the irs considers “self employment tax”). they also pay for the tools they need to perform their work. Employers in ontario are faced with a decision to make: hire employees or independent contractors. there are benefits and challenges to each; however, from a legal perspective, there are important distinctions that may have lasting effects on your business. the classification of employee vs. contractor impacts worker’s entitlements and employer responsibilities under the law. in […].

Employee Vs Independent Contractor What S The Difference An independent contractor operates as their own business and works independently – often for multiple clients. they are responsible for paying both halves of payroll taxes, both the employee’s and the employer’s (which the irs considers “self employment tax”). they also pay for the tools they need to perform their work. Employers in ontario are faced with a decision to make: hire employees or independent contractors. there are benefits and challenges to each; however, from a legal perspective, there are important distinctions that may have lasting effects on your business. the classification of employee vs. contractor impacts worker’s entitlements and employer responsibilities under the law. in […]. Relationship. employees develop an employer employee relationship with a company, and full time employees are likely to dedicate all working hours to the company. as a workforce, you expect them to perform all work that is essential to the business. contractors tend to perform short term, specialized functions. The pros and cons of hiring an employee vs. a contractor.

Comments are closed.