Employee W2 Vs Independent Contractor 1099 Gg Cpa Services

Employee W2 Vs Independent Contractor 1099 Gg Cpa Services The designation of employee (w2) vs independent contractor (1099) is not up to the free will of the parties. it has to follow regulations released by the irs, dol, and state authorities. some business owners might consider that independent contractors might be less costly as there is no employer portion, no payroll processing fees, no workers. As part of the issue number: ir 2021 186 and , the irs reminded business owners the differences between independent contractors and employees. independent contractor vs. employee whether a worker is an independent contractor or an employee depends on the relationship between the worker and the business. generally, there are three categories to examine: behavioral control − […].

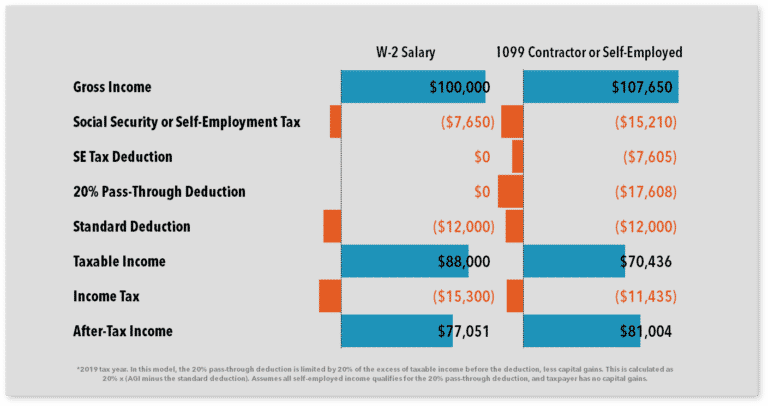

1099 Vs W2 Difference Between Independent Contractors E Cons of being a 1099 contractor. benefits: as a contractor, you won’t get employee benefits like healthcare, retirement savings accounts, and employee discounts. you don’t get paid when you don’t work — time off is unpaid. further, there is no promise of a certain number of hours, days, or years of work. Worker classification 101: employee or independent. 1099 vs. w 2 employees: key differences and how to. The line between a w 2 employee and a 1099 independent contractor may seem blurry, but the most important difference is whether your business must withhold taxes from a worker's payments. if you classify a worker as a w 2 employee, you are required to withhold social security tax, income tax, medicare tax, and any state income taxes for the.

Comments are closed.