Esg And Risk Assessment Market Risk вђ Risk Spotlight

Pwc Esg Report 2024 Sheri Wenona Stated simply, it is the risk of financial losses faced by companies or investors from trading activities. market risk is also known as systemic risk in that it cannot be diversified but can be hedged. market risk can take the following forms: equity risks : the risk of losses from a drop in share prices. interest rate risk: the risk of losses. In this blog series, i will explore the potential integration of esg in market risk management including stress testing and scenario building, operational risk, and credit risk. not an easy task because of the absence of ways to test my theory, but not impossible either as i am undertaking a theoretical exploration and therefore, giving myself.

How To Turn Esg Reporting Into Your Best Asset Var is widely used because it provides decision makers one number that is the best representation of enterprise wide risk and allows them to determine how much capital to allocate for risk. var maybe explained as an absolute amount (i.e. $1 million), or a percentage of market value (i.e. 3.5% of portfolio). a var of $1 million at 99% confidence. Abstract. this paper investigates the possible impact of esg risk when incorporated into front office driven fundamental market risk measurement approaches. the main principle is, that esg risk is implicitly embedded in observable market risk factors, like share prices and credit spreads, and interprets the esg risk of an equity portfolio as an. Environmental, social, and governance (esg) risk assessment is an essential component for businesses in today’s world. it evaluates the potential risks and impacts of a company’s esg practices and initiatives. understanding esg risks is critical for effective risk management, long term competitiveness, and meeting stakeholder expectations. An effective risk assessment—which also may identify opportunity—starts with a survey of e, s, and g factors in the context of the company’s current and possible future strategy. depending on the nature of the risks, management may identify risk mitigation factors; however, in other circumstances, this assessment may lead to fundamental.

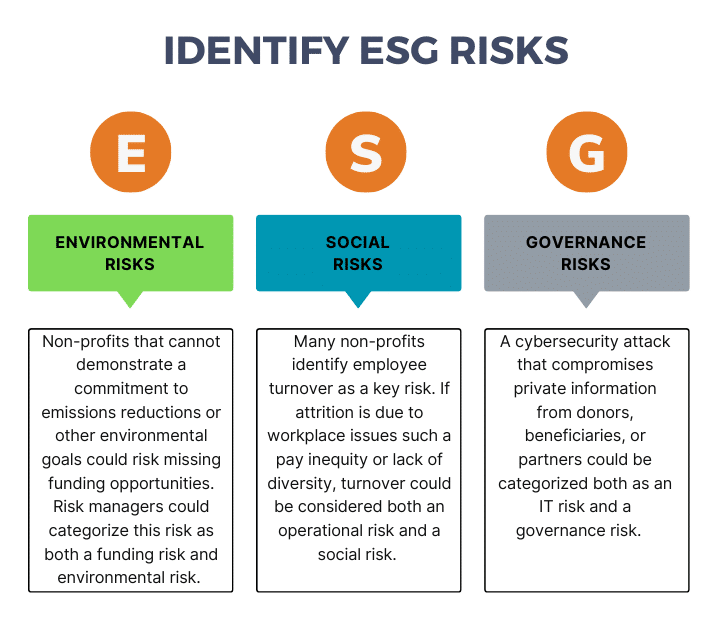

Esg For Non Profit Risk Managers Grf Cpas Advisors Environmental, social, and governance (esg) risk assessment is an essential component for businesses in today’s world. it evaluates the potential risks and impacts of a company’s esg practices and initiatives. understanding esg risks is critical for effective risk management, long term competitiveness, and meeting stakeholder expectations. An effective risk assessment—which also may identify opportunity—starts with a survey of e, s, and g factors in the context of the company’s current and possible future strategy. depending on the nature of the risks, management may identify risk mitigation factors; however, in other circumstances, this assessment may lead to fundamental. Use the outcomes of an esg risk assessment to integrate esg risks into your business strategy. consider how these risks will translate into controls and governance practices. integrate key issues into awareness training, company policies and mission statements to boost company culture, drive attitudes and actions that align to these values. tip. Esg risk management is becoming an important issue for companies that want to succeed in today's business environment. building an effective esg risk management framework requires a comprehensive approach that includes governance and leadership, risk assessment, policies and procedures, training and education, and monitoring and reporting.

Crisil Esg Risk Assessment Leadership Category Credly Use the outcomes of an esg risk assessment to integrate esg risks into your business strategy. consider how these risks will translate into controls and governance practices. integrate key issues into awareness training, company policies and mission statements to boost company culture, drive attitudes and actions that align to these values. tip. Esg risk management is becoming an important issue for companies that want to succeed in today's business environment. building an effective esg risk management framework requires a comprehensive approach that includes governance and leadership, risk assessment, policies and procedures, training and education, and monitoring and reporting.

Comments are closed.