Everything Banking News 15g 15h Form Fill Up Step Wise Guideline With

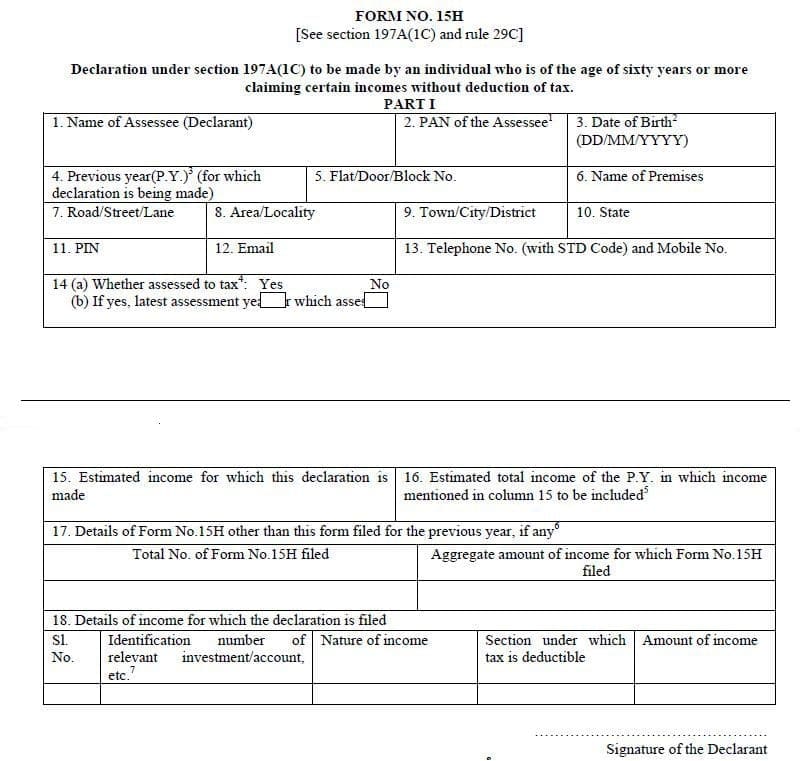

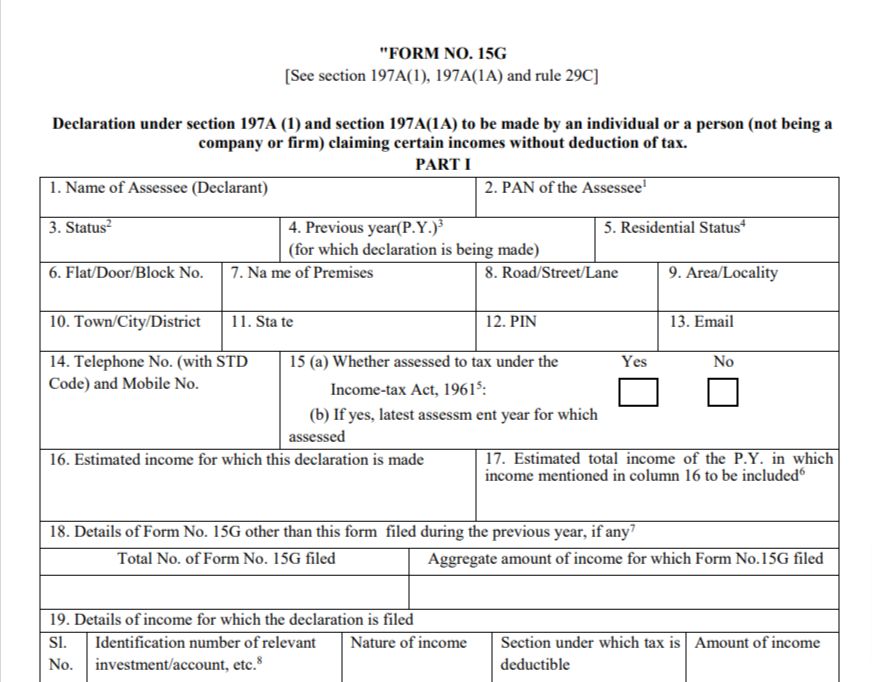

Everything Banking News 15g 15h Form Fill Up Step Wise Guideline With The tax deductor issues a unique identification number, or uin, to each person who files a form 15g or form 15h. form 15g and form 15h quarterly statement filings require the uin. for a minimum of seven years, forms 15g and 15h must be kept up to date. uin includes 3 fields – sequence number, financial year, and tan of the payer deductor. 15g 15h form fill up step wise guideline with sample filled form 2016. 1. name of assessee (declarant): write the name as mentioned on pan card. 2. pan of the assessee: write your pan number. 3. status: individual hindu undivided family (huf): as applicable in your case. 4.

How To Guide To Fill New Form 15g And 15h Tds Waiver Vrogue Co Tds is deducted on rent exceeding rs 2.4 lakh annually. if tax on your total income is nil, you can submit form 15g or form 15h to request the tenant to not deduct tds (applicable from 1 april 2019). tds on insurance commission. tds is deducted on insurance commission, if it exceeds rs 15000 per financial year. Before filling the form 15g and 15h, gather your pan card, income details, and previous forms submissions if any. after that, download the form 15g online or get it from your bank. here’s a step by step guide on how to fill form 15g effectively, and provide correct details to avoid any issues in the future. Form 15g and 15h are self declaration forms to be filed and submitted by individuals to ensure that the banks or financial institutions do not deduct tds on the interest income earned accrued in a financial year as their estimated total income will be below the basic exemption limit (i.e., ₹2,50,000 or ₹3,00,000 or ₹5,00,000, as applicable) and there is no tax liability in that. How to fill form 15g and 15h ★ filled form 15g sample ★ form 15h sample 176 comments fixed income , investment plan , saving account by amit march 30, 2021 form 15g and form 15h are self declaration forms which can be submitted to banks and other institutions to avoid tax deduction at source (tds) by banks on fixed and recurring deposit.

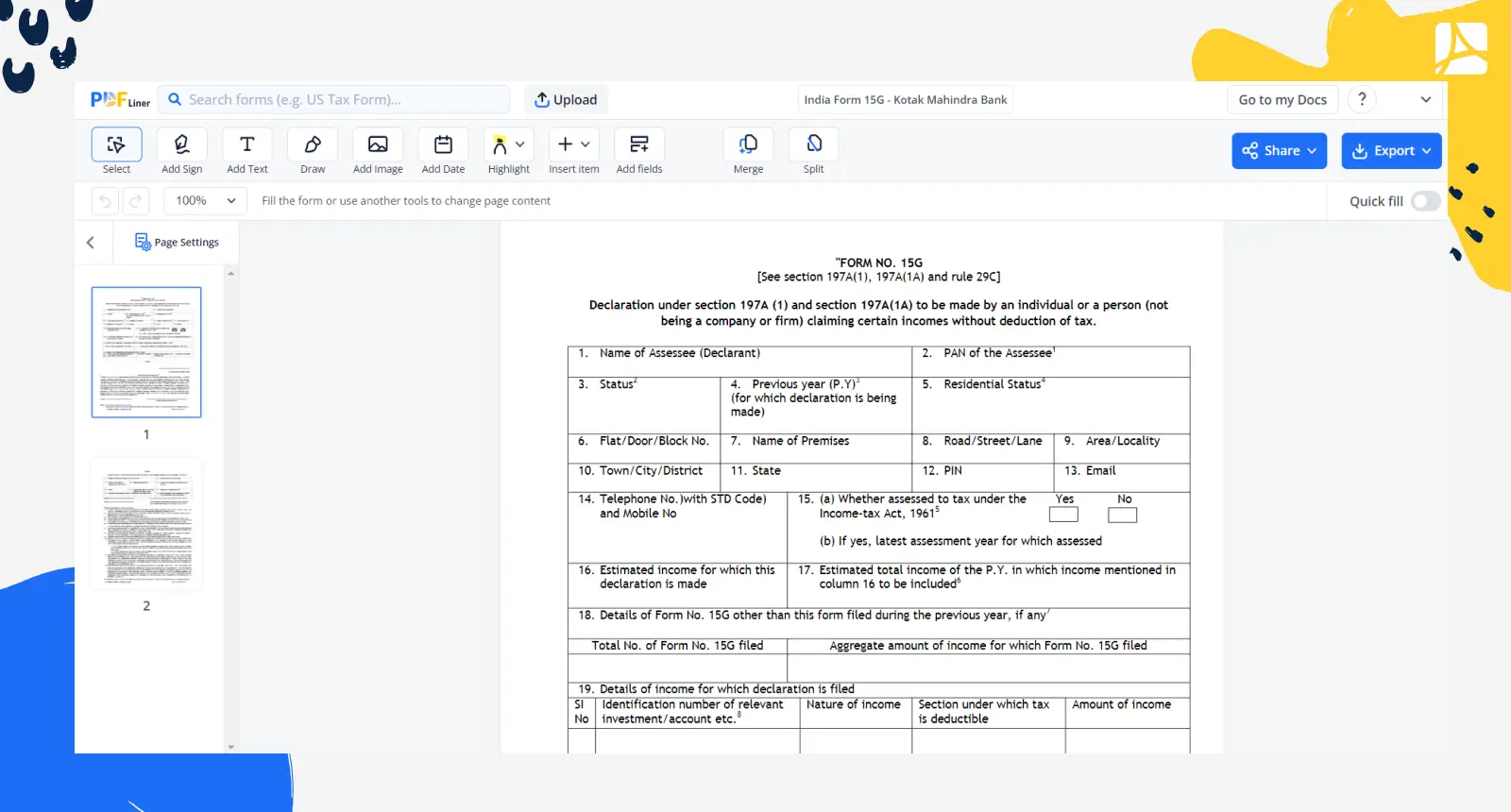

Form 15g Kotak Mahindra Bank Fill Out Sign Online Doc Vrogue Co Form 15g and 15h are self declaration forms to be filed and submitted by individuals to ensure that the banks or financial institutions do not deduct tds on the interest income earned accrued in a financial year as their estimated total income will be below the basic exemption limit (i.e., ₹2,50,000 or ₹3,00,000 or ₹5,00,000, as applicable) and there is no tax liability in that. How to fill form 15g and 15h ★ filled form 15g sample ★ form 15h sample 176 comments fixed income , investment plan , saving account by amit march 30, 2021 form 15g and form 15h are self declaration forms which can be submitted to banks and other institutions to avoid tax deduction at source (tds) by banks on fixed and recurring deposit. In case of sbi fixed deposit, if you wish to submit the forms in the sbi bank offline, here are the links to download form 15g and form 15h . here are the steps to submit the form 15g or 15h in. Go to e file > upload form 15g 15h. select the form name either form 15g or form 15h, financial year, quarter and the filing type. click validate. once the details are validated, the following screen is displayed. browse and attach the zip file and signature file. zip file and signature file can be generated from the dsc management utility.

Form 15g Kotak Mahindra Bank Fill Out Sign Online Doc Vrogue Co In case of sbi fixed deposit, if you wish to submit the forms in the sbi bank offline, here are the links to download form 15g and form 15h . here are the steps to submit the form 15g or 15h in. Go to e file > upload form 15g 15h. select the form name either form 15g or form 15h, financial year, quarter and the filing type. click validate. once the details are validated, the following screen is displayed. browse and attach the zip file and signature file. zip file and signature file can be generated from the dsc management utility.

15g Sample Form Fill Online Printable Fillable Blank Vrogue Co

Comments are closed.