Fers Pension Deductions How Much Money Will You Get In Retirement

Fers Retirement Pension Calculator All the things that get deducted from your fers pension. How to calculate your fers retirement pension.

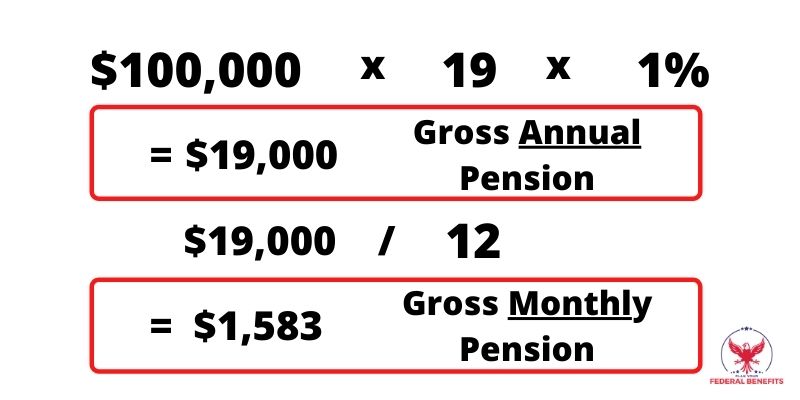

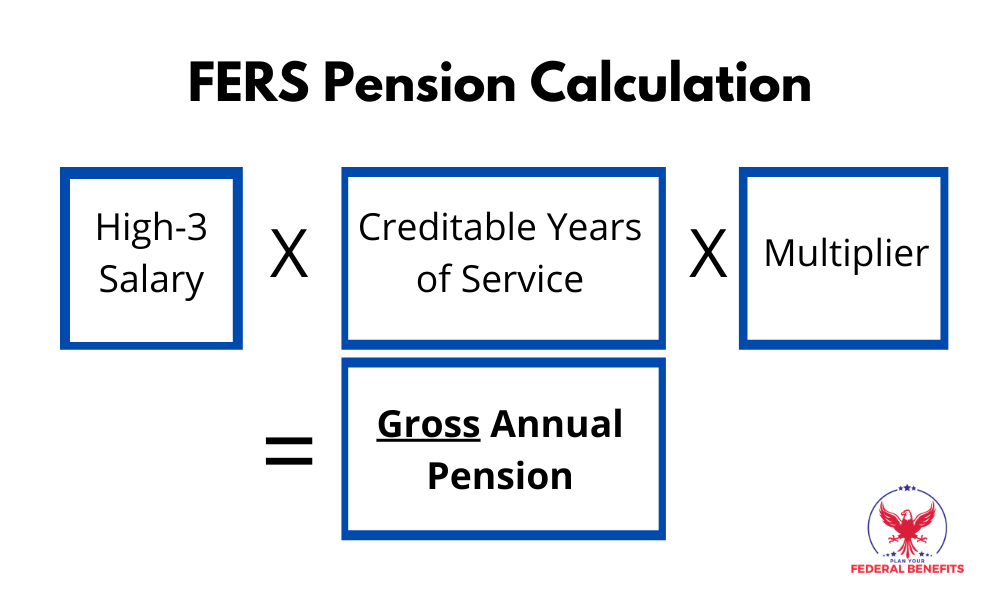

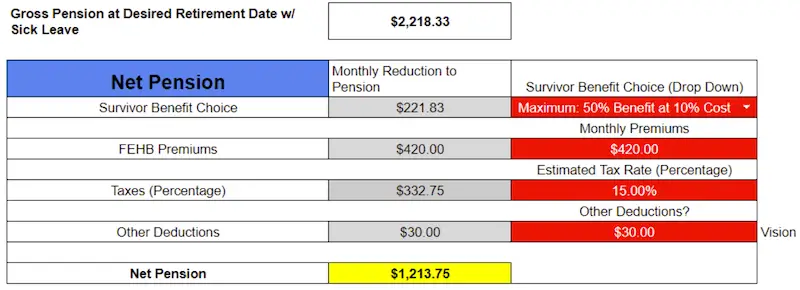

Fers Retirement Pension Calculator Fers contributions. In retirement, most fers are looking at a 10% to 20% tax rate for all that money. just make sure it’s planned so that you know exactly, month by month, how much you’d get from your pension. Fers pension = 1% x high 3 salary x years worked. * age 62 or older at separation with 20 or more years of service. fers pension = 1.1% x high 3 salary x years worked. this equals 1% – 1.1% of your highest annual salary for every year of federal service. you can max out your benefit with more than 30% of your pre retirement income covered. Fers disability benefits are computed in different ways depending on the annuitant’s age and amount of service at retirement. in addition, fers disability retirement benefits are recomputed after the first twelve months and again at age 62, if the annuitant is under age 62 at the time of disability retirement. fers disability computation if.

How Much Of Your Fers Pension Will The Government Take In Retirement Fers pension = 1% x high 3 salary x years worked. * age 62 or older at separation with 20 or more years of service. fers pension = 1.1% x high 3 salary x years worked. this equals 1% – 1.1% of your highest annual salary for every year of federal service. you can max out your benefit with more than 30% of your pre retirement income covered. Fers disability benefits are computed in different ways depending on the annuitant’s age and amount of service at retirement. in addition, fers disability retirement benefits are recomputed after the first twelve months and again at age 62, if the annuitant is under age 62 at the time of disability retirement. fers disability computation if. Fers information opm. For example, let’s say you paid $30,000 in the system during your career. if the government projects that you will have a 30 year retirement, that would mean that $1,000 dollars of your pension would not be taxable each year, so in most cases, about 95% to 98% of your pension is taxable. while i am not going to focus on it during this article.

Comments are closed.