Fico Score Vs Credit Score Is Credit Score The Same As

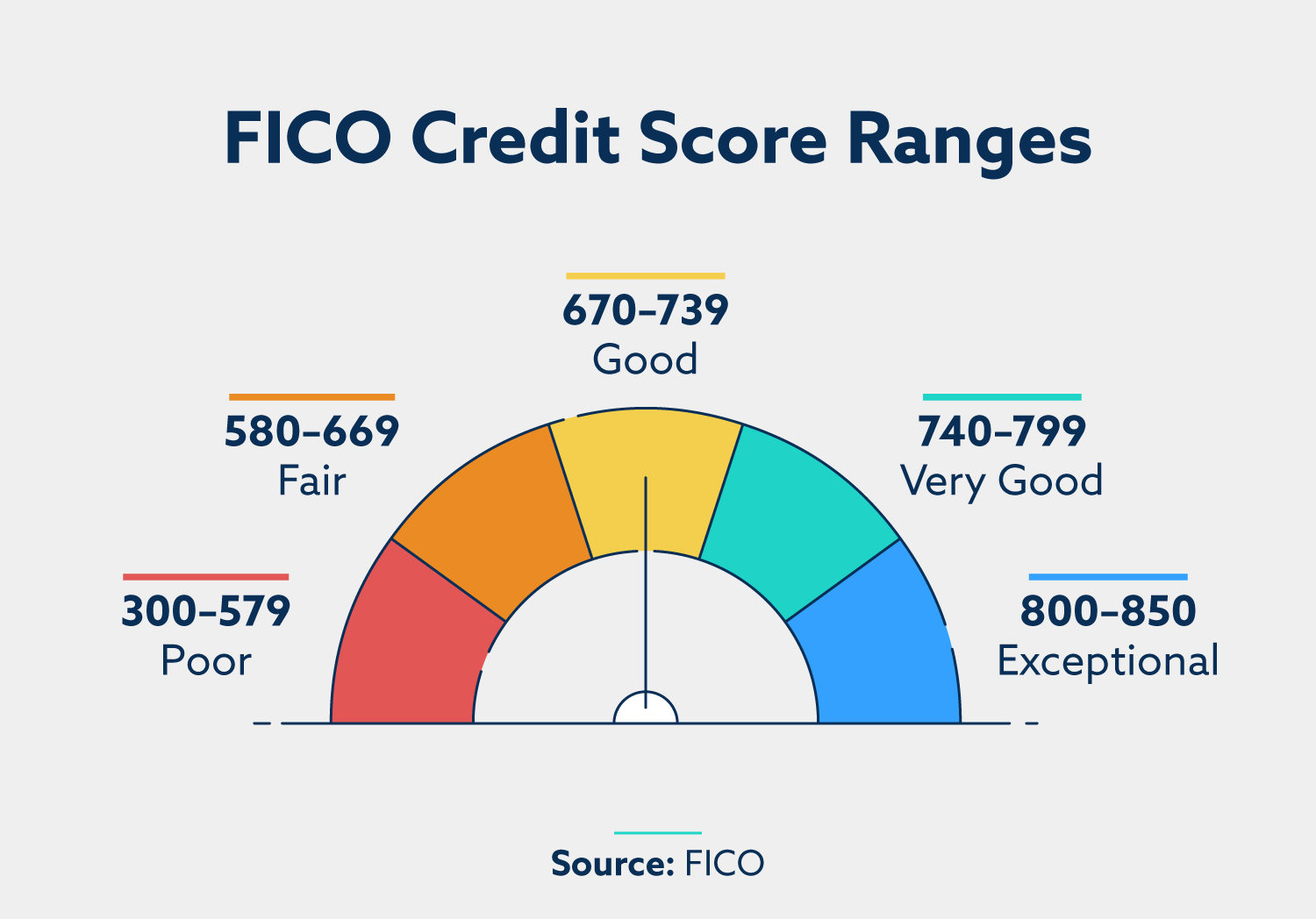

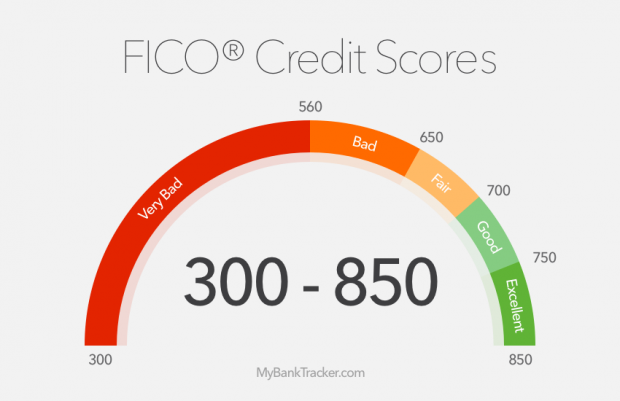

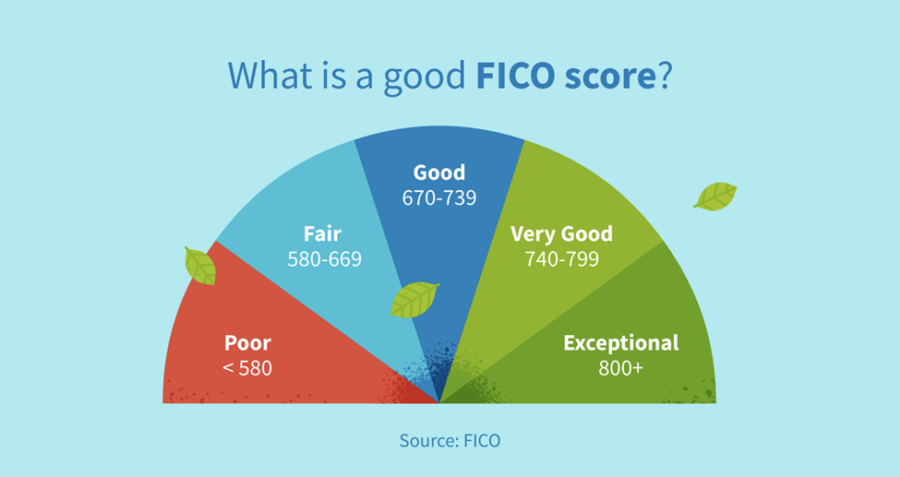

Credit Score Ranges What They Mean And Why They Matter Two main companies provide credit scores — FICO and VantageScore from opening new credit accounts around the same time can lower your score Not only are you more likely to be approved Jeff Rossen explains why credit scores differ across major credit agencies and offers tips on maintaining a good score

Ficoв Score Vs Credit Score Different Credit Scores One Pu Your credit score is a crucial financial tool that impacts your ability to borrow money, secure favorable interest rates, and even rent an apartment Understanding what affects your credit score There are two main credit-scoring models in the US, VantageScore and FICO Each evaluates consumers based on slightly different criteria and assigns a score that is typically between 300 and 850 Having great credit can be a more valuable tool than you think Find out how I've personally benefited from my own high credit score FICO and VantageScore weigh each factor differently, so your score will likely differ slightly In contrast, having too many of the same kind of credit account — such as credit cards

15 Credit Facts Everyone Needs To Know In 2021 Lexington Law Having great credit can be a more valuable tool than you think Find out how I've personally benefited from my own high credit score FICO and VantageScore weigh each factor differently, so your score will likely differ slightly In contrast, having too many of the same kind of credit account — such as credit cards If the same borrower has a credit score between 700 and 759, their rate would go up to 6187% That rate starts to rise precipitously as the score drops below 700, according to FICO: With a 640 A credit score of 800 or above is considered excellent and comes with the same benefits as a perfect 850 score Benefits of an 800 credit score include better credit offers, lower interest rates and Fortunately, many of the same ways you would improve your credit including student loans—is used to create a credit score FICO scores are the most commonly used type of credit score You're still evaluated on the same core factors — payment the best rates on your mortgage According to FICO, a borrower with a credit score of 760 can expect an interest rate of 647%

Whatтащs The юааdifferenceюаб юааbetweenюаб юааficoюаб юааscoreюаб юааvsюаб юааcreditюаб юааscoreюаб If the same borrower has a credit score between 700 and 759, their rate would go up to 6187% That rate starts to rise precipitously as the score drops below 700, according to FICO: With a 640 A credit score of 800 or above is considered excellent and comes with the same benefits as a perfect 850 score Benefits of an 800 credit score include better credit offers, lower interest rates and Fortunately, many of the same ways you would improve your credit including student loans—is used to create a credit score FICO scores are the most commonly used type of credit score You're still evaluated on the same core factors — payment the best rates on your mortgage According to FICO, a borrower with a credit score of 760 can expect an interest rate of 647% Your credit utilization determines 30% of your credit score Learn more about this scoring factor, and how to keep credit utilization from harming your credit Updated August 30, 2024, 4:41 PM EDT If you have a 600 FICO score, you're considered a fair credit borrower About 166% of Americans are in the same boat, according to Experian A fair credit

юааficoюаб юааscoreюаб юааvsюаб юааcreditюаб юааscoreюаб Whatтащs The юааdifferenceюаб Creditrepair Fortunately, many of the same ways you would improve your credit including student loans—is used to create a credit score FICO scores are the most commonly used type of credit score You're still evaluated on the same core factors — payment the best rates on your mortgage According to FICO, a borrower with a credit score of 760 can expect an interest rate of 647% Your credit utilization determines 30% of your credit score Learn more about this scoring factor, and how to keep credit utilization from harming your credit Updated August 30, 2024, 4:41 PM EDT If you have a 600 FICO score, you're considered a fair credit borrower About 166% of Americans are in the same boat, according to Experian A fair credit

Comments are closed.