Fico Score Vs Credit Score Top 6 Differences Similarities

Fico Score Vs Credit Score Top 6 Differences Similarities Another major difference is how long it takes to generate a credit score. while fico needs at least 6 months of data before it can generate a credit score, you just need a month of data — such as a full payment cycle on a new credit card — to generate a vantagescore credit score. Fico is a brand name for the credit scoring model. credit bureaus use it for a borrower’s credit rating. on the other hand, a credit score is a parameter of the creditworthiness of an individual, which banks, companies, lenders, and borrowers calculate using a credit rating tool like fico. hence, fico comes after the lenders request.

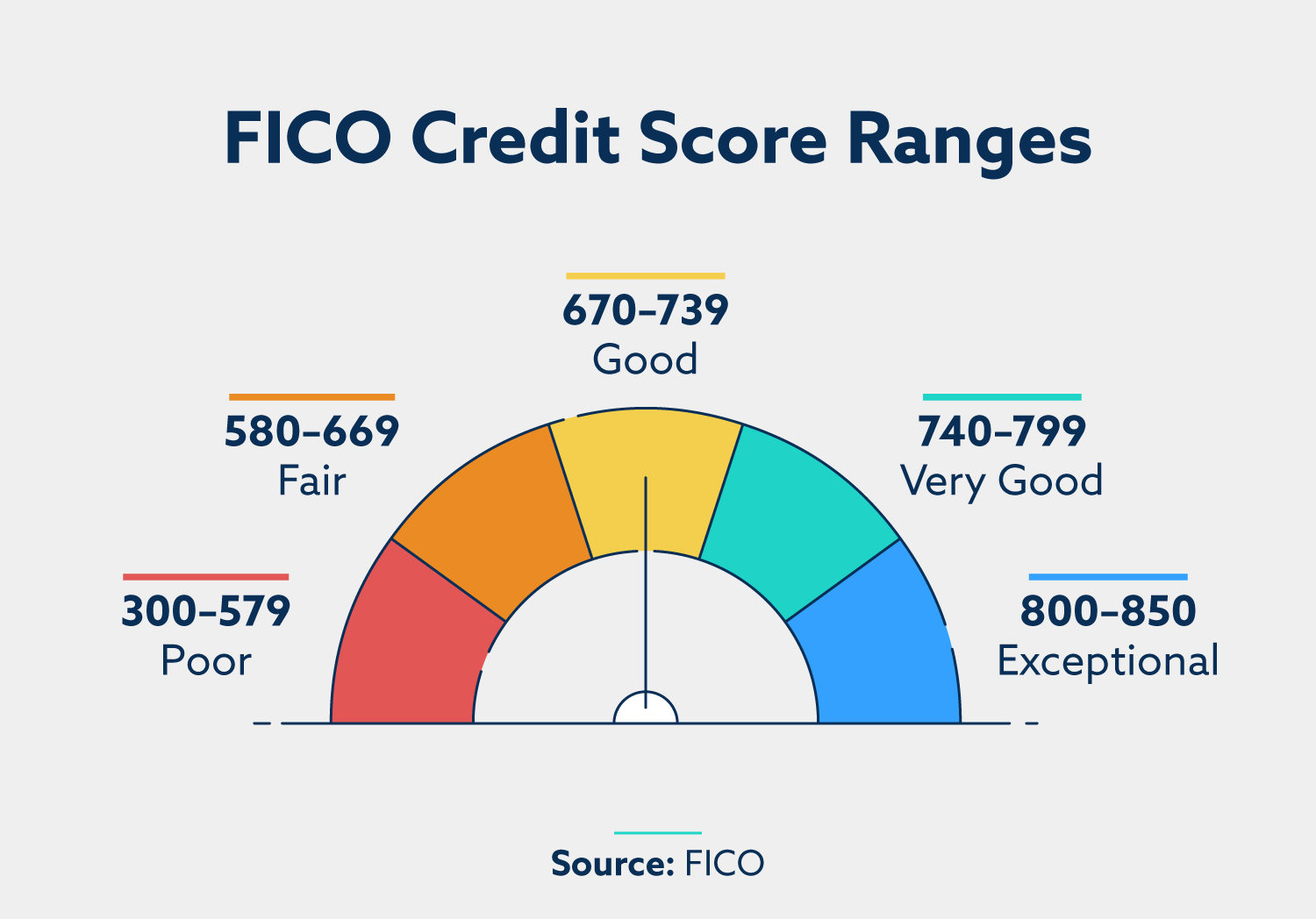

Fico Score Vs Credit Score Top 6 Differences Similarities Fico defines the following credit ranges based on fico® score 8 credit scores: exceptional: 800 . very good: 740 to 799. good: 670 to 739. fair: 580 to 669. poor: 579 and below. industry specific fico® scores — including fico® auto score 8 and fico® bankcard score 8 — have a broader range of 250 to 900. New credit (10%): the number of new credit accounts on your credit reports will have an effect on your fico score. too many new accounts or new inquiries in a short period of time may also be a. 2. you can make more informed financial decisions. with fico scores, you're better prepared to know when to apply for credit because you're viewing the scores used by 90% of the top lenders. remember, non fico credit scores can differ by as much as 100 points. other credit scores may vary from your fico score by several points. Fico ® and vantagescore credit scores range from 300 to 850, and group consumers by credit scoring ranges. for example, a fico ® score of 800 to 850 is considered "exceptional." however, even if they use the same range and information from the same credit report, each scoring model takes a unique approach that may result in a different score.

юааficoюаб юааscoreюаб юааvsюаб юааcreditюаб юааscoreюаб Whatтащs The юааdifferenceюаб 2. you can make more informed financial decisions. with fico scores, you're better prepared to know when to apply for credit because you're viewing the scores used by 90% of the top lenders. remember, non fico credit scores can differ by as much as 100 points. other credit scores may vary from your fico score by several points. Fico ® and vantagescore credit scores range from 300 to 850, and group consumers by credit scoring ranges. for example, a fico ® score of 800 to 850 is considered "exceptional." however, even if they use the same range and information from the same credit report, each scoring model takes a unique approach that may result in a different score. Getty images. a credit score is a three digit number that tells lenders how likely you are to pay your credit obligations. a fico® score is a type of credit risk score, much like coca cola® is a. Here are the fico® score 8 ranges [2]: excellent: 800 and above. very good: 740 – 799. good: 670 – 739. fair: 580 – 669. poor: 579 and below. while credit scores are based on your credit history, lenders typically base their decisions to approve (or not approve) a borrower on more than credit scores.

15 Credit Facts Everyone Needs To Know In 2021 Lexington Law Getty images. a credit score is a three digit number that tells lenders how likely you are to pay your credit obligations. a fico® score is a type of credit risk score, much like coca cola® is a. Here are the fico® score 8 ranges [2]: excellent: 800 and above. very good: 740 – 799. good: 670 – 739. fair: 580 – 669. poor: 579 and below. while credit scores are based on your credit history, lenders typically base their decisions to approve (or not approve) a borrower on more than credit scores.

юааficoюаб юааscoreюаб юааvsюаб юааcreditюаб юааscoreюаб Whatтащs The юааdifferenceюаб Lendingtree

Comments are closed.