Financial Technology Mobile Banking Seen To Overtake Internet Banking

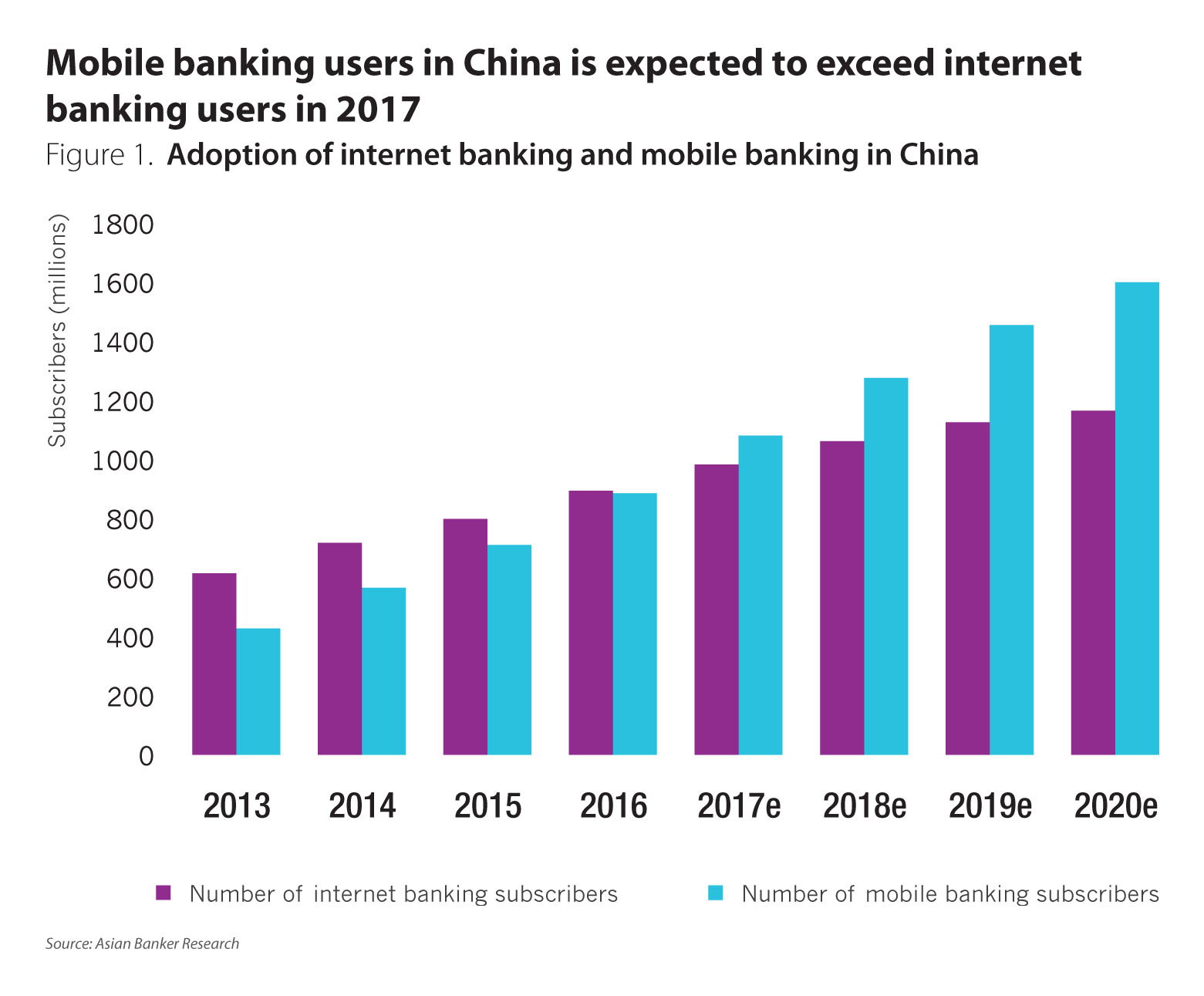

Mobile Banking Seen To Overtake Internet Banking The Asian Ba Joint stock commercial banks have seen faster growth in mobile banking users. the number of mobile banking subscribers in china minsheng bank corporation (cmbc) and china merchant bank (cmb) surged by 65% and 39% annually between 2013 and 2016, respectively. digital banking is witnessing phenomenal growth in rural china. Mobile banking to overtake internet banking in most developed markets, internet banking has reached near saturation levels and banks have been focusing more on mobile banking in recent years. an increasing number of consumers have shifted most of their transactions to mobile banking , and thus some banks have seen a decrease in the use of internet banking.

Financial Technology Mobile Banking Seen To Overtake Internet Banking “to me financial technology (fintech) is more of the digitisation trend helping to reduce costs and it will be very much the branch costs. the atm costs are lesser than (operating the) branch costs while internet banking costs the least. between internet banking and mobile banking, internet banking is (still) the least because of the sheer. 3. cloud computing will liberate financial services players. mckinsey research shows that by 2030, cloud technology will account for ebitda (earnings before interest, tax, depreciation and amortization) in excess of $1 trillion across the world’s top 500 companies. our research shows that effective use of the cloud can increase the efficiency. Nitin chugh, head of digital banking at hdfc bank, tells bhavik nair in an interview that in the next two to three years, mobile banking is expected to overtake internet banking users. The development of financial technology (fintech) in areas such as mobile internet, cloud computing, big data, search engines, and blockchain technology have significantly changed the financial industry. fintech is expected to overturn the traditional banking business model, forcing banks to upgrade and transform.this study adopts a comparative case study method to contrast and analyze the.

How Mobile Technology Benefits The Banking Finance Industry Latest Nitin chugh, head of digital banking at hdfc bank, tells bhavik nair in an interview that in the next two to three years, mobile banking is expected to overtake internet banking users. The development of financial technology (fintech) in areas such as mobile internet, cloud computing, big data, search engines, and blockchain technology have significantly changed the financial industry. fintech is expected to overturn the traditional banking business model, forcing banks to upgrade and transform.this study adopts a comparative case study method to contrast and analyze the. Presently, on hdfc bank’s internet banking platform a customers can do 175 different types of transactions while on mobile banking 80 different type of transactions are enabled. the iwatch app enables customers to do ten different types of transactions such as viewing the account balance, recharging mobile and dth, hotlist debit card and requesting cheque book. With improvements in financial technology, however, money can be stored digitally, lenders and investors can source funds directly over the internet, and money transfer can be done digitally. a review of financial technology and banking literature is provided by thakor . he highlights that financial service companies are now being provided by.

Main Differences Between Digital Banking Online Banking Presently, on hdfc bank’s internet banking platform a customers can do 175 different types of transactions while on mobile banking 80 different type of transactions are enabled. the iwatch app enables customers to do ten different types of transactions such as viewing the account balance, recharging mobile and dth, hotlist debit card and requesting cheque book. With improvements in financial technology, however, money can be stored digitally, lenders and investors can source funds directly over the internet, and money transfer can be done digitally. a review of financial technology and banking literature is provided by thakor . he highlights that financial service companies are now being provided by.

Revolutionary Financial Technology Of Internet Banking Technology

Comments are closed.