Form 15g For Pf Withdrawal How To Fill Form 15g For Pf Withdrawal Epfo Form 15g Kaise Bhare

How To Fill Form 15g For Pf Withdrawal If you are wondering how to fill out form 15g for pf withdrawal, follow the steps given below: firstly, log in to the epfo uan portal. then, select ‘online services’ and click on ‘claim’. for verification, enter your bank account number and click on ‘verify’. press on ‘upload form 15g’ below the ‘i want to apply for’ option. Form 15g is mandatory if you want to avoid deduction from the pf withdrawal amount. according to section 192a of the finance act 2015, pf withdrawal attracts tds if the withdrawal amount exceeds rs.50,000, and your employment tenure is less than 5 years.

Form 15g Filled Form 2023 Printable Forms Free Online Know how to fill form 15g for pf withdrawal in 2021 22, and how to submit form 15g in the pf portal online.download form 15g: incometaxindia.gov . Step 3: mention financial details: enter your assessment year (usually the financial year for which you are submitting the form). mention your estimated total income for the financial year. declare the total income for which this declaration is being made, including epf withdrawal. Step 1: log in to the epfo uan portal, click on the ‘online services’ option and select ‘claim’. step 2: now, you need to enter the last 4 digits of your registered bank account for verification. step 3: search for the “upload form 15g” option to obtain the form downloaded on your desktop or mobile. No, form 15g is not mandatory for pf withdrawal. however, if the total amount of pf withdrawal is more than rs. 50,000 and the individual has not completed five years of continuous service, tds will be deducted at the rate of 10% if pan is provided. use our pf calculator to estimate your savings.

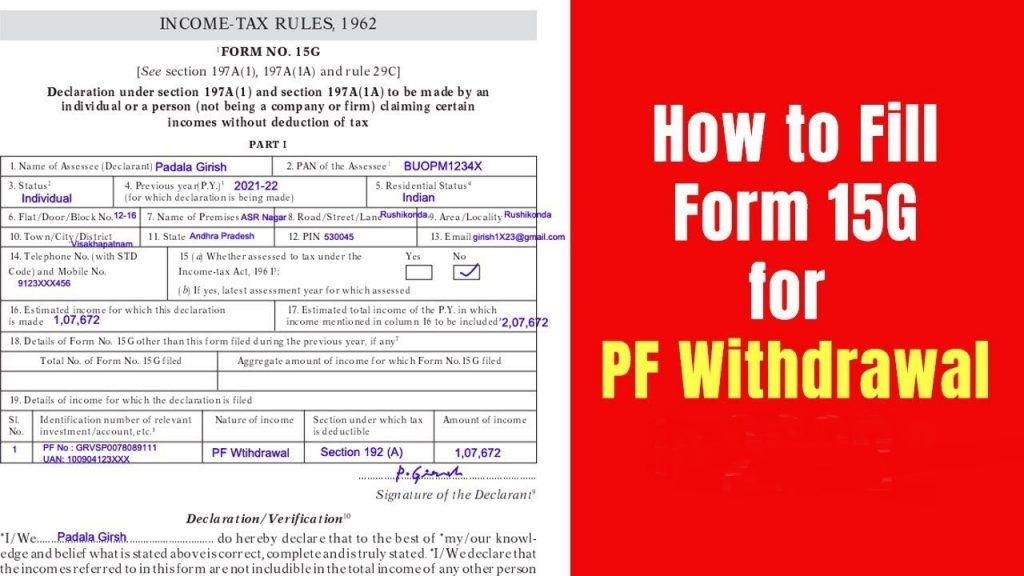

Where To Submit Form 15g For Pf Withdrawal Online Printable Forms Step 1: log in to the epfo uan portal, click on the ‘online services’ option and select ‘claim’. step 2: now, you need to enter the last 4 digits of your registered bank account for verification. step 3: search for the “upload form 15g” option to obtain the form downloaded on your desktop or mobile. No, form 15g is not mandatory for pf withdrawal. however, if the total amount of pf withdrawal is more than rs. 50,000 and the individual has not completed five years of continuous service, tds will be deducted at the rate of 10% if pan is provided. use our pf calculator to estimate your savings. Form 15g for pf withdrawal – a step by step process. let’s understand how to fill form 15g for online epf withdrawal: step 1: log in to epfo unified portal for members. step 2: visit the ‘online services’ section. step 3: go to ‘claim (form 31, 19, 10c &10d)’ from the drop down menu. The first part is meant for individuals who want to claim no deduction of tds on certain incomes. the following are the fields you need to fill out in the first segment of form 15g: field (1) name of the assessee (declarant) – name as mentioned on your pan card. field (2) pan of the assessee: valid pan card is mandatory to file form 15g.

Download Form 15g For Pf Withdrawal 2023 Printable Forms Free Online Form 15g for pf withdrawal – a step by step process. let’s understand how to fill form 15g for online epf withdrawal: step 1: log in to epfo unified portal for members. step 2: visit the ‘online services’ section. step 3: go to ‘claim (form 31, 19, 10c &10d)’ from the drop down menu. The first part is meant for individuals who want to claim no deduction of tds on certain incomes. the following are the fields you need to fill out in the first segment of form 15g: field (1) name of the assessee (declarant) – name as mentioned on your pan card. field (2) pan of the assessee: valid pan card is mandatory to file form 15g.

Comments are closed.