Forsyths Accounting Financial Services Audit Payg Instalment

Forsyths Accounting Financial Services Audit Payg Instalment Payg instalments is a system that helps you manage your expected tax liability on income from your business or investments for the current income year by making smaller regular payments. to assist taxpayers experiencing financial difficulty as a result of covid 19, the ato is providing added flexibility to manage your instalments to suit your. The good news is that you can vary your instalments so the amount you prepay is closer to your expected tax for the year. if you pay payg instalments using the instalment dollar amount provided by the ato (option 1 on your activity statement), you may want to vary if there has been a significant change in your instalment income this year. you.

Forsyths Accounting Financial Services Audit Varying Payg After cancelling the abn, it will pay to keep in mind that you may have a payg instalment obligation through to the date of ceasing business, and may still receive instalment activity statements. you are able to vary your payg instalment amount if the amount or rate the ato calculated doesn’t reflect your circumstances. step 5: record keeping. The annual installment is a single, lump sum payment of your payg liability for the year. for more information see the payg annual installment fact sheet. if your company is not eligible to pay an annual installment, you can pay payg installments quarterly. each quarter the ato will send you an activity statement. Here we will use three 2020 tax lodgement scenarios; lodged 31 july 2020, lodged 31 january 2020 and lodged 15 may 2021. lodgement date: 31 july 2020 (as lodged by tax agent) quarter. employee x. september 2020 paygi payable 28 october 2020. $2,317.50. Taxpayers are automatically required to pay payg instalments if: for an individual, they have: business and investment income in their most recent tax return of $4,000 or more. tax payable on their latest notice of assessment of $1,000 or more, and. estimated tax for the current income year of $500 or more. for a company, they either:.

Forsyths Accounting Financial Services Audit Covid 19 And Smsf Here we will use three 2020 tax lodgement scenarios; lodged 31 july 2020, lodged 31 january 2020 and lodged 15 may 2021. lodgement date: 31 july 2020 (as lodged by tax agent) quarter. employee x. september 2020 paygi payable 28 october 2020. $2,317.50. Taxpayers are automatically required to pay payg instalments if: for an individual, they have: business and investment income in their most recent tax return of $4,000 or more. tax payable on their latest notice of assessment of $1,000 or more, and. estimated tax for the current income year of $500 or more. for a company, they either:. Forsyths accountants mackay offer financial services,accounting, taxation, bas preparation, tax planning, business advice, bookkeeping. call us today. reception@forsythsmackay .au (07) 4953 1099. Payg instalments: what you need to know. payg (pay as you go) instalments provide individuals with a convenient method to pay their taxes throughout the year, rather than facing a large tax bill at the end of the financial year. this approach helps in managing cash flow, avoiding financial strain, and facilitating better budgeting for tax.

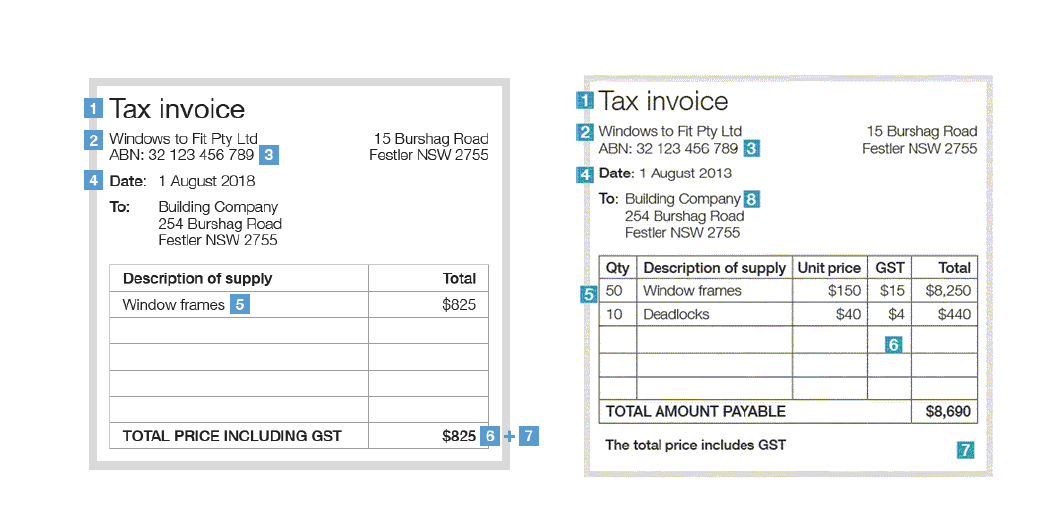

Forsyths Accounting Financial Services Audit Fending Off Gst Audits Forsyths accountants mackay offer financial services,accounting, taxation, bas preparation, tax planning, business advice, bookkeeping. call us today. reception@forsythsmackay .au (07) 4953 1099. Payg instalments: what you need to know. payg (pay as you go) instalments provide individuals with a convenient method to pay their taxes throughout the year, rather than facing a large tax bill at the end of the financial year. this approach helps in managing cash flow, avoiding financial strain, and facilitating better budgeting for tax.

Comments are closed.