Forward Contract Meaning Features Advantages And Risks

Forward Contract Meaning Features Advantages And Risks Reshaping Forward contract: how to use it, risks, and example. The following are the essential features of a forward contract –. these are not standardized and are not traded on a stock exchange. also, the parties can make changes in the agreement with regard to the underlying assets, amount and delivery date. thus, they are customizable. the parties can settle these contracts in one of the ways.

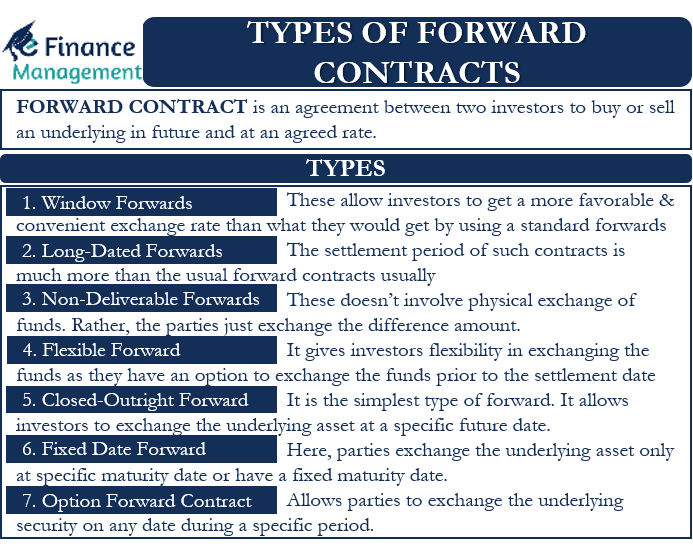

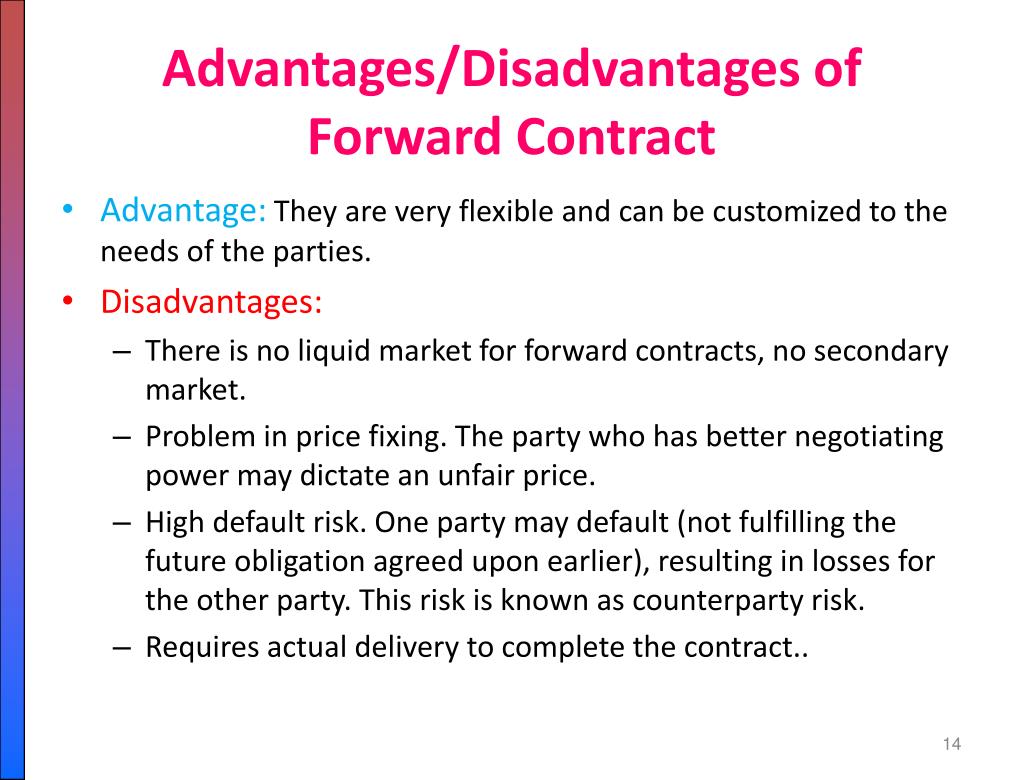

Types Of Forward Contracts вђ All You Need To Know What is a forward contract? definition, pros and cons. A forward contract is a financial agreement between two parties to buy or sell a specific asset at a fixed price and date in the future. it is a derivatives asset with underlying security which can be stocks, market indices, commodities, foreign currency, etc. this contract also has a specific size that denotes the number of asset units being. Features of forward contract. the basic features of forward contract are given in brief here as under: bilateral. riskier than futures. customized contracts. long and short positions. delivery price. synthetic assets. pricing of arbitrage based forward prices. Forward contracts offer several key features that make them popular in financial markets. one of the main advantages of these contracts is the ability to customise the terms according to the needs of the parties involved. unlike standardised futures contracts, they allow for asset, quantity, price, and delivery date flexibility.

Ppt Chapter 7 Powerpoint Presentation Free Download Id 2369105 Features of forward contract. the basic features of forward contract are given in brief here as under: bilateral. riskier than futures. customized contracts. long and short positions. delivery price. synthetic assets. pricing of arbitrage based forward prices. Forward contracts offer several key features that make them popular in financial markets. one of the main advantages of these contracts is the ability to customise the terms according to the needs of the parties involved. unlike standardised futures contracts, they allow for asset, quantity, price, and delivery date flexibility. A forward contract is a type of derivative. a derivative is an investment contract between two or more parties whose value is tied to an underlying asset or set of assets. for example, commodities, foreign currencies, market indexes and individual stocks can all be underlying assets for derivatives. in a forward contract, the buyer and seller. Forward contracts vs. futures contracts: what's the.

Comments are closed.