Free File Fillable Forms Non Resident Printable Forms Free On

Free File Fillable Forms Non Resident Printable Formsођ Create your account. select “start fillable forms now” from the free file landing page. once at the free file fillable forms landing page, select “start free file fillable forms.”. even if you used this program in previous years, if you have not created an account for the current tax year, you need to “create an account” for this. After you submit your return, you will receive an email from customer service@freefilefillableforms , that the irs accepted your federal return. if your return is not accepted before the application closes, print and mail it. page last reviewed or updated: 27 aug 2024. a few "must knows" for taxpayers to learn before starting the free file.

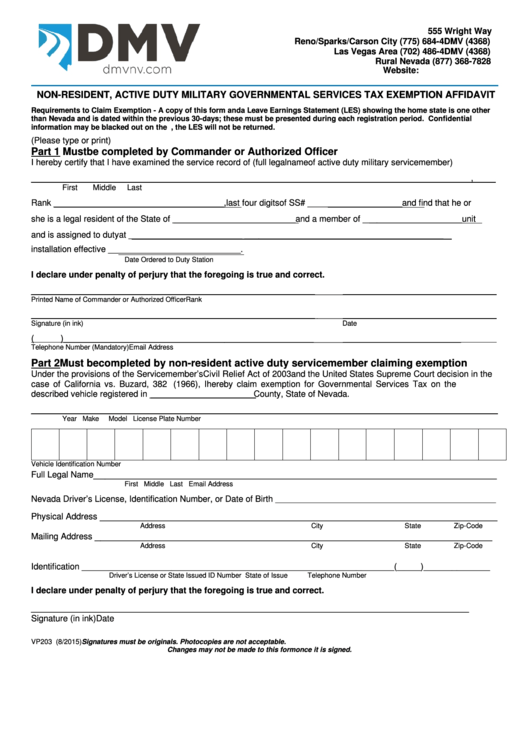

Fillable Form Vp 203 Non Resident Active Duty Military Governmental Irs free file lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software. it’s safe, easy and no cost to you. those who don’t qualify can still use free file fillable forms. file an extension: no matter your income, you can file an extension with a trusted irs free file partner. It 201 v (fill in) instructions on form. payment voucher for income tax returns. it 203 (fill in) it 203 i (instructions) nonresident and part year resident income tax return; description of form it 203. this is the only return for taxpayers who are nonresidents or part year residents of new york state, whether they are itemizing their. No matter your income level, you can use free file fillable forms for your federal tax return. these are identical to irs paper forms, so this option is like the old “pencil and calculator” method of filing. however, the fillable forms don’t come with any additional guidance. if you plan to use this option, you should be comfortable with. Earned income tax credit (eitc) the earned income tax credit (eitc) is a refundable tax credit for low to moderate income working individuals and families. taxpayers who earned less than $60,000 in 2023 may qualify for eitc. and adjusted gross income (agi) must each be less than: if filing single, head of household or widowed:.

Comments are closed.