Get Your Free Copy Of Rental Property Investment 3 In 1 Va

Solved Deduction For The Rental Properties For The Current Chegg Va loans for investment property. va loans are intended to be the buyers' primary residence. however, under certain circumstances, you may be able to use a va loan for rental property. published on january 7, 2021. potential homebuyers are often drawn to the appeal of using their va home loan benefit on an investment property. Traditionally, it guarantees 25% of your total loan amount up to $144,000. but that doesn’t actually limit your potential entitlement. it just means that the va’s maximum guarantee for loans up to and under $144,000 is $36,000. there’s additional, or bonus, entitlement for loans exceeding that amount.

Solved Invest In A Rental House Property Assume That You Chegg Mixed use property and va loans. a mixed use property is a building that is zoned for both residential and commercial use. these types of properties can pose a unique advantage to veterans. however, it’s important to note the commercial space cannot exceed 25 percent of the total square footage. limitations on the size of the commercial space. Follow the steps below to get your primary residence pulling double duty as a real estate investment property. 1. make sure you meet eligibility requirements. the first step you’ll need to take before applying for a va loan is to make sure you meet at least one of the following va eligibility requirements:. The u.s. department of veterans affairs does not originate, but backs va home loans. benefits of using a va loan for investment property include no down payment and no minimum credit score, although the issuing lender may impose credit score requirements. a va loan can be used to finance the purchase of a single family home or a multifamily. Using a va loan to purchase a home and later turning it into a rental property can be a viable financial strategy for veterans. it's important to note the benefits and limitations of renting with a va loan to ensure you are well informed before proceeding with this investment route. talk with a veterans united loan officer at 855 259 6455 if.

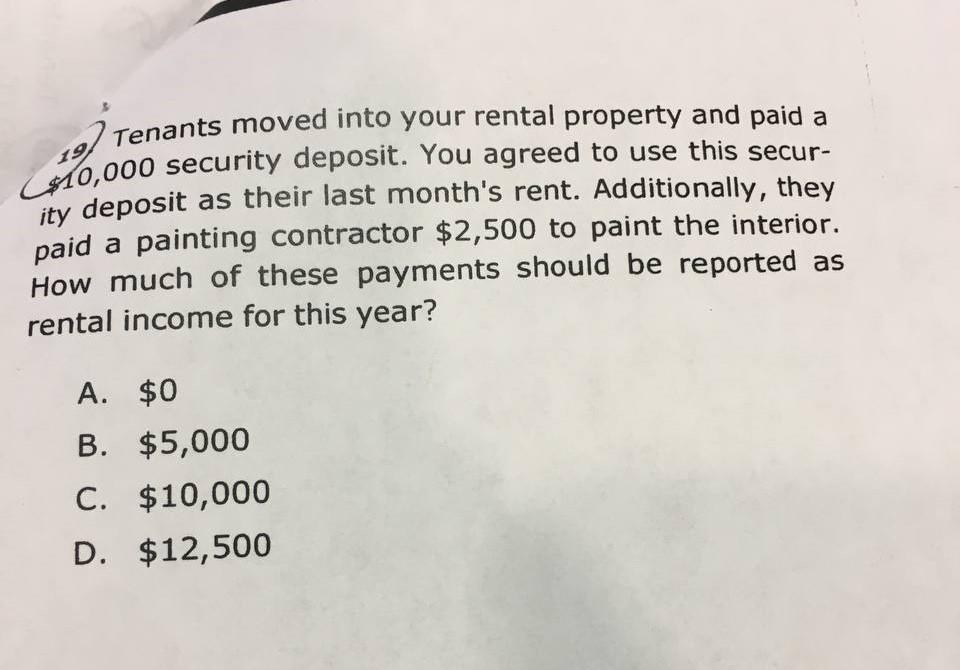

Solved Tenants Moved Into Your Rental Property And Paid A Chegg The u.s. department of veterans affairs does not originate, but backs va home loans. benefits of using a va loan for investment property include no down payment and no minimum credit score, although the issuing lender may impose credit score requirements. a va loan can be used to finance the purchase of a single family home or a multifamily. Using a va loan to purchase a home and later turning it into a rental property can be a viable financial strategy for veterans. it's important to note the benefits and limitations of renting with a va loan to ensure you are well informed before proceeding with this investment route. talk with a veterans united loan officer at 855 259 6455 if. Va loan rental property: experience required. if you are looking to use the va loan for investment property, and want to get into the rental properties business as a landlord, but don’t have experience; think again. the va requires you have rental management experience if you are going to buy a multifamily unit or rent a previous residence. A 1 – 4 unit property. a va loan can be used to purchase any of these types of homes: a single unit home, a duplex, a triplex or a quadplex. if you’re looking to buy an investment property with a va loan, your best bet is a duplex or other multifamily home style. as long as you live in one of the units while renting out the other units, the.

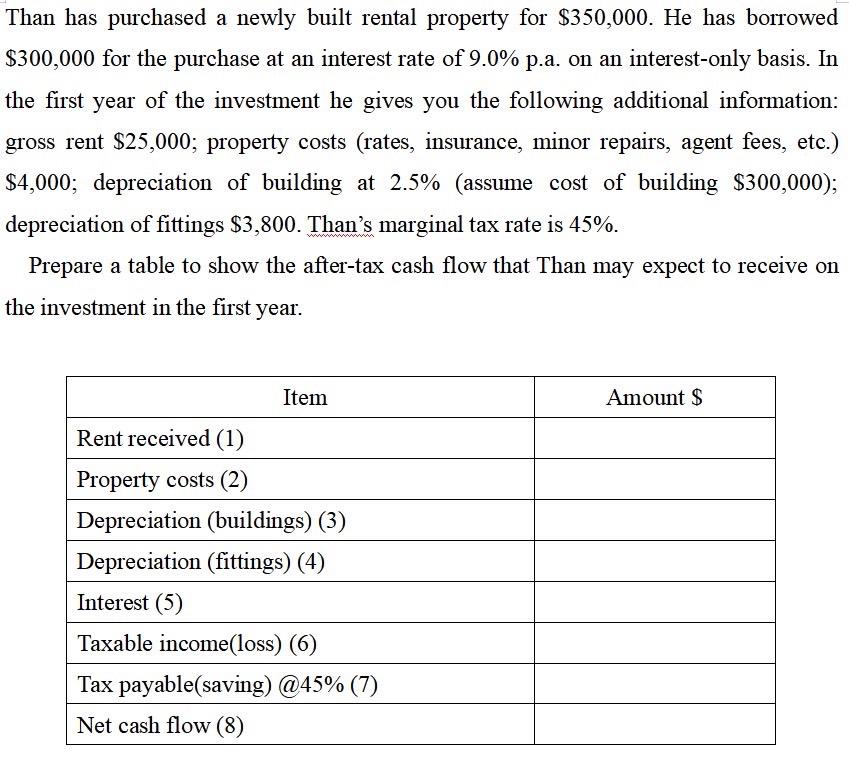

Solved Than Has Purchased A Newly Built Rental Property For Chegg Va loan rental property: experience required. if you are looking to use the va loan for investment property, and want to get into the rental properties business as a landlord, but don’t have experience; think again. the va requires you have rental management experience if you are going to buy a multifamily unit or rent a previous residence. A 1 – 4 unit property. a va loan can be used to purchase any of these types of homes: a single unit home, a duplex, a triplex or a quadplex. if you’re looking to buy an investment property with a va loan, your best bet is a duplex or other multifamily home style. as long as you live in one of the units while renting out the other units, the.

Solved Question 1 An Individual Acquires A Rental Property Chegg

Comments are closed.