Global Pharma Industry Growth Projected To Moderate In 2017 And Beyond

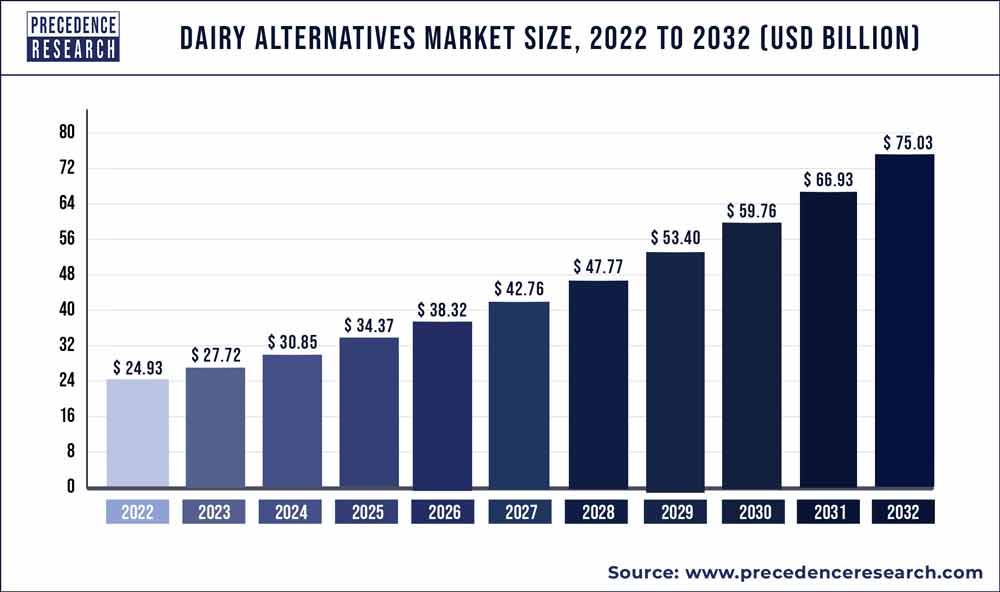

Dairy Alternatives Market Growth Report 2022 To 2030 Global pharma industry growth projected to moderate in 2017 and beyond total spending on medicines is forecast to reach $1.5 trillion by 2021, up 33% from 2016 levels even as annual growth moderates from the record pace set in 2014 and 2015. Projected global pharmaceutical sales for 2027, by region (in billion u.s. dollars) premium statistic global spending on medicines 2010 2027 global spending on medicines 2010 2027.

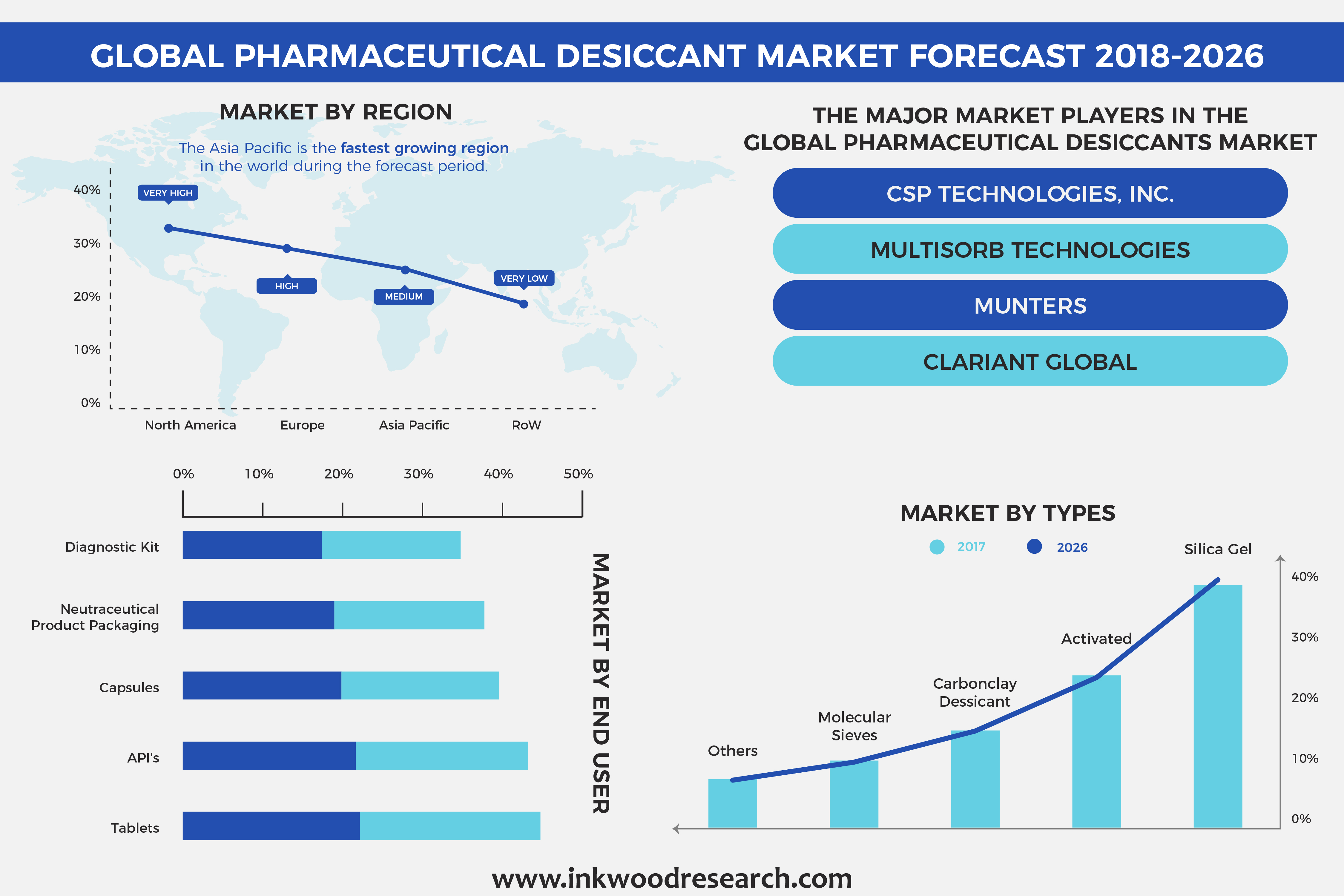

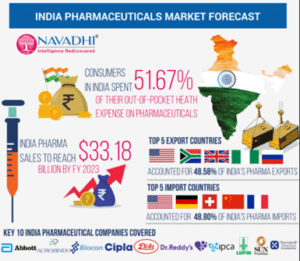

Continuous Growth In The Pharmaceutical Industry Is Fueling The Growth Dcat value chain insights examines the key developments to watch in 2017. a top 10 countdown for 2017. 1. global pharmaceutical industry growth moderates. as always, an overarching issue will be the performance of the global pharmaceutical industry, which is expected to see positive growth but at moderating levels in 2017 and beyond. total. But many pharma leaders see scaling these advanced technology plays beyond a handful of pilots as a challenge. tackling a few high value use cases in drug discovery or customer engagement helps, but the real opportunity is to reimagine the pharmaceutical company of the future, powered by intelligent technologies across the enterprise. Fifteen countries account for approximately 65% of the expected growth in these non core markets, which are projected to reach sales of $470 billion by 2026, up from $364 billion in 2022, representing a cagr of 6.6%, above the global cagr benchmark of 5.4% in this forecast period. key country contributors to growth in select regions are russia. The pharmaceutical sector is at a crossroads. in a heavily disrupted marketplace, characterized by shifting payer attitudes and patient empowerment, neither incremental adjustments nor steady evolution are likely to halt the decline of the traditional pharmaceutical business model. this paper looks ahead to a 2030 scenario to examine the trends.

5 Pharma Trends For 2023 Challenges And Opportunities In The Post Fifteen countries account for approximately 65% of the expected growth in these non core markets, which are projected to reach sales of $470 billion by 2026, up from $364 billion in 2022, representing a cagr of 6.6%, above the global cagr benchmark of 5.4% in this forecast period. key country contributors to growth in select regions are russia. The pharmaceutical sector is at a crossroads. in a heavily disrupted marketplace, characterized by shifting payer attitudes and patient empowerment, neither incremental adjustments nor steady evolution are likely to halt the decline of the traditional pharmaceutical business model. this paper looks ahead to a 2030 scenario to examine the trends. A 2019 deloitte study points out that while biopharma companies made significant r&d investments to innovate in the last 10 years, the returns declined significantly during that same period—from 10.1% to 1.8%. this represents an average decline of 0.83% per year. Today’s challenging environment. a healthy pharma sector produces positive outcomes for both patients and investors. over the last year, we’ve seen breakthroughs in vaccine development, cancer treatments, glp 1 drugs that are revolutionizing obesity management, gene therapy and gene editing technology for rare diseases and new treatments for complex diseases like alzheimer’s.

Pharma Sector Shift Focus From Volume To Value Universal Group Of A 2019 deloitte study points out that while biopharma companies made significant r&d investments to innovate in the last 10 years, the returns declined significantly during that same period—from 10.1% to 1.8%. this represents an average decline of 0.83% per year. Today’s challenging environment. a healthy pharma sector produces positive outcomes for both patients and investors. over the last year, we’ve seen breakthroughs in vaccine development, cancer treatments, glp 1 drugs that are revolutionizing obesity management, gene therapy and gene editing technology for rare diseases and new treatments for complex diseases like alzheimer’s.

Comments are closed.