Golden Rule Of Accounting Journal Entries Account For

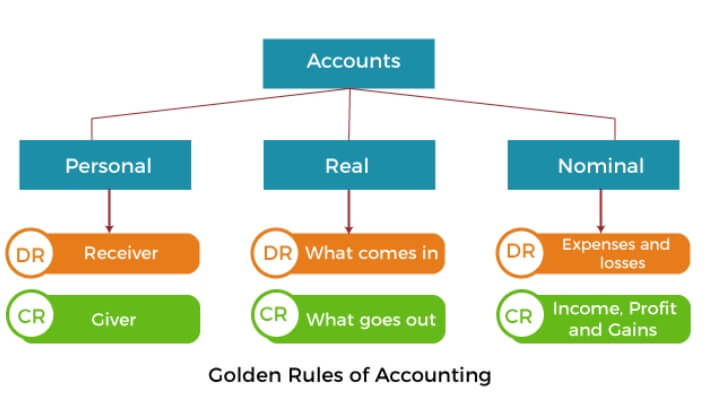

3 Golden Rules Of Accounting Explained Concepts Behind It Easy interpretation of 3 golden rules of accounting. real account. if the item (real account) is coming into the business then – debit. if the item (real account) is going out of business then – credit. personal account. if the person (or) legal body (or) group is receiving something – debit. Golden rules of accounting: overview and types.

3 Golden Rules Of Accounting With Example And Journal Entries What are the 3 golden rules of accounting? ( how to use. Take a look at the three main rules of accounting: debit the receiver and credit the giver. debit what comes in and credit what goes out. debit expenses and losses, credit income and gains. 1. debit the receiver and credit the giver. the rule of debiting the receiver and crediting the giver comes into play with personal accounts. Example 1 – golden rules. x purchases machinery using cash. two accounts are involved in this transaction – an asset (machinery) account and a cash account, which fall under the real account. therefore, the journal entry will be made based on the following rule:. The three golden rules of accounting. these three golden rules of accounting: debit the receiver and credit the giver; debit what comes in and credit what goes out; and debit expenses and losses credit income and gains, form the bedrock of double entry bookkeeping. they regulate the entry of financial transactions with precision and consistency.

Golden Rules Of Accounting Javatpoint Example 1 – golden rules. x purchases machinery using cash. two accounts are involved in this transaction – an asset (machinery) account and a cash account, which fall under the real account. therefore, the journal entry will be made based on the following rule:. The three golden rules of accounting. these three golden rules of accounting: debit the receiver and credit the giver; debit what comes in and credit what goes out; and debit expenses and losses credit income and gains, form the bedrock of double entry bookkeeping. they regulate the entry of financial transactions with precision and consistency. Balance sheet. the golden rules ensure that the accounting equation (assets = liabilities equity) remains balanced, providing a snapshot of a company’s financial health at any given time. real accounts follow the rule “debit what comes in, credit what goes out,” helping accurately record assets and liabilities. Golden rules of accounting types & examples.

Types Of Golden Rules Of Accounting Taxhelpdesk Balance sheet. the golden rules ensure that the accounting equation (assets = liabilities equity) remains balanced, providing a snapshot of a company’s financial health at any given time. real accounts follow the rule “debit what comes in, credit what goes out,” helping accurately record assets and liabilities. Golden rules of accounting types & examples.

Comments are closed.