How Bank Account Takeover Scams Work And Can Happen At Any Bank

How Bank Account Takeover Scams Work And Can Happen At Any Bank Youtube To help prevent this, plaid beacon offers a network based solution. when a fraudulent user is detected on any of the apps on the beacon network, it sends an alert to all of the other apps to let them know an identity is associated with stolen id, synthetic, or account takeover fraud. fintechs can use this to stop the chain reaction of fraud, as. Account takeover fraud occurs when cybercriminals gain access to your online accounts and use them to withdraw money, make purchases or extract information they can sell or use to access your other accounts. potential targets of account takeover fraud include social media and email accounts, as well as those you use to shop or handle bank and.

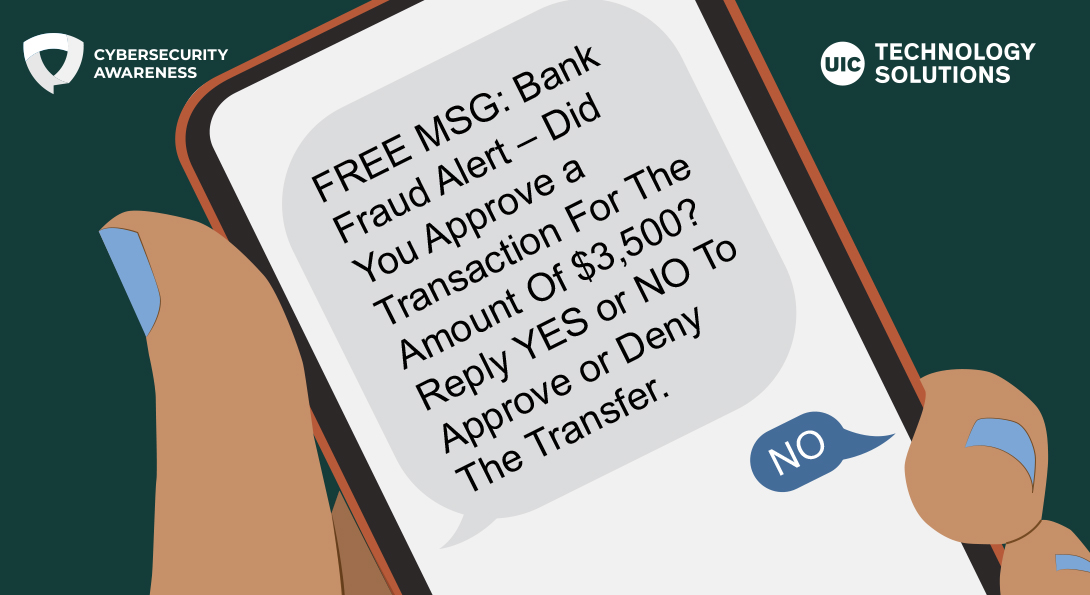

Beware Of A Text Scam Involving Fake Bank Fraud Alerts Information Fraudsters never sleep. among one of their many tactics: bank account takeover fraud. how it works. scammers will text a large number of consumers impersonating various banks and financial institutions to ask if you initiated a transfer or ask if you were making a purchase. it is a trick. don’t respond. In 2022, 22% of all u.s. adults fell victim to account takeover fraud – with average losses of $12,000 . ato has become a serious issue for millions of americans as well as businesses and financial institutions. once fraudsters gain access to a victim’s account, they can scam your contacts, drain your bank accounts, or steal your identity. Account takeover fraud is a form of identity theft where bad actors gain unlawful access to a user’s online accounts in order to commit financial crimes. this often involves the use of bots. information that enables account access can be compromised in a variety of ways. it might be purchased and sold on the dark web, captured through spyware. Recover the account. first, freeze the affected account (s) and force a password reset. alert the customer. next, alert the customer that their account has been taken over, but be careful about your language. words like “freezing” or “securing” accounts sound much better than words like “compromised” or “taken over. 9.

Top 9 Most Common Online Scams And How To Avoid Them Pnc Insights Account takeover fraud is a form of identity theft where bad actors gain unlawful access to a user’s online accounts in order to commit financial crimes. this often involves the use of bots. information that enables account access can be compromised in a variety of ways. it might be purchased and sold on the dark web, captured through spyware. Recover the account. first, freeze the affected account (s) and force a password reset. alert the customer. next, alert the customer that their account has been taken over, but be careful about your language. words like “freezing” or “securing” accounts sound much better than words like “compromised” or “taken over. 9. Victims of bank account takeover scams express how terrifying it was to wake up and see $5,000 stolen from their checking account. Account takeovers are a common type of identity theft, and it can take a lot of time to untangle all the fallout after one happens. that’s why it’s important to do everything possible to ensure this doesn’t happen to you. how to prevent account takeover fraud. your primary strategy against account takeover fraud is simple: pay attention.

Comments are closed.