How Do Mortgage Escrow Accounts Work

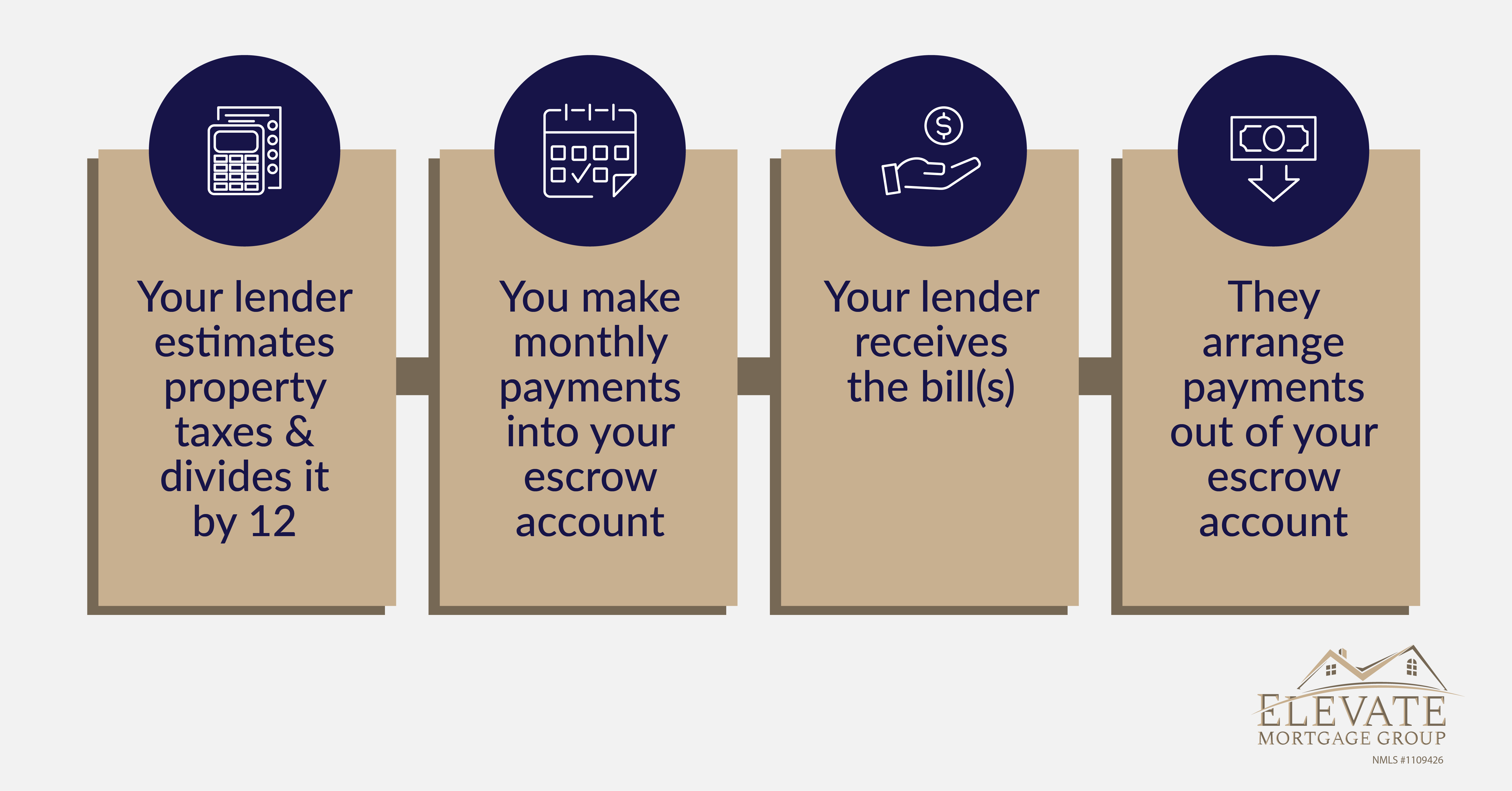

What Is Escrow How Does It Work In A Mortgage How mortgage escrow accounts work. the yearly and monthly costs for your escrow account will be estimated during the mortgage application process and finalized at closing. to come up with the. How does an escrow account work? to set up your mortgage escrow account, the lender will calculate your annual tax and insurance payments, divide the amount by 12 and add the result to your monthly mortgage statement. each month, the lender deposits the escrow portion of your mortgage payment into the account and pays your insurance premiums.

How Do Mortgage Escrow Accounts Work Youtube An escrow account is a contractual arrangement in which a neutral third party, known as an escrow agent, receives and disburses funds for transacting parties (i.e., you and the seller). typically, a selling agent opens an escrow account through a title company once you and the seller agree on a home price and sign a purchase agreement. Escrow for homebuyers is typically 1% to 3% of the total cost of the property. mortgage escrow is usually determined by the lender, who estimates your property taxes, insurance payments and other. Escrow acts as a neutral third party in a real estate transaction. pre closing, escrow's job is to hold onto money during the transaction before agreed upon actions are completed on both sides. in the case of buying or selling a home, neither the buyer nor the seller has access to said money. once all conditions are met in the transaction. An escrow account (also called an impound account) is used to cover your property taxes and homeowners insurance, spreading out the cost over your 12 monthly mortgage payments. if you have an.

How Do Mortgage Escrow Accounts Work Youtube Escrow acts as a neutral third party in a real estate transaction. pre closing, escrow's job is to hold onto money during the transaction before agreed upon actions are completed on both sides. in the case of buying or selling a home, neither the buyer nor the seller has access to said money. once all conditions are met in the transaction. An escrow account (also called an impound account) is used to cover your property taxes and homeowners insurance, spreading out the cost over your 12 monthly mortgage payments. if you have an. How does an escrow account work in a mortgage? escrow accounts ensure property taxes and homeowners insurance premiums are paid on time, and are required if you make less than a 20% down payment on a conventional loan, and on all government backed mortgages. the mortgage escrow account’s purpose is to:. Escrow account definition. an escrow account is essentially a savings account that’s managed by your mortgage servicer. your mortgage servicer will deposit a portion of each mortgage payment into your escrow to cover your estimated property taxes and your homeowners and mortgage insurance premiums. escrow accounts are also known as impound.

Comments are closed.